There’s a lot of rhetoric flying around about the debt ceiling these days, and it’s set up a very nice opportunity for us to buy a 7%-yielding closed-end fund (CEF) we always have on our watch list.

That would be the Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX).

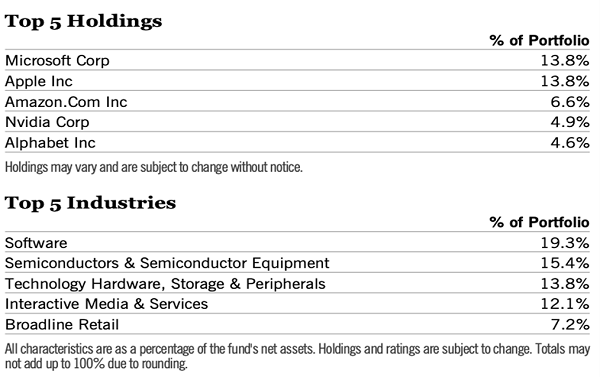

A good way to think of QQQX is like a NASDAQ index fund but with higher dividends and a smart way to turn volatility into extra dividend cash. I say QQQX is like a NASDAQ index fund because its holdings mirror those of the Invesco QQQ Trust (QQQ), including all the big-cap techs we all know well:

Source: Nuveen

QQQX, like QQQ, tracks the NASDAQ 100, so it’s no surprise that you’ll see great tech firms in its portfolio. Plus, QQQX does something pretty special: it sells call options on its portfolio, both as a form of insurance and as a way to generate extra income.

Since QQQX owns $1.2 billion worth of stocks, it can sell options on its portfolio that can generate around 2% to 3% of its asset value in the form of cash premiums paid to the fund by option buyers. QQQX then hands that cash to shareholders as dividends.

Of course, QQQX’s yield is more than 3%. More than double that, in fact, because the fund also gets about a 0.8% dividend yield from its holdings. It supplies the rest of its total return (including the rest of its dividend) with capital gains from its portfolio.

The fund’s option strategy does well when volatility ticks up—and volatility could be poised to do just that in the coming weeks, with the debt ceiling adding to investor worries.

The Debt-Ceiling Scare

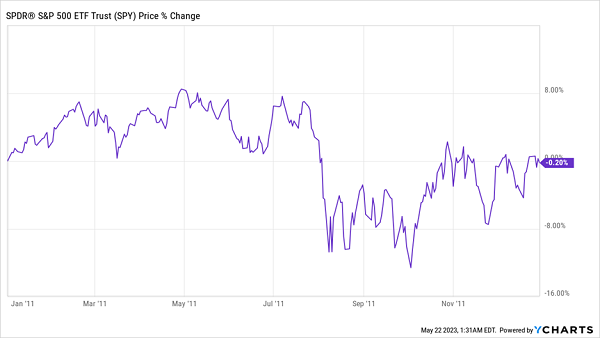

The last time the US Congress flirted with defaulting on debt was in 2011, and the stock market was not happy.

Debt-Ceiling Worries Weighed on Stocks in 2011

In 2011, stocks failed to rise, despite a good start to the year and despite the recovery that was already in force, both in the economy and the stock market after the Great Recession. Congress stymied that momentum, and it’s easy to see from the chart when that happened—although Congress did eventually pass a last-minute deal.

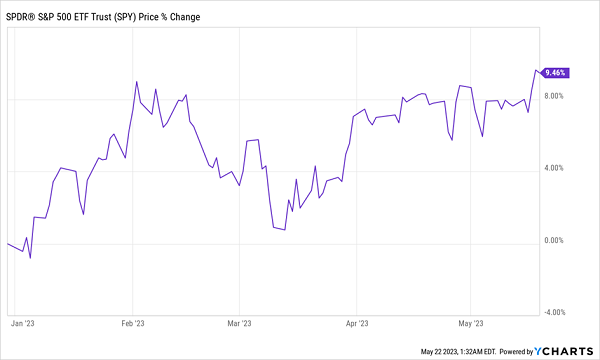

History Rhymes

Fast-forward to this year and we have not seen the same phenomenon play out in the markets—yet. That’s because this time markets have realized Congress’s political wrangling about the debt ceiling is just that: political. Last-minute deals, worrying warnings of a default and overheated rhetoric from both sides are all part of the game around the debt ceiling.

In 2011, markets were fragile after the subprime mortgage crisis, and movements like Occupy Wall Street added to the insecurity. These days, markets are more in tune with the fact that Congress likes to inflame the fear surrounding the debt ceiling. So I don’t see markets taking a serious tumble from here. But even so, more volatility is likely between now and when a deal is inevitably signed.

That’s our in with QQQX, which effectively turns that volatility into cash, while getting us exposure to some of the strongest tech stocks to hold for long-term gains.

Forget the Debt Ceiling: Buy These 10% Dividends NOW (and Hold Them for Life)

No matter what happens with the debt ceiling, the Fed or the economy, the 5 bargain-priced CEFs I discuss right here are all smart buys to make now.

I call them “Lifetime Profit” funds because you can literally do just that—buy them and tuck them away for decades, collecting their rich dividends the entire time.

I urge you to buy these 5 top picks now, while you can still get them for at a discount, and start collecting their outsized 10% payouts immediately.

Recent Comments