Investors are suffering from dividend anxiety, searching far and wide for extra income to help compensate for low yields.

Could 10%+ Yielding Mortgage REITs help calm the jitters?

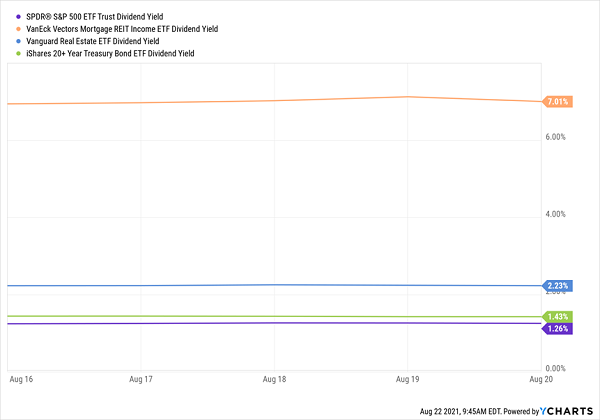

The yields offered by the S&P 500 or safe government bonds are near decade lows.

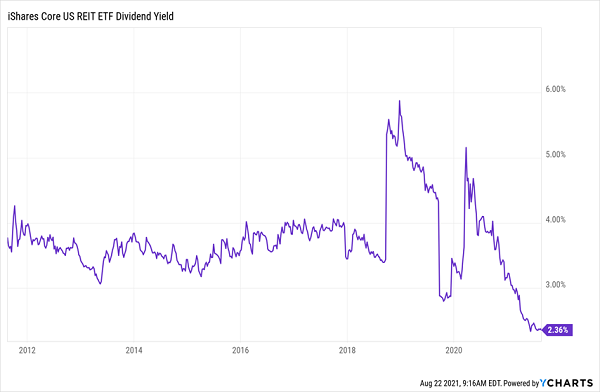

Even REIT investors are getting squeezed, with the average dividend yield now at about 2.4%.

Simply put, the majority of income provided by safe bonds, high-yielding equities, or REITs may not provide the income needed to meet retirement goals.

However, I’ve found a better path to the retirement promised land.

There is one area of the REIT market that can provide exceptional yields and in some cases more than 4x the income of the average equity REIT, and 8x that of the S&P 500.

I’m talking about Mortgage REITs (or mREITs), which have the highest overall dividend yield across the REIT sector.

Mortgage REITs are a bit of a different breed in comparison to traditional REITs that own real estate. As the name implies, mREITs invest in the loans themselves and not the property supporting the loans.

They are typically more highly levered versus a traditional ‘equity REIT’, and this can lead to more volatility in dividend payments.

And understanding mREITs is a bit more complicated, as their success is tied to the path of interest rates and the overall composition of their mortgage portfolio, not the underlying value of any property.

So, this space is not without risk, but there can be some high-yield gems if you spend enough time digging.

And if you find the right ones, it can be a home run for your retirement portfolio.

I’ve spent extensive time studying the space and found three Mortgage REITs yielding 10% or more that should at least be considered as a part of your retirement portfolio.

Invesco Mortgage Capital (IVR)

Dividend Yield: 11.4%

Let’s start with Invesco Mortgage Capital (IVR), which is a mortgage REIT managed by a team of investment professionals under the Invesco asset management umbrella.

As shown, the stock plunged precipitously when the pandemic hit. And there’s been no recovery in sight.

What caused the plunge?

At the height of the pandemic, rates were plunging, and mortgage asset valuations cratered. IVR faced margin calls on its mortgages as the credit markets completely froze up. They were forced to sell assets and slashed the dividend.

Since then, IVR has moved to convert its portfolio to safer agency-backed mortgage securities, those backed by the big quasi-governmental agencies such as Fannie Mae, Freddie Mac, and Ginnie Mae. This is a big shift from what used to be a portfolio of higher-risk commercial non-agency mortgage securities.

Mortgage REITs are typically valued using Book Value; since we don’t have any property to value, we can assess the current value of their loan portfolio. In the case of IVR, their most recent book value was reported as $3.25, which puts the stock trading at about a 3% discount to book value.

One note is that the book value did drop by about 12% in the recent quarter, mostly due to a more hostile rate backdrop that pressured agency mortgages. One risk right now is that the Fed might start to pull back on its purchases of agency-backed mortgages sooner rather than later.

Agency MBS investors, given the sharp economic recovery and hawkish commentary from nonvoting FOMC members, began to price in the potential for an earlier than expected tapering of asset purchases, including the possibility of a faster pace or earlier start in agency RMBS relative to U.S. Treasury purchases.

– CEO John Anzalone, Q2 2021 IVR Earnings Call

However, the hope here is that the conversion of the majority of the portfolio to more conservative agency securities can help reduce their future risk of margin calls if the credit market freezes again, hopefully making this more of a stable dividend payer over time.

Note that it has met its last two quarterly dividend payments of 9 cents per share, equating to a current 11.4% dividend yield.

Consider IVR a high-risk, high-reward type of investment.

Ready Capital (RC)

Dividend Yield: 10.9%

Ready Capital (RC) suffered a similar fate to IVR, with its stock plunging in early 2020, as the Mortgage REIT faced margin calls, while also slashing its dividend. However, the stock has made a strong recovery, nearly clawing back all of its pandemic-fueled losses.

How has it fared better than IVR?

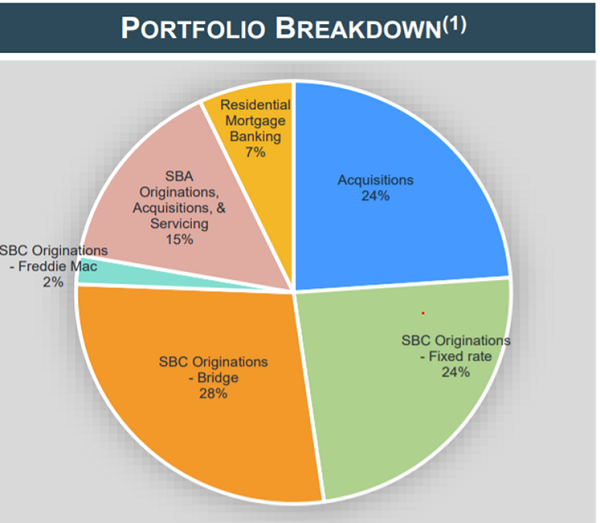

For one, the business is well-diversified; RC does business and real-estate lending; a solid mix between small business loans (SBA), small balance commercial loans (SBC), and residential mortgage lending.

Source: RC Investor Presentation

One big benefit that helped Ready outpace some of the competitors in the space last year; it partnered with the SBC and the Treasury Department to offer PPP loans, to the tune of $3 Billion in loans across 40,000 applicants.

The company has also been able to pick up attractive assets at fire-sale prices during the last few quarters, including the buyout of Anworth Mortgage Corp in December 2020, and Red Stone, a $4.5 Billion commercial loan company in August.

Deals like these have led to a consistent increase in book value from the pandemic lows. The current book value for RC is $14.87, representing a current 1% premium for the share price.

Given that management has been able to generate strong profits, with a current dividend that now sits ABOVE pre-pandemic levels, this near 11% yielder is one that I think represents a solid spot in any retirement income portfolio.

Cherry Hill Mortgage Investment Corp (CHMI)

Dividend yield: 12%

CHMI is the highest yielder of the three mREITs and like IVR, is still trading well below pre-pandemic levels.

The company takes a hybrid approach to investing in mortgages, splitting investments between mortgage servicing rights (MSRs) and agency residential mortgage-backed securities (RMBS).

They have however been quite aggressive in building up the MSR portfolio of their portfolio; note that when interest rates rise, there are fewer prepayments and the value of mortgage servicing rights increases.

We expect to further invest in MSRs to take advantage of an anticipated bounce in interest rates that we believe should generate value for the company and our shareholders.

– CEO Jay Lown, Q2 CHMI Earnings Call

Like others in the space, CHMI worked to build up liquidity during the pandemic, while reducing the leverage on its aggregate portfolio from 6.1 times during the pandemic to a current 3.6 times.

Its core earnings reported in recent quarters has been ample to pay out the 12%+ dividend yield, although any slow down in prepayment levels or additional interest rate volatility could lead to a future cut.

Management, for now, feels like the dividend is on stable footing:

While we are watching closely the recent fluctuations in rates and the potential impact on prepayments and asset yields, we remain confident in the near-term sustainability of our dividend.

– CEO Jay Lown, Q2 CHMI Earnings Call

The latest book value of $9.63 puts the stock trading at an 8% discount to book, which makes the potential here that much more intriguing.

Want More High Yielders That Won’t Require You To Draw Down Principal?

Chief Investment Strategist Brett Owens has you covered with his “No Withdrawal” Retirement Portfolio.

Here’s where you can earn a stress-free $35,000 on a half-million… $70,000 on a million… and $100,000+ annually on anything higher.

Plus, you won’t even have to tap your initial capital or “draw down” any of your priceless principal.

Recent Comments