Has the market bottomed, or are we headed for another leg down before we can start to even think about any upside? It’s a debate that will be with us for a while yet.

But maybe not in every corner of the market. Because there’s a funny thing happening with closed-end funds (CEFs): for some of these high-yield investments, the recovery has already come.

Let me explain.

In a selloff, a CEF can get hit in a couple ways, namely from the market and from investors. In the case of regular stocks, these are the same. But for CEFs, there’s a key difference: while CEFs trade on the open market, like stocks, they have a fixed number of shares (hence the name“closed-end funds”). This means the value of their portfolios, known as their net asset value, or NAV, can deviate significantly from the value the market places on a single share of that CEF.

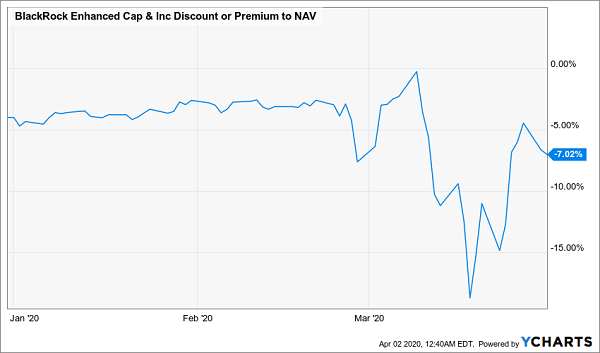

As a result, some funds can trade at huge discounts to NAV. The Blackrock Enhanced Capital and Income Fund (CII), for instance, trades at a 7% discount as I write this, but it traded at a whopping 18% discount just a few days ago.

A Big Discount, Half Gone

The cause of that big discount is obvious: the current crisis. As a result of travel being suspended and lower spending across the country (and the world), CII’s portfolio value fell, and so did its market price:

CII Gets Hit Twice

Of course, CII is still cheap, with its bigger-than-average current discount. But elsewhere in the CEF universe, discounts have actually disappeared for some high-quality funds.

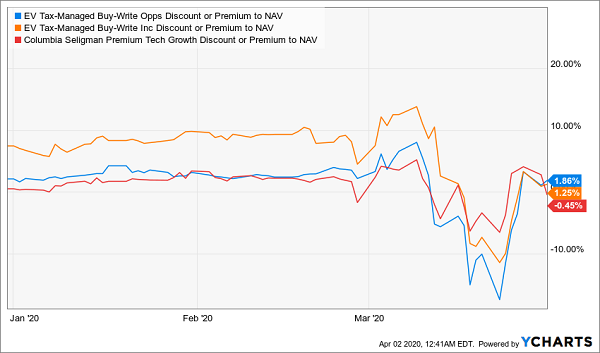

Take the Eaton Vance Tax-Managed Buy-Write Income Fund (ETB), Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV) and Columbia Seligman Premium Tech Growth Fund (STK). When the market fell in March, these funds saw their premiums disappear, then dive into discount territory, before returning to around, or just above, par, as of this writing.

Discounts Appear, Then Vanish

My CEF Insider service is dedicated to identifying when funds fall to a steeper-than-usual discount, because these dips happen fast and are entirely irrational—and that gives us contrarians a chance to buy CEFs for less than market value.

As you can see above, STK, ETB and ETV have each recovered from deep-discount territory. There’s good reason for that: before the crash, each had a long history of strong gains and high dividends (they’re yielding around 10% now, but have paid over 7% for years):

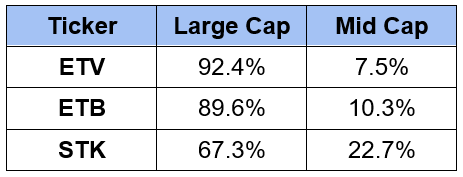

Why have investors come back to these funds? Because they’re among the strongest high-yielding investments out there. Check out their diversification between large- and mid-cap stocks:

Conservative Funds for Turbulent Times

Source: CEF Insider

With the vast majority of their assets in large caps and most of the rest in mid caps, these funds are steering clear of the firms most at risk these days: small caps with huge debt loads and little access to credit.

Instead, these funds have gone with companies that will survive the crisis and thrive afterward, like Microsoft (MSFT), Costco (COST), Walmart (WMT) and Visa (V).

Savvy investors realized this and bought into these funds when everyone else was panicking and selling everything. As such, they’re likely going to sit back and enjoy 10% yields for years. Such is the life of the contrarian CEF investor.

It’s Not Too Late

While it’s too late to get these funds at a discount, it’s not too late to get many others at a price far below what their assets are really worth. As of this writing, there are 41 CEFs investing in high-quality companies based mostly in the US that also trade at discounts to NAV. A full 22 of those funds trade at discounts over 10%!

However, time is running out on this sale. All of those 41 CEFs had larger discounts just two weeks ago, and almost all have seen their discounts shrink since. This means you still have a chance to get in for bargain-priced 10% yields and strong long-term profits—but it won’t last.

From 41 to 4: My Top CEF Buys for This Crisis (8.4%+ Dividends)

Let’s face it, 41 CEFs is still a lot of funds to sift through—and many of these are cheap for a reason: their management teams have no plan for closing their discounts, and ideally swinging them to a premium.

That’s why I’ve gone through each of these funds to come up with my 4 very best CEF buys now. These 4 CEFs yield an outsized 8.4%, on average, and the highest yielder of the bunch pays an incredible 10.3%.

These 4 funds also trade at unusual discounts now—discounts I fully expect to snap back to premiums, just as they’ve done many times in the past. When that happens, these shrinking discounts will “catapult” our gains higher—plus we’ll enjoy their big dividend payouts while we wait.

Full details on these 4 high-yielders are waiting for you now. Click here and I’ll share all of my research on them with you: names, tickers, buy-under prices, complete dividend histories and much more.

Recent Comments