Far too many investors ignore dividends, even in a bull market. When there’s a correction, like the one we’ve seen over the last few weeks, they flip the script, making safe cash dividends a lot more popular.

Luckily for us, there’s one ignored corner of the market where we can grab payouts that triple what the typical stock dribbles out.

That would be in municipal bonds, or “munis” for short. We hold one fund that owns such bonds, the RiverNorth Managed-Duration Municipal Income Fund (RMM), in our CEF Insider portfolio.

Munis are a kind of debt instrument issued by local governments to fund infrastructure. The best thing about them is their high, safe dividends, with yields of 5%, 6% or even 7%. Most muni-bond CEFs—including RMM—pay us tax-free dividends, which can considerably boost their income stream’s value to you, depending on your tax bracket.

Muni-Bond Selloff Gives Us Our In

There’s been a lot of chatter about the selloff in municipal bonds since the start of 2022. We discussed the situation—which as you’ll see below I view as a buying opportunity for muni-bond CEFs—in a February 14 article here on Contrarian Outlook.

The selloff has started to level off since, so it’s a good time to talk muni-bond CEFs again, as it’s given us a nice moment to add to our muni-bond CEF holdings at attractive discounts. And even in the event of a further downdraft, the muni-bond CEF discounts on offer now (along with higher dividend yields, thanks to the pullback) will help shield our returns, letting us collect our rich dividends in peace.

For example, RMM now offers us a 6.4% discount to net asset value (NAV), down from an average of 1.8% over the last year and 3% over the lifetime of the fund. Meantime, its dividend yield (based on its market price) has jumped to 6.3%. Remember, too, that if you’re in the top tax bracket, that payout is worth 10.4% to you.

I’m bullish on muni-bond CEFs now for a couple of other reasons, too: for one, with stocks falling and investors looking for safe income wherever they can find it, they’ll trickle back into municipal bonds.

Second, the reason for this pullback is that investors are worried that investments that guarantee your principal, like Treasuries, will see yields that rival those of munis as rates rise. But I think you’ll agree that it’ll be a long time (if ever!) before a Treasury can pay more than a muni-bond CEF yielding 6%+.

Here’s a three-CEF “instant portfolio” for you to consider.

A 3-Buy Muni-Bond “Mini-Portfolio” Yielding 6%+

Let’s start with the highest yielder among our trio, the Guggenheim Taxable Municipal Managed-Duration Fund (GBAB), which pays a hefty 7.5% dividend (note that as the name says, this dividend isn’t tax-free, but GBAB makes up for that with a higher payout than many muni-bond CEFs offer).

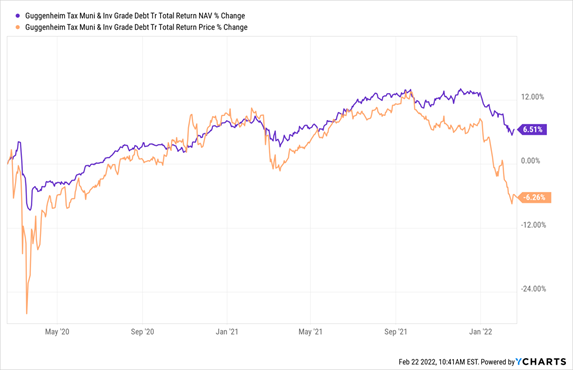

GBAB also shows that with munis (and all CEFs), it’s critical to pay attention to the fund’s NAV, or the performance of its underlying portfolio. Unlike a fund’s market price, NAV is freed from investor moodiness, making it the cleanest indicator of management performance.

As you can see below, over the last two years, from right before the pandemic hit, GBAB’s total NAV return has been steady, as you’d expect from a muni-bond fund. Its market price has largely tracked NAV, until recently, when it fell to a deep discount. That makes now a good time to buy—and ride that unusual discount back up:

A Buying Opportunity Opens

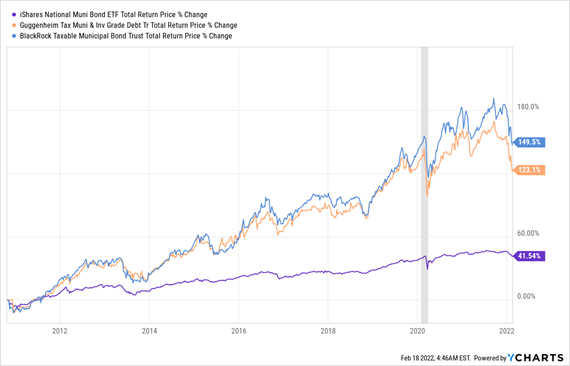

Right now, GBAB’s discount is 6%, even though it has traded at a premium for much of the last five years and has has been a winner in the long run–getting over 123% gains in the last decade, versus just 41.5% for muni bonds more broadly over the same time period.

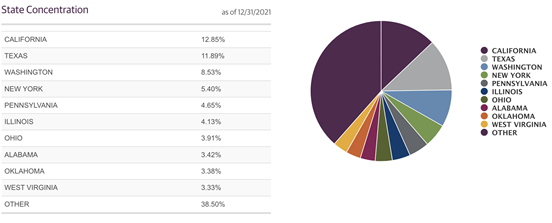

This is due in large part to GBAB’s portfolio, which holds bonds from across the US that have been selectively chosen for their maximum potential, as GBAB’s managers are among the first to get the call when issuers release new bonds, thanks to Guggenheim’s deep connections. Believe it or not, this first-mover access is not only fully legal but the norm in muni bonds—another good reason to buy from a fund and not directly.

Source: Guggenheim Investments

Our next fund, the 6.6%-yielding BlackRock Taxable Municipal Bond Fund (BBN) uses a similar strategy as GBAB and is similarly discounted, with a 6.7% discount to NAV. But it’s also worth holding because of its strong historical performance, having slightly outrun GBAB over the long haul, while both CEFs have soundly beaten the index fund.

Another Muni CEF Roars Ahead

Like GBAB, BBN has the privilege of getting first-look access to munis, which is no surprise. BlackRock has nearly $10 trillion in assets under management and is one of the largest municipal-bond investors in the world, so brokers go to the firm first. It’s also no surprise that BBN has been crushing the market for as long as it has.

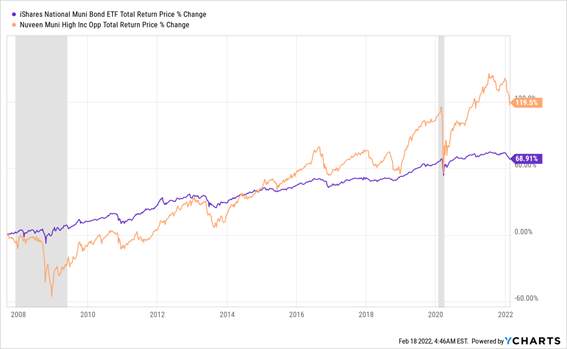

Finally, you could round off your muni-bond holdings with the Nuveen Municipal High Income Opportunities Fund (NMZ). The great thing about NMZ is that it has a long history, being over a decade old, and it has crushed the index for years.

NMZ Ahead of the Pack

This outperformance comes while NMZ yields a nice 5.8%, which is equivalent to 8% or even 9%, depending on your tax bracket, as the fund’s income stream is tax-free for most Americans.

Plus NMZ is particularly compelling because of its knack for buying municipal bonds at a discount: its managers will scour the market and see who needs to sell muni bonds fast. It will then pick those bonds up and collect their income, which it then hands over to you.

These are just three examples of the diversification, stability and income you can get from muni-bond CEFs, making them strong additions to your portfolio during a pullback like the one we’ve been dealing with.

Buy These 4 Bargain 7.5% Dividends Now—and Hold Them Forever

Muni-bond picks like the ones above are excellent anchors for the 4 other CEFs I’m pounding the table on now.

They throw off a rich 7.5% dividend and all 4 of these cash machines pay you monthly, to boot!

Thanks to their deep discounts, low volatility and blockbuster yield, these 4 powerful income generators shield your investment from pullbacks and give you the stability you need to enjoy their huge 7.5% average dividends in peace. You can literally buy them now and tuck them away forever!

These 4 CEFs plays are ripe for buying now, and I can’t wait to show them to you. Click here and I’ll give you full details on each one: names, tickers, current yields, discounts, my complete analysis of management and everything else you need to know before you buy.

Recent Comments