“Buy low, sell high.” It’s the oldest investor slogan there is—and the deadliest one, too!

You simply cannot afford to give in to this “wisdom” today, even though it’s tempting. Now that we’ve seen a couple of days of weakness, you might be wondering if the recent all-time high was a sign to sell—and if all-time highs are often signs to sell. But do that now and you’ll certainly leave huge income—and upside—on the table.

Instead, now is the time to buy, especially closed-end funds (CEFs) paying dividends of 7% and up. I’ll give you an example of one of these high yielders—which drops its payout into your account monthly—further on.

What’s more, plenty of these funds are cheap today: as I write, 118 CEFs trade at discounts of 10% or more.

Before we get to that, let’s look at why market timing is a recipe for disaster, even though this simple advice feels right on almost every level.

A Trap as Old as Money Itself

The market-timing temptation is easy to understand when you look at a chart of the market’s performance in the last few years—in hindsight, it looks pretty easy to buy when the market freaks out and sell at a peak.

A (Seemingly) Simple Play

But of course, you can only spot a peak (or a trough) in hindsight. And when you guess, you almost always guess wrong. Check out this chart up until July, when stocks broke to their highest point. At those heady levels, it sure felt like a correction was about to drop—and soon!

Investors Who Fell for This “Warning” …

But if you had sold when stocks broke out of the channel above in early July, you would’ve missed out on higher prices over the next five months, not to mention dividend payouts:

… Missed Out on Gains (and Dividends)

So why doesn’t market timing work?

Simple: because it’s natural for the market to be at an all-time high. You should chuckle whenever you see a headline that says “Stocks reach a new record,” because that’s exactly what stocks are supposed to do!

And, historically, that’s exactly what stocks have done.

Over the last 70 years, stocks hit all-time highs about one out of every 15 days. What’s more, stocks rarely go into bear markets after hitting all-time highs (this happened in 2000, 2007 and 2018, but those occasions represent just 4% of every all-time-high day over that period and less than 1% of all trading days.

It isn’t the all-time highs that are rare, but the bear markets!

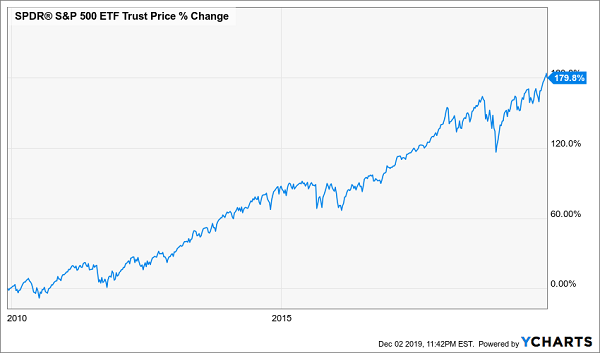

When all-time highs occur, stocks have a higher chance of going up to a new all-time high within a month or staying within 2% of the all-time-high level than they have of declining 5% or more. That’s why the market’s long-term performance looks like this:

One All-Time High … Then Another … And Another

Over the last 50 years, US stocks have gained an average of 9.1% annually, making them one of the world’s best-performing assets. That’s because all-time highs aren’t a sign to sell, like with beanie babies, baseball cards or cryptocurrencies: they’re a time to buy.

118 CEFs Trading at 10% (or More) Off

What if you’re worried about a long market lull, like the famous 10 years from 2000 to 2009, when stocks flatlined? While such downturns are unusual (2000–09 and the Great Depression are the only periods where this happened), if you’re close to retirement and need cash from your investments, it’s a serious concern.

This is where CEFs are a big help.

CEFs are a kind of mutual fund that focuses on large dividend payouts. With an average payout of 6.9%, CEFs trounce the 1.8% dividends you’d get with an index fund like the SPDR S&P 500 ETF (SPY).

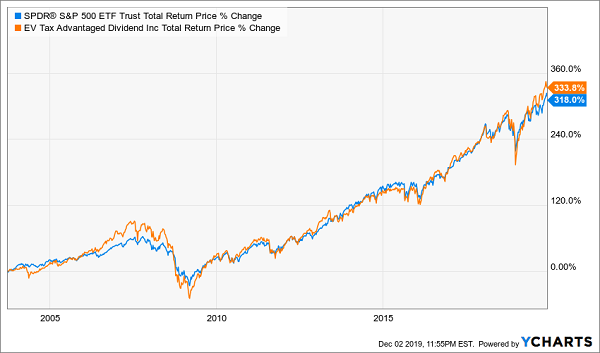

And you don’t have to sacrifice diversification or dig into risky small-caps to get that kind of yield. For instance, the Eaton Vance Tax-Advantaged Dividend Income Fund (EVT) pays a 7% dividend yield. Large-cap stocks, like JPMorgan Chase (JPM), Verizon Communications (VZ) and Walt Disney Co. (DIS), make up about 75% of the portfolio. The rest is a mix of corporate bonds, mid-cap stocks and other investments. What makes EVT even more impressive is that it’s beaten the S&P 500 since its inception.

Huge Dividends and Market-Crushing Gains in 1 Buy

Besides high dividends and market-beating performance, many CEFs offer another benefit: discounts. Because their market prices can deviate from the net asset value (NAV) of their portfolios, some CEFs trade for less than their assets are worth. While EVT’s strong historical performance means it’s now trading at about par to its NAV, there are other CEFs out there—118 as I write this—trading at 10% or less than the actual value of their portfolios.

Most important, these CEFs deliver strong income that’s invaluable if the market flatlines or pulls back. During the 2000–09 flat market, EVT kept on paying its investors, giving them the cash they needed without having to sell—and take the huge risk of trying to time the market.

8.8% Dividends, 20% Upside in 2020: Learn How Here

When I said there were other CEFs out there trading at discounts of 10% or more, I wasn’t kidding. As I said, there are 118 CEFs with discounts that big—and even bigger.

And I’m going to share my 4 very best CEF bargains with you right now. Not only is this quartet trading at a serious discount now, they also yield a massive 8.8%, on average!

In other words, when you put your cash into these 4 funds, you’re essentially getting the historical return of US stocks in dividends alone, before we even get to any price gains. It’s the perfect recipe for a flat market, and a key “safety valve” in a pullback.

And speaking of price gains, the discounts on these 4 funds are so big, I’m fully expecting their prices to jump 20% by this time next year—not including their huge cash payouts!

Full details are waiting for you now: simply click here and I’ll give you everything I have on these funds: names, tickers, best-buy prices, my complete take on each fund’s manager—all of my research!

Recent Comments