When you think about the biggest returns you could get on the market today, what do you think of? Tech? Biopharma? Gold stocks?

What about utilities?

This “boring” sector is known for high-yield stocks with little volatility. The (usual) downside to that income is lackluster capital gains, with many utilities staying range bound for years.

Except when they don’t.

Today we’re going to look at two utility funds that, over time, have crushed the S&P 500: the Cohen & Steers Infrastructure Fund (UTF) and the Reaves Utility Income Fund (UTG). Over their near 20-year histories, these funds have returned an annualized 11% per year. Even after the recent market panic, both are still way up over the S&P 500 (in blue below).

“Sleepy” Dividends Beat the Popular Names

These big returns are in large part thanks to these funds’ huge dividends: UTG yields 7.3%, and UTF offers a whopping 9.4% income stream. Not only do these payouts crush the S&P 500’s 2% yield, they’re more than twice the payout you’d get from a utilities index fund like the Utilities Select Sector SPDR ETF (XLU).

How are these big yields possible? And how can there be such huge returns in a sleepy sector like this one? Let’s tackle both of these questions now.

The Simple Trick Behind Big CEF Dividends

To understand how these funds yield what they do, we first need to talk about how they’re built.

UTG and UTF are closed-end funds (CEFs), which are different from ETFs and mutual funds in one important way: under most circumstances, CEFs can’t issue new shares to new investors. As a result, their market prices will deviate from the intrinsic value of their portfolios (called the net asset value, or NAV). That leads many CEFs to trade at discounts to their NAV—and those discounts can be huge.

Right now, UTF trades at a 9.1% discount and UTG at 3.6%. CEF discounts vary, which is why I like holding several of these funds at once and rebalancing between them as the discounts go up and down.

The Random Discount Walk

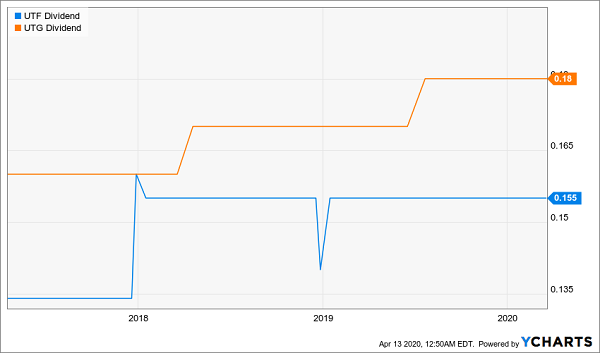

As you can see, in 2018 and briefly in 2019, the discount on UTG (in orange above) fell below that of UTF, providing an opportunity to rebalance between the two. And all the while, you would have collected these funds’ huge, and growing, dividends.

Big Payouts Get Bigger

Utility stocks’ above-average payouts are part of the reason for these CEFs’ outsized dividends (the small dip in late 2018 was a special dividend); the discount to NAV is another key factor. A fund that pays an 8% dividend on its market price and trades at a 10% discount actually pays a 7.2% yield on its NAV. This matters because fund managers only need to earn the yield on NAV to sustain their payouts.

This means that buying a CEF at a discount not only gets you assets for cheaper than their market value, it also makes the dividend more sustainable now and over the long haul.

The Truth About Active Management

Even with this “trick” working to their advantage, managers need to do a lot of work to make a double-digit total return sustainable over a decade. So how do they do it?

While active management has gotten a lot of bad press, in many pockets of the market, active managers outperform their index, and utilities are one of those areas. For investors, then, it’s just a matter of finding the funds that do and avoiding the ones that don’t.

And these are funds that do, as is evidenced by their years of market outperformance. But there’s an additional advantage fund managers have in the world of utilities: size and market influence.

For example, Cohen & Steers has $57.4 billion in assets under management and controls not only stock funds but several debt funds, as well. This gives them unique (and legal!) access to information on utilities that you and I could never get on our own. That, in turn, puts them in a great position to make decisions on what utility stocks to buy and which to avoid.

The advantages of the CEF structure, exclusive corporate access and these funds’ huge management firms have combined to make UTF and UTG winners for years—and will continue to do so. This is why now is a great time to consider these funds and other CEFs like them: both UTF and UTG were trading at premiums to NAV just a few months ago, and those premiums will likely come back when the market fully recovers. Until then, they’re great opportunities to grab big, and growing, income streams.

Shocking Pullback Buys: 4 CEFs “Hard-Wired” for Fast 28%+ Upside

UTF and UTG are great funds, but they’re just the start. Let’s amp up your dividends even further with 5 other CEFs that are also throwing off huge cash payouts (often paid monthly, to boot)!.

These 5 perfect pullback buys yield 8%, on average (with one paying more than 10%)!

Here’s the best part: these 5 cash machines are trading at discounts that are even more outrageous than those on our two utility plays—discounts so large that I’ve got them pegged for 20%+ gains in the next 12 months.

Throw in their massive 8%+ payouts and we’re talking about 28% total returns here, by this time next year. And thanks to their huge dividends, a big slice of that gain will be in safe dividend cash!

I don’t want to waste your time, so let’s get right to it. Click right here and I’ll tell you everything you need to know about these 5 cash-rich CEFs (with 28%+ upside!), including names, tickers, buy-under prices and my complete analysis of their management teams and strategies. Don’t miss your chance to buy now, before these 5 funds’ prices run away from us.

Recent Comments