Money-losing firm India Globalization Capital (IGC) found the magic formula. They put the 2018 and 2017 investing buzzwords side-by-side:

- Cannabis, and

- Blockchain.

The savvy marketers at IGC then introduced an energy drink infused with hemp, and wow, what a rush!

IGC Rises 10-Fold on Buzzwords

We level-headed contrarians should stay away from this circus. In fact, you need to be honest with yourself about the latest weed craze. If you’re tempted at all to buy this junk, it’s better if you change the channel.

Many marketers know that you and your peers are fixating on these parabolic charts. It’s going to end in tears, but they don’t care. They know they can get your attention now with a weed-fueled promise of 100% to 1,000%+ gains.

This time last year, they were peddling Bitcoin-related investments. Sadly, anyone who started the year with $1,000,000 in the cryptocurrency “blue chip” has only $459,000 to their name today. And they didn’t collect any dividends along the way, either!

Bitcoin Investing: A Bad Idea, After All

Is it possible to make money slinging crypto and weed-related stocks? Sure. But why would we gamble on any stock price movement when we can completely eliminate that risk and generate income-for-life funded by sustainable dividend payments alone?

“I’m In for 100% Dividends. But How?”

“I’m in!” you say. “Dividend income sounds great,” you’re no doubt thinking. “But don’t stocks only pay sexy high yields like these at the depths of bear markets – or when they are in so much trouble their stock prices are low for a reason?” That’s partially true. Blue chips tend to only pay yields of 4% or so near stock market bottoms, and high yields should never be accepted without scrutiny.

With popular stocks paying less than 2% today, how do we bank enough in dividends to actually live on them?

The proper solution is to find under-the-radar investments that pay meaningful yields today. For example, my Contrarian Income Report portfolio yields 7.3% right now. My readers who bought this basket of generous payers instead of Bitcoin are banking $73,000 in dividend income on a million bucks. Plus, their original capital stays intact (or grows!)

There are three main stock market vehicles available today that pay reliable yields of 7.3% or higher. We’ll discuss them in detail in a moment. First, let’s get used to one important income investing concept that is so obvious we rarely hear about it.

Let’s take the big firms that manage most individual investment money in the US today. Think Wells Fargo, Morgan Stanley, Merrill Lynch, and also your neighborhood Edward Jones, and even Fidelity, Schwab and Vanguard. These outfits may customize investments for you if you have a gazillion dollars, but for everyone else, it’s cookie cutter. They all put you through your age, money, future earnings, expenses – all sorts of inputs into fancy software that spits out a nice looking profile, with colored pie charts and everything! Plus, they have these nice offices. People think, “They must know what they are doing!”

They do, to a point. But they are serving hundreds of thousands of clients, with millions and millions of dollars, around the country and the world. So, if they are offering the same approaches for people of similar situations, they can only offer investments there are “enough of” – have enough liquidity – for everyone!

That means one simple thing. The familiar names can’t recommend our high- income producers to you. Instead, they stick you in pretty much what everyone has.

Apple (AAPL) has a market value of more than $1 trillion. And shares yield just 1.4%. Convenience, familiarity and liquidity come at the expense of the stock’s current payout.

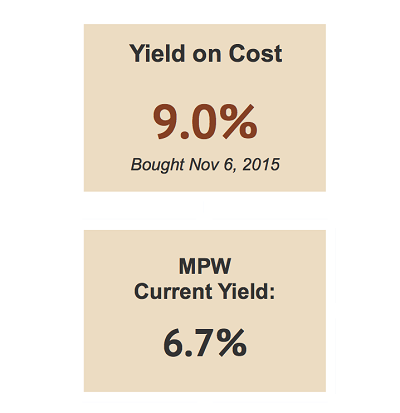

Let’s contrast Apple with hospital landlord Medical Properties Trust (MPW). The firm pays a generous 6.7% on capital you invest today – nearly five times as much as Apple! And its focus, the hospital, is arguably even more indispensable than the iPhone (which does have competition from Samsung and others).

But MPW the stock isn’t large enough for the big pension funds to buy, or for the brand-name money managers to pile into. With a modest market cap of $5 billion, MPW is plenty liquid for you and me – and exclusive enough to provide us with this generous yield premium!

Plus, just like Apple, it raises its dividend every year. In fact, my readers who bought the stock when I recommended it are now enjoying a 9.0% yield on cost:

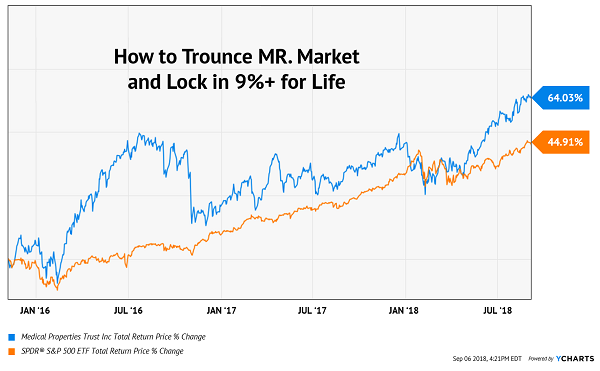

And oh, by the way, MPW also trounced the broader market while it was paying us 9% annually:

Our “Boring” Payer Delivered 64% Total Returns, and Counting

Our modest side is our edge as individual investors. We should smartly focus on investment vehicles that have market caps between $1 billion and $10 billion. Many of these stocks and funds pay 7% and 8% current yields. Their obscurity is our big advantage.

A “billion” is pretty huge for you and me to invest in, but it’s not something in which Wells Fargo advisors can invest their clients. Big time money managers can’t buy them, either – they’d move the market like an elephant in a bathtub, which is why they must focus on mainstream names like Apple. Their cash constraints create opportunity for us.

These “under the radar” dividend vehicles are plenty liquid enough for you and me – they can handle our buying and selling just fine – but not for the big institutional investors that hold two-thirds of all shares in public stocks. And the financial media really only care about what’s well known and most liquid. So, smaller companies (yes, a few billion in market value is small, relatively) make up only a fraction of the stock market’s total capitalization) so they don’t get much coverage from the financial media. There’s more of a chance for us to find something juicy in an orchard that hasn’t been picked over. And there is plenty of high yield fruit once we aren’t looking where everyone else is.

While these ignored corners of the financial markets offer ideal places for us to search for high yields, they are like any other sectors. There are good investment candidates and bad ones there too.

The 8 Best 8% Dividends with Big Upside to Buy Today

Most Wall Street spreadsheet jockeys say we investors can’t have both the income and safety of bonds and the upside of stocks. We have to choose, or allocate, or whatever.

They’re wrong. My 8% “no withdrawal” retirement strategy lets retirees rely entirely on dividend income and leave their principal 100% intact.

Well, that’s not exactly right. Their principal is more than 100% intact thanks to price gains like these! Which means principal is actually 110% intact after year 1, and so on.

To do this, I seek out stocks and funds funds that:

- Pay 7%, 8% or better…

- Have well-funded dividends…

- Trade at meaningful discounts to their intrinsic values…

- And know how to make their shareholders money.

And I talk to management, because online research isn’t enough. I also track insider buying to make sure these guys have real skin in the game.

Today I like three “blue chip” funds as best income buys. And wait ‘til you see their yields! These “slam dunk” income plays pay 8.5%, 8.7% and even 8.9% dividends.

Plus, they trade at 10-15% discounts to their intrinsic values today. Which means they’re perfect for your retirement portfolio because your downside risk is minimal. Even if the market takes a tumble, these top-notch issues will simply trade flat… and we’ll still collect those fat dividends!

If you’re an investor who strives to live off dividends alone, while slowly but safely increasing the value of your nest egg, these are the ideal holdings for you. Click here and I’ll explain more about my no withdrawal approach – plus I’ll share the names, tickers and buy prices of my three favorite closed-end funds for 8.5%, 8.7% and 8.9% yields.

Recent Comments