Today I’m going to show you how to get a livable income stream from a $300,000 nest egg—while growing your savings at the same time.

Sounds impossible, right?

Wrong.

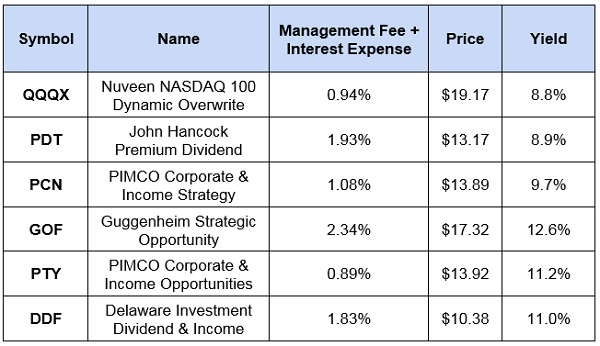

What’s more, we’re going to pull it off using just six funds. When we’re done, we’ll end up with a simple, diversified portfolio that throws off an amazing, steady 10.4% dividend yield—more than five times the S&P 500 average!

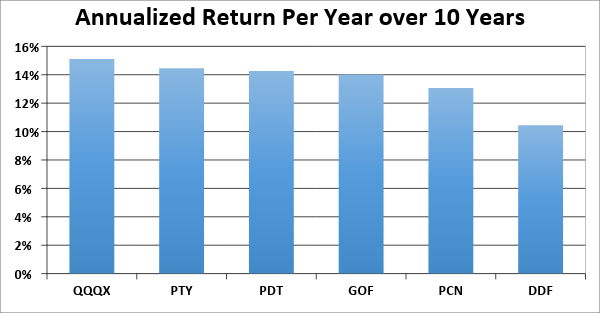

And if you’re worried that this outsized yield could come at the cost of a weak total return, don’t be, because these funds have delivered 12% per year over the past decade.

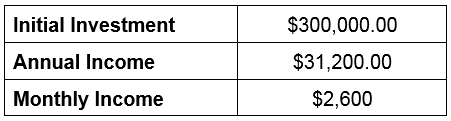

Before I get into these six funds, let me show you what numbers like these can mean for you: if we start with an upfront investment of $300,000 in this portfolio and leave it alone for 10 years, we can expect our capital to explode to nearly $1 million in a decade.

History tells the tale: if you had invested $300,000 in these funds 10 years ago, you would have done just that.

Now I’m not saying history is going to repeat exactly here, but remember that we’re talking total returns, and much of that gain came in the form of dividends.

And we can expect those hefty payouts to continue. As I said off the top, this portfolio has a 10.4% yield, meaning our $300,000 initial investment is going to give us $31,200 in annual income—that’s $2,600 per month!

Granted, many Americans make more than that in a year, so you may not be able to completely replace your income with this cash stream. But some folks could. In some parts of the country, average incomes do go down to $31,000, and with rents for one-bedroom apartments falling below $650 in some cities (like Wichita, Cleveland, Tucson, El Paso and Albuquerque), it is possible to live entirely on this income stream.

But even if you can’t live on $2,600 a month, this portfolio could hand you a nice, reliable supplementary income stream, leaving you much less reliant on the 9-to-5 grind.

So how does the portfolio work?

Connecting the Pieces

The six funds I’m talking about come from five management firms with impressive track records: PIMCO, John Hancock, Nuveen, Guggenheim and Macquarie.

Together, they hand you exposure to over a thousand firms through stocks and bonds. On top of that, the Nuveen NASDAQ 100 Dynamic Overwrite Fund uses an insurance strategy that helps protect you from a bear market by selling call options on its equity portfolio. (My colleague Brett Owens explained how this works—and why it cuts your risk—in an article you can read here.)

And of course, by throwing $300,000 into this group of six funds, we can earn a monthly income of exactly $2,600 on this portfolio:

Surely with such high yields, you’re going to sacrifice capital gains, right? In many cases, this is a tradeoff investors need to make, but these funds have performed tremendously, with annualized gains of 12% over the last decade:

Those gains are what allowed your $300,000 to balloon to almost $1 million if you chose to keep these funds and save the cash they yielded in dividends.

With numbers like these, you might be asking yourself why hardly anyone is talking about these funds.

The answer: these six funds are known as closed-end funds, which are an obscure corner of the market (I explain exactly how CEFs work in a quick primer you can read here.)

Why are these funds so obscure? Because their massively popular cousins, passive exchange-traded funds, have stolen the spotlight, even though many ETFs yield less than 3% (and many yield less than 2%). That’s not going to cut it if you’re yearning for an income stream that puts you on the road to financial freedom.

Then there’s the other cousin of CEFs, mutual funds, which have kept their stranglehold on the American financial industry thanks to regulation. Since 401ks can’t invest in anything other than mutual funds, many Americans have little choice but to invest in these funds when it comes to retirement planning.

But savvier investors who use IRAs and brokerage accounts can choose the six CEFs above, and others like them, and get a stronger cash stream.

And there are plenty of other CEFs to pick from. There are about 500 on the market now, and dozens of them are beating their benchmarks.

As a result, more people are learning that CEFs are a great tool for building a reliable income stream while also helping their portfolios grow. If you haven’t checked them out yet, now is the time to do so, starting with…

5 “Must-Buy” 8%+ Dividends for 2019

When it comes to retirement, the truth is, outsized dividends like I just showed you aren’t just nice to have—they’re a must-have if you want to achieve the “retirement holy grail”: clocking out and living on dividends alone.

Because when your dividends cover your bills (and then some!) and roll in like clockwork, who cares what Mr. Market gets up to on a day-to-day basis?

This is how everyone should approach retirement investing. And the good news is I recently released my top 5 CEFs to buy in 2019 in an exclusive Special Report—“5 Hidden Income Plays the ETF Companies Don’t Want You to Know About.”

You can get your own copy, and discover these 5 cash-rich funds for yourself, when you click here.

The best thing about these CEFs is that they’re throwing off a safe 8% average dividend.

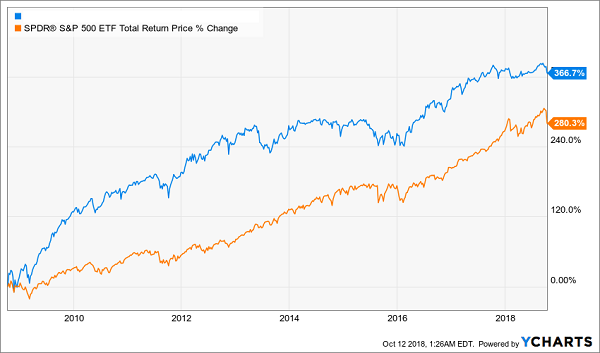

And that’s just the start, because these 5 income stars also have strong price upside, too. Take a look at how one of these buys—pick No. 3, to be exact—has manhandled the market since inception:

Market-Crushing Gains and an 8.7% Dividend—in 1 Buy!

My paying subscribers already have insider access to this exclusive top-5 list, and now I want to let YOU in on it, too. Simply click here and I’ll give you everything I have on these 5 high-yield CEFs: names, ticker symbols, buy-under prices, current dividend yields and much more!

Recent Comments