2024 may be remembered as the year the stock-market recovery “stuck.” While 2023 resuscitated stocks from their 2022 doldrums, it’s been 2024 that got the indices to hold above all-time highs.

Also, unlike 2023, this year’s gains are increasingly broad-based, with nine out of the 11 sectors of the S&P 500 up so far.

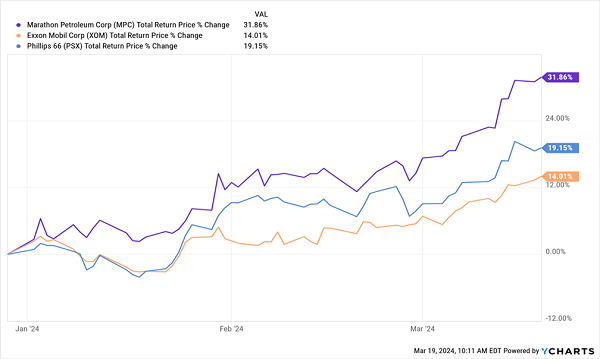

The biggest winner? The energy sector, which has been bolstered by particularly strong gains from Marathon Petroleum (MPC), Exxon Mobil (XOM) and Phillips 66 (PSX).

Energy Gains Across the Board

Is this an opportunity, especially for income-hungry investors? After all, energy stocks’ payouts can be massive, with pipelines offering yields well over 10% in many cases.

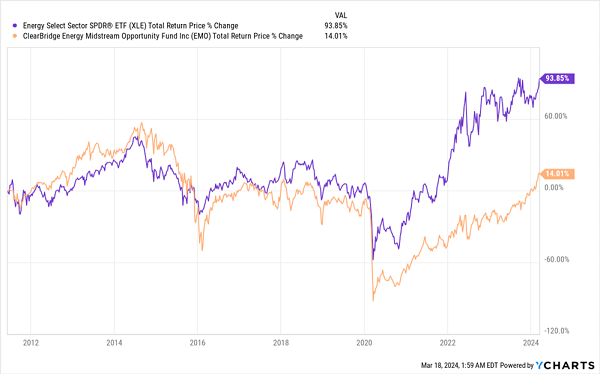

We’ll answer that in a sec. First, let’s zoom out. While energy is seeing a renaissance now, particularly in some of the aforementioned big names, the broader index has been a dud over the long term.

While Marathon is up 467% over the last decade, the benchmark Energy Select Sector SPDR ETF (XLE) is up just 56%, or a measly 4.5% annualized. That’s less than a CD will get you!

This points to one big problem with energy: The winners very often take from the losers, which is why energy index funds tend to underperform. If refiners like Marathon are doing well, it doesn’t necessarily mean everyone downstream of MPC will do equally well, as XLE’s meager returns demonstrate.

And if we stick to the energy winners like Marathon, we’re going to sacrifice income: The stock pays just a 1.7% dividend, after all.

So can the best actively managed energy funds do better? If energy is a matter of picking the winners and avoiding the losers, we should expect the top-performing energy funds to beat XLE. So let’s take a look.

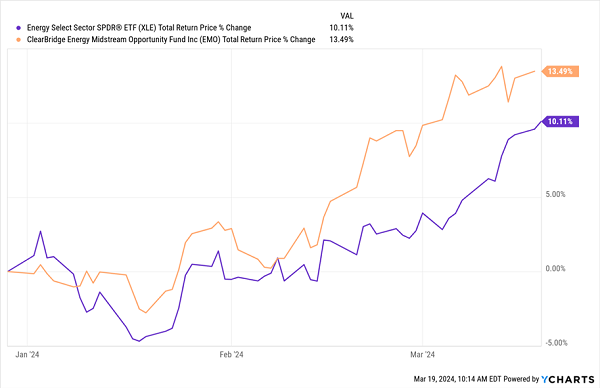

There are dozens of energy plays among closed-end funds (CEFs) with yields as high as 17% (not a typo!). The top-performing funds of 2024, however, yield much less, with the ClearBridge Energy Midstream Opportunity Fund (EMO) paying out just 6.9%. I say “just,” but that’s nearly double XLE’s 3.5% yield and obviously miles ahead of the S&P 500’s 1.3%, so EMO is still a heavy hitter in the income world.

And it’s doing great now.

EMO Outruns the Energy Sector in 2024 …

With a 13.5% total return for 2024 alone, EMO, in orange above, is clearly beating out the broader energy market. But let’s zoom out further—and prepare to be disappointed.

… But Has Been Pummeled Since Inception

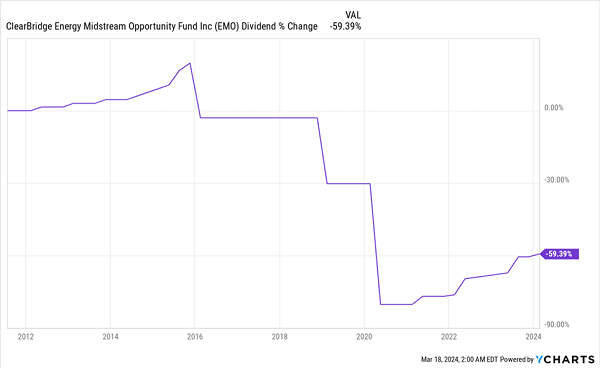

Over the life of the fund, investors have made money, but not much. Barely a 1%-per-year gain is unacceptable, especially with a dividend history as bleak as this one:

EMO’s Dividend Takes Hit After Hit

EMO has both slashed payouts and barely eked out a positive return over its lifetime, so even though it’s doing pretty well in 2024, we can’t expect that performance to continue. This also means the CEF market should punish EMO for its poor performance and dividend-slashing ways, right?

Think again.

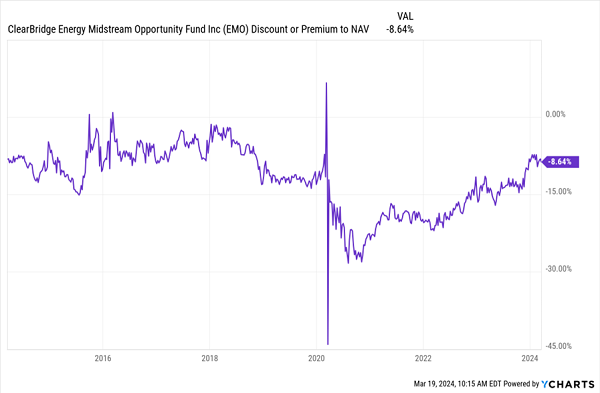

Illogical CEF Market Bids Up EMO

As you can see above, despite underperformance and dividend cuts, EMO’s discount has been disappearing in 2024, continuing a two-year trend!

The big story here is that energy demand, after the pandemic, has been growing, and that has increased demand for midstream oil firms like those EMO holds after the hit that the pandemic put on the entire sector. That’s been good for strategic traders who bought EMO when it was at its bottom during the pandemic.

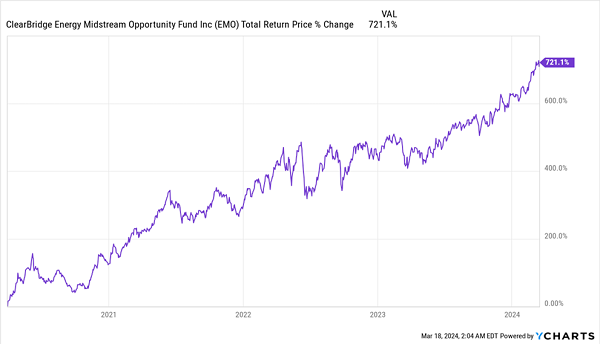

EMO’s Big-Trader Profits

There were many moments along this period where quick profits were available from a fund like EMO, but the trade now seems a bit long in the tooth.

Still, more strong gains from EMO can be had by savvy traders in the short term—and it isn’t the only energy CEF to offer such potential. But there are significant risks to a fund like this one: If you hold it for even a little too long, you’ll likely get burned.

These 7.8% “AI-Powered” Payouts Crush EMO (They’re Just Getting Started)

While EMO (and most energy funds) look played out now, there’s another corner of the CEF market that’s anything but: AI funds—including the four I’m urging all investors to buy now.

You may be surprised to hear me say there’s still value in the AI trade, but that’s exactly where we are with these 4 funds, which hold the top names in AI. But here’s the twist: They trade at big discounts to the value of their portfolio holdings. That means we’re essentially buying the brightest AI names at prices we last saw months ago!

That’s right: We’re literally turning back the clock on the AI boom here—and we’re picking up a solid 7.8% dividend from these 4 unsung funds while we do.

Recent Comments