Last month, this company cut its dividend by 48%. Five days later, its ticker was booted out of the Dow Jones Industrial Average (DJIA).

Vanilla investors fled the stock. Nonconformists like us, on the other hand, started to pay attention.

When there’s nobody left to love a dividend dog, we consider adoption. The payout was slashed 48%. This stock is 71% off its all-time highs. The Dow doesn’t love it any longer.

Sign us up for the stock that sounds like an old-time country music song, “The Ticker That’s Lost Everything.” We’ll give the herd their Nvidia (NVDA) at 36-times sales. At the chipmaker’s current valuation and popularity, there’s nobody left to buy it.

We want a stock where there is nobody left to sell it!

Think Nvidia can justify its valuation? Not likely. Four years ago, a company called MarketAxess (MKTX) traded at similar nosebleed levels—for 35-times sales in the summer of 2020!

Why the bubble pricing during a pandemic? Of course, there’s a story that sounds plausible in the moment but preposterous in hindsight.

MarketAxess makes fixed-income trading tools. Bonds have traditionally changed hands via phone deals. Old school. MarketAxess brought bond trading into the twenty-first century.

Today, the company handles one out of every five bond trades. This is a “big bad” bond business. The company continues to execute, launching a new platform last year called Adaptive Auto-X, which boosted its market share nearly 5% in just a year.

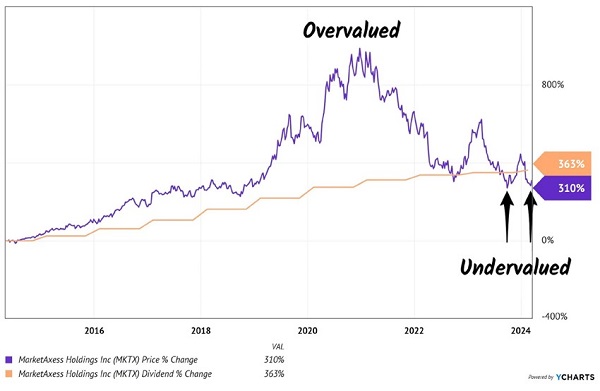

The problem for investors who bought in 2020 is this. They paid such an absurd multiple that they would only make money if MKTX had 100% market share by now. Which was just plain nuts:

Reminder: Don’t Pay 30-Times Sales for a Stock

It took four years for the froth to cool. MarketAxess shares are reasonably priced for the first time in a decade, with respect to their dividend. Which is the only fundamental that matters to us.

Over time, stock prices follow their dividends. They may drift for months and years but, eventually, these tickers reconnect with the direction of their payouts—for better and for worse!

Nvidia “buy and hopers” beware!

Let’s instead dumpster dive for what the Dow Jones just discarded: Walgreens Boots Alliance (WBA). WBA still yields 4.8% post cut. That’s not bad, and it’s almost certainly a sustainable payout.

This was Walgreens’ first dividend cut since 1977, interrupting a 47-year streak of dividend raises. Which means the pharmacy is no longer a Dividend Aristocrat, either.

Double yuck for the mainstream dividend crowd!

Which, again, whets our appetite here at Contrarian Outlook. We know that Chief Financial Officers are like carpenters. They measure twice and cut once. The last thing management wants to do is to tell Wall Street it’s cutting its payout again.

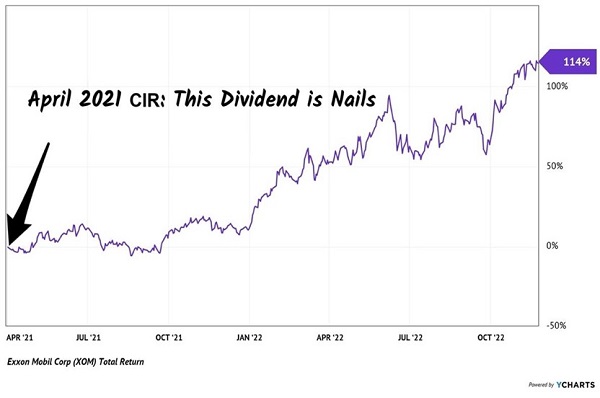

The removal from the Dow is another point in Walgreens’ favor. Let’s recall Exxon Mobil (XOM), which was removed from the index in August 2020, exactly when shares were beginning a mega-rally.

In these pages, we reasoned that the castoff Exxon and its 6.1% yield had 61% upside. Our April 2021 edition of Contrarian Income Report described the energy producer’s dividend as nails. It sure was: the stock rallied 114% during our short holding period:

XOM’s 114% Run in CIR Portfolio

You know who missed out on these gains? The Dow Jones Industrial Average.

Of course, it won’t be easy for Walgreens the business to get back on track. The physical stores feel like a relic of the 1990s. Meanwhile Amazon Pharmacy continues to expand, bringing online competition.

Walgreens must expand its e-commerce sales. Personally I send digital photos to my local Walgreens for physical copies every so often. Once in a while we’ll get a prescription filled there. It’s not exactly a Peter Lynch “buy what you know and frequent” type of stock.

That said, everyone knows it’s not, and they have already sold. Any progress from Walgreens on the profit front could pop the stock. As I write its monthly moving average sits 31% higher—a reasonable target as long as the news progresses from bad to less bad.

It’s your move, Walgreens management. There’s nobody left to sell your stock. Now, see if you can give investors some reason to buy. In the meantime, the 4.8% dividend looks good—after all, it’s been measured twice.

If Walgreens can figure out a catalyst, it will be a strong candidate for my Post-COVID dividend portfolio. I’m not talking about options or crypto or penny stocks. I’m talking about dividends like Walgreens that are secure with stocks that have serious upside potential.

Granted, its 4.8% yield is a bit light for my liking. I prefer 8% dividends or better. At these payout levels we can build a Perfect Income Portfolio that lets us retire on dividends—click here to learn more.

Recent Comments