Exchange-traded funds (ETFs) sure are easy to buy. There’s an ETF for just about anything we can think of—stocks, bonds, commodities, growth, value, sectors, industries and, of course, high yield.

Dividends are our beat here at Contrarian Outlook. And ETFs keep us busy, because for every income investing angle, there is a popular dividend fund that we can easily improve upon.

I commend you for realizing that ETFs are not the final retirement solution. Convenient, yes. But we contrarians have more effective income tools available than ETFs.

Let’s walk through seven popular dividend ETFs (yielding a mouthwatering 5% to 10%), and tinker with each a bit to improve their future performance and their payouts. I’m talking about yields up to 8%, paid monthly!

Now ETFs are an improvement from the funds of yesteryear: mutual funds. They’re cheaper. They’re more tax-efficient. They can hold a much wider field of investments. And their tickers are a whole lot easier to remember.

Likewise, closed-end funds (CEFs) are the next step in dividend evolution. Here’s why:

- CEFs typically deliver higher dividends.

- Many CEFs pay monthly (not just quarterly).

- CEFs have fixed pools of shares, which means they often trade at discounts to their net asset values (NAVs).

The final point is an important one. It means we are often able to buy dividend holdings for less than they would cost individually on the open market.

Given all that, you’d think CEFs would be among the most popular funds on the planet. But that couldn’t be farther from the truth.

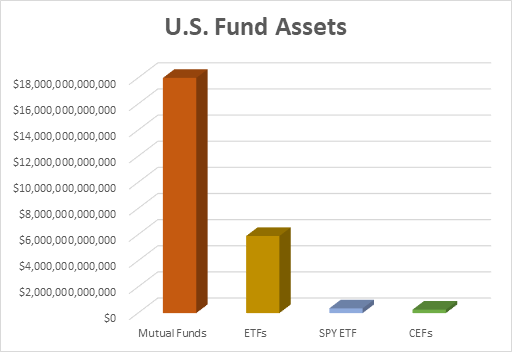

Mutual funds in the U.S. alone are a $18 trillion business. But ETFs just keep clawing away year after year, month after month, and have themselves become a $5.9 trillion domestic market.

CEFs? The entire industry (consisting of a few hundred funds) accounts for just $262 billion. For comparison’s sake, that’s $102 billion less than a single ETF, the SPDR S&P 500 ETF Trust (SPY).

I won’t disparage the ETF industry as a whole. But I will say that most of the assets sitting in dividend ETFs is being wasted on a second-class income-investment vehicle.

Meanwhile, that money is missing out on CEFs, which can regularly deliver high-single-digit and even double-digit yields—unheard-of income in mutual funds and a rarity among ETFs.

Let me show you what I mean. Here, we’ll look at seven of the market’s best-yielding ETFs, and we’ll review what they get wrong, and how we can bank bigger dividends and better performance.

Regular High Yield

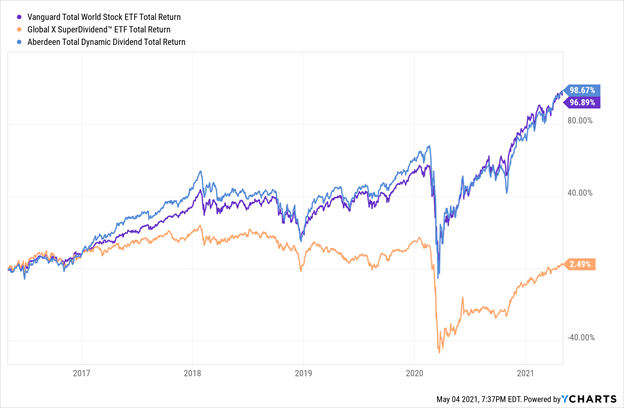

The Global X SuperDividend ETF (SDIV, 6.6% yield) is one of the biggest yields we’re going to find on a straight-up equity ETF.

You won’t be surprised to learn that SDIV doesn’t yield 6.6% by yielding a bucket of U.S. blue chips. Instead, it tracks an index that scans the globe for high-dividend opportunities—the U.S. accounts for a little more than a quarter of the fund, with 17% of assets in Chinese stocks, another 11% in Hong Kong and the rest scattered across the world.

It also leans hard on real estate, at 43% of assets. Only two other sectors—energy (13%) and financials (11%)—have double-digit exposure, meaning there’s not a ton of diversification here.

But while the income is impressive, performance has been anything but. A hyperfocus on high yield has left SDIV invested in a lot of losers, so much so that investors are barely breakeven over the past five years, while a plain global index has nearly doubled in that time.

Super Dividends … And Nothing Else

You’re less likely to have heard of the Aberdeen Total Dynamic Dividend Fund (AOD, 7.0% yield), which boasts just more than $1 billion in assets. But its global portfolio, which is roughly half-invested in the U.S., has been far more competitive while also delivering monthly dividends to its shareholders.

AOD’s Management Doesn’t Have to Bottom-Fish for High Yield

The icing on the cake? We can buy that outperformance for 89 cents on the dollar right now, as the fund trades at an 11% discount to NAV.

MLPs

Sometimes, the advantages aren’t as clear-cut, as we’ll see in the master limited partnership (MLP) space.

For instance, look at the Kayne Anderson NextGen Energy & Infrastructure (KMF, 5.3% yield) and the First Trust MLP and Income Fund (FEI, 8.0% yield) versus the ubiquitous Alerian MLP ETF (AMLP, 8.8% yield) and Global X MLP ETF (MLPA, 10.0% yield).

MLPs’ Struggles Have Choked Indexes and Managers Alike

But first, note that KMF and FEI have produced better performance despite less current income, demonstrating that their managers have been more adept at picking higher-quality holdings.

Then consider the road forward.

Whether we buy AMLP or MLPA, we’re assuredly going to buy their collective MLP holdings at price that fairly represents their underlying holdings.

Now look at KMF, as a for-instance. We’re not just getting skilled management—at current prices, but at a 20% discount to NAV, we’re also buying those MLPs at 80 cents on the dollar. And while Kayne’s fund typically trades at a discount, this is far deeper than normal, suggesting a 1-2-3 punch of returns: yield, a rebound in MLPs and additional price gains as KMF catches up with its historical valuation.

Special High-Yield Assets

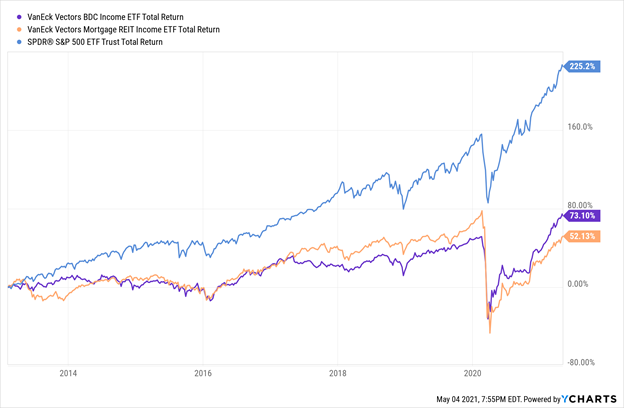

We can buy almost anything via ETFs, and that’s the case for a few special stock classes, such as business development companies (BDCs) and mortgage real estate investment trusts (mREITs).

But while we should avoid some ETFs because there are better CEF versions out there, I would suggest shunning the likes of the VanEck Vectors BDC Income ETF (BIZD, 8.6% yield) and VanEck Vectors Mortgage REIT Income ETF (MORT, 6.8% yield) for a different reason.

They water down the winners.

BDCs and mREITs are two of the toughest industries to compete in. Stagnant dividends (and even payout cuts) are commonplace. Despite the fact that both classes can dole out double-digit payouts without breaking a sweat, longtime returns for their respective ETFs have been downright dreary.

BDCs and mREITs Can’t Even Sniff the SPY

Each industry boasts at least a couple of proven winners that have delivered far more substantial results, but those returns are drowned out by the lackluster performance of dozens of their peers.

With these classes, we’re better off without funds at all.

Even Bonds!

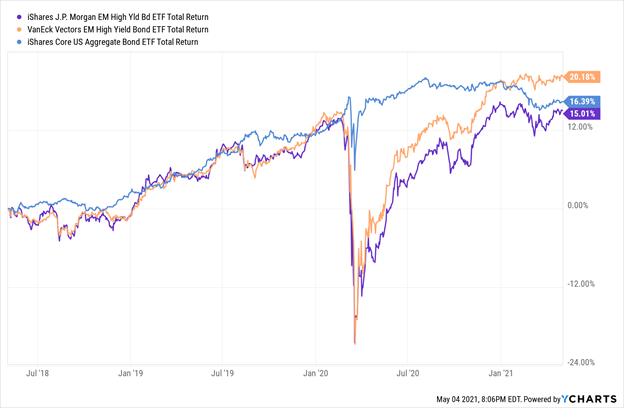

The Federal Reserve has knocked bond yields to the mat. In fact, things are so bad that one of the only places where we can find 5%-plus yields in bond ETFs are emerging-market junk funds like the iShares J.P. Morgan EM High Yield Bond ETF (EMHY, 5.4% yield) and VanEck Vectors EM High Yield Bond ETF (HYEM, 5.0% yield).

While emerging-market debt can certainly deliver better income than just about anywhere in the bond market, it can be a minefield when trouble strikes, as 2020 showed us:

30% Swings in a Bond Portfolio?

Indexes just aren’t built to pivot on the fly, leaving them wide-open to whatever the market deals them.

The “A” Squad: Monthly Payers Doling Out 8% Yields

While the indexes were caught off-guard, the seasoned managers of my favorite EM fund sure weren’t. This 7.9% yielder took its lumps like everyone else in the space, but it has roared back far more aggressively than the computers at iShares and VanEck.

Better still?

Even after beating up on the competition, this little-known fund trades at a 6% discount to its NAV, so we’re buying a well-managed portfolio for less than the sum of its parts!

And that’s just one of the dividend-generating machines powering my “8% Monthly Payer Portfolio!”

My “8% Monthly Payer Portfolio” is an elite set of high-income, high-frequency dividend payers that, at current prices, are smack-dab in the middle of our ideal “buy zone.” And as the name suggests, these 8% dividends are paid out to investors each and every month.

What I love about most of the picks in my “8% Monthly Payer Portfolio” is that they deliver not just massive yields, but shockingly aggressive price performance, simply by leveraging the power of surprisingly steady, boring holdings. That allows us to do the unthinkable from an income strategy: double our money much more quickly than traditional blue-chips-and-mutual-funds portfolios … but without piling on risk!

These dividends aren’t just good.

These dividends aren’t just great.

These dividends are downright life-changing.

A little quick math will blow your mind: If you drop $500K—that’s less than half what most financial gurus suggest you need to retire—into this powerful portfolio now, you’d kick-start a $40,000 annual income stream.

That’s about $3,300 a month in regular income checks!

Discounts on great investments don’t last forever, though, so the time to get in is now while you can still buy at bargain prices. Click here to get everything you need—names, tickers, complete dividend histories and more—instantly!

Recent Comments