Members of my CEF Insider service often tell me they’d love to know a lot more about the people at the helm of closed-end funds—the good, the bad and the ugly.

It makes sense: after all, when you buy a CEF, these folks play a huge role in whether you notch a big gain (and income stream) or, well, not so much.

An Insider’s View

As one of the few analysts who focuses solely on CEFs—especially smaller CEFs—I’ve had several conversations with managers at CEF companies from across the market.

A common theme? They’re all frustrated that the average investor doesn’t know the many benefits CEFs deliver.

Because on top of the 7% dividends the average CEF pays out, there’s also the “trick” CEFs use to make fees essentially disappear—a big benefit most people miss and we’ll delve into further on. (I’ll also name 2 CEF firms whose offerings have long histories of crushing the market.)

First, we need to talk about these funds’ discounts to their “true” value, which I’ve told you about before.

You may already know that a CEF is effectively “closed” from issuing new shares to new investors, which limits the supply of shares and stops management from diluting your stake. This has another great benefit: discounts!

Because of that limited number of shares, if the CEF’s portfolio (or “net asset value”) grows more than the market price, the fund will suddenly be priced at a discount to its NAV.

And these markdowns can be huge.

Take the very small (just $53-million!) Gabelli Go Anywhere Trust (GGO), which has gone from a double-digit premium to a 5.4% discount to NAV in just over a month:

A Pricey Fund Drops Into the Bargain Bin

The reason why this happened is simple: while the fund’s NAV has stayed flat, the price of the fund has plummeted by 14%:

Hard Fall for a Steady Fund

The reason for the selloff?

Nothing more than market inefficiency. Big investors won’t bother with such a tiny fund, and small investors mostly don’t know it exists. A measly 600 shares have traded per day, on average, in the last month!

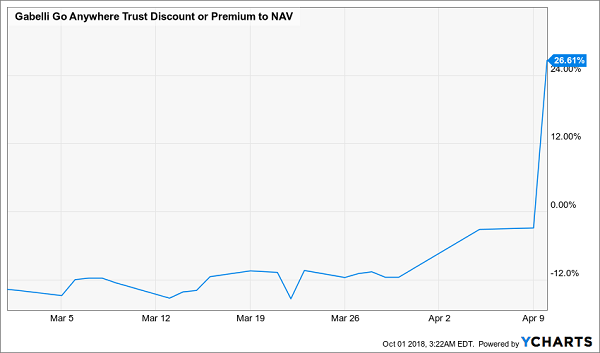

This inefficiency goes the other way, of course. GGO swung from a double-digit discount to a whopping 26.6% premium to NAV earlier in 2018:

Massive Markdown Pulls a 180

Obviously, this matters because if you buy a CEF at a huge discount and wait for it to go to a premium, you can reap massive gains. But there’s a second reason why this matters a lot—and it’s why a lot of fund managers wish CEFs were more popular.

It comes back to the “free” management fees I mentioned earlier.

Management “Sleight of Hand” Works in Your Favor

Let me explain it like this: imagine a fund has a 1% management fee and $100 in NAV. If you get the fund at a 10% discount to NAV, you’re paying $90 for that $100 in NAV.

Keeping in mind that we’re paying a $1 management fee for the privilege of getting that $100 in NAV for just $90, we’re essentially paying a dollar to get a $10 discount.

That already sounds like a good deal, but the real magic happens when the fund’s NAV goes up. If it rises 10% and pulls the market price up the same amount, that’s a $10 increase—but since we paid $90, this $10 gain translates into an 11.1% profit on our invested capital. That 1.1% extra return on our original investment equals 99 cents—or about the same as the fund’s fees!

In other words, by buying a CEF at a discount (if the discount is big enough proportional to the fund’s fees), we’re essentially sidestepping the fees—they’re cleared when the fund swings to trade at its net asset value or at a premium to its NAV.

And this is why fund managers love CEFs: these funds give them a chance to charge fees the market ultimately pays for. It’s also why individual investors should love CEFs: they can take advantage of this to essentially get smart, active fund management for free.

The Major CEF Managers

So who runs the most CEFs in 2018?

While a lot of fund managers have told me they prefer CEFs for the reasons I outline above, the massive popularity of ETFs has forced many of these pros to focus on ETFs instead.

For that reason, many of the biggest fund managers are also well-known for their ETFs: BlackRock, Invesco and Credit Suisse are all CEF issuers, and some of these companies have pushed for more CEF investment in recent years, even as market forces have caused them to ramp up ETF issuances, as well.

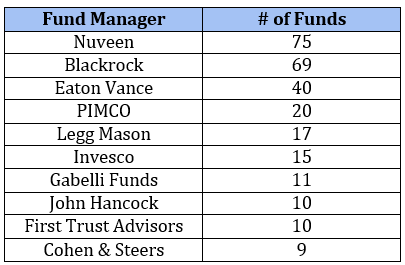

Here are the biggest CEF issuers by name:

Big Names Rule CEF Land

This shows you just how concentrated the CEF space is: of the 487 CEFs currently tracked by CEF Insider, these 10 issuers alone account for 56.7%!

2 CEF Firms With Market-Crushing Gains—1 Big and 1 Small

A lot of readers have asked me if it’s best to go with bigger fund managers, like BlackRock, whose $6.3 trillion in AUM has made it a larger economic force than many countries.

The answer is: it depends.

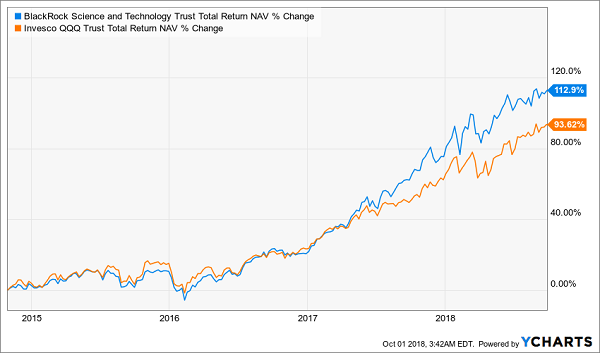

Sometimes the big players’ access to high-quality research helps their funds outperform. Take, for instance, the BlackRock Science and Technology Trust (BST), which has demolished the “dumb” Nasdaq 100 index fund, the Invesco QQQ Trust (QQQ):

Big Name Wins Out—This Time

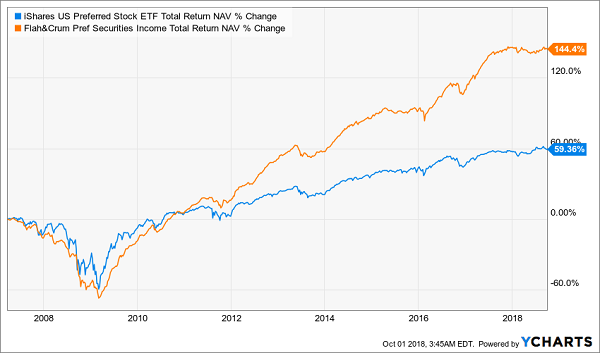

But sometimes the smaller managers’ specialization means they outperform the market: for instance, the preferred-stock experts at the relatively small Flaherty & Crumrine Preferred Securities Income Fund (FFC) have more than doubled the preferred-stock index fund: the iShares US Preferred Stock ETF (PFF):

David Slays Goliath

Although Flaherty & Crumrine’s total AUM is small and FFC has just $849.2 million in AUM (versus PFF’s $16.4 billion), it has crushed the index.

Why? Because Flaherty & Crumrine focuses all of its time and energy in the preferred-stock market, so it knows this area better than anyone else—its outperformance proves it.

It isn’t alone. Several CEF managers stay small and nimble, but because they’re experts, they crush the market as a whole and are able to do that for years. Yet investors often ignore these funds, instead being lured by the low fees and massive marketing dollars thrown at “dumb” index funds—and leaving a lot of gains (and income) on the table.

My Next Top CEF Buy (9.1% Dividends and Quick 20%+ Gains Ahead)

As I just showed you, the big players’ obsession with ETFs over CEFs does a huge disservice to investors, because it distracts them from retirement game-changers like the other fund I want to tell you about now.

Here are 2 things you’ll love about this undercover dividend star:

- This unsung CEF sports a massive 9.1% dividend, and

- It trades at a truly bizarre discount to NAV that just can’t last (in fact, it’s already swinging back toward its usual premium, so you’ll need to act now).

The upshot? This ridiculous markdown exists even though this fund is run by a Warren Buffett disciple with a 30-year track record of handing his lucky shareholders massive returns!

And here’s something else you should know: this incredible fund has crushed the S&P 500 over the long term—and thanks to that huge 9.1% dividend, most of that gain was in CASH!

A Cash Machine Built to Last

Even if a recession hits tomorrow, this fund’s 9.1% dividend is SAFE. You can simply keep collecting this rich payout while you sit back and let the battle-tested pro at the top stickhandle his way through.

Best of all, when this CEF’s rare discount swings to a big premium (a take-it-to-the-bank certainty, in my view), we’ll be locked in for fast 20%+ upside from here, on top of that massive dividend!

This hidden gem is just one of 5 CEFs I’ve uncovered with SAFE dividends up to 10%, plus 20%+ price gains ahead in the next 12 months.

Full details on each of these 5 high-yield funds are just a click away. Just go right here and I’ll give you everything you need to know about these 5 income (and growth) plays: names, ticker symbols, buy-under prices and more.

Recent Comments