These days, everyone’s in a tizzy about rising interest rates. But what if I told you that this panic is overblown—and it’s setting us up for some very nice windows to buy some top-quality high-yield funds throwing off payouts of 7% and up?

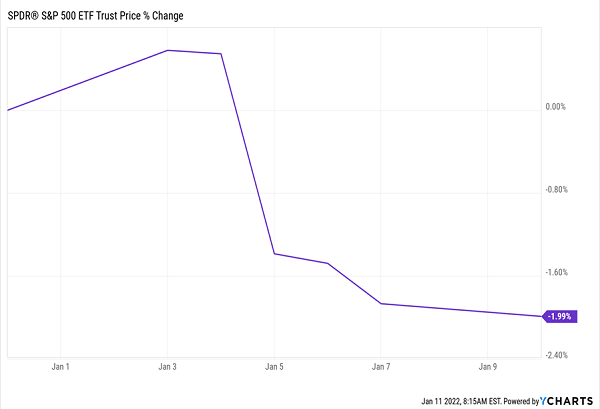

Why do I think it’s overblown? We’ll get into that below. But before we do, we should be careful to acknowledge that the early-2022 “crash” pundits are bleating about isn’t much of a crash at all:

You Call This a Crash?

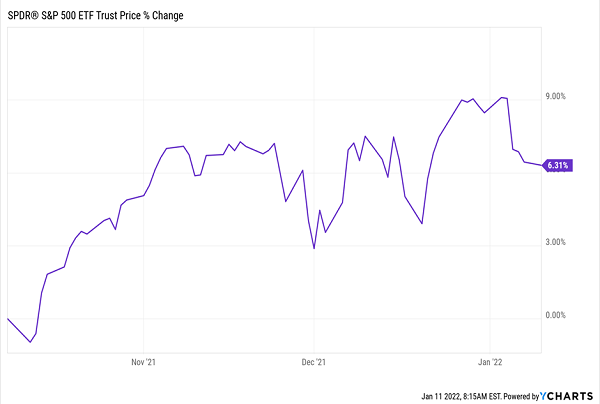

The S&P 500 is down less than 2%, and while that isn’t great, it isn’t terrifying, either, especially when we zoom out just three months.

…This Definitely Isn’t a Crash

That’s Exhibit A in my case that rising-rate fears are overblown: the press is panicking more than the markets!

The Fed’s Outdated Fears

Here’s Exhibit B: back in the middle of December, the Federal Reserve released minutes of its monthly meeting, which said, and I quote, “Current conditions included a stronger economic outlook, higher inflation and a larger balance sheet, and thus could warrant a potentially faster pace of policy rate normalization.”

The press ran with this, with headlines pointing to a more hawkish Fed ready to raise rates faster. What wasn’t reported is that the Fed also noted that Omicron might hinder economic activity, a fact that may cause the central bank to hold off on rate hikes, at least for a little while.

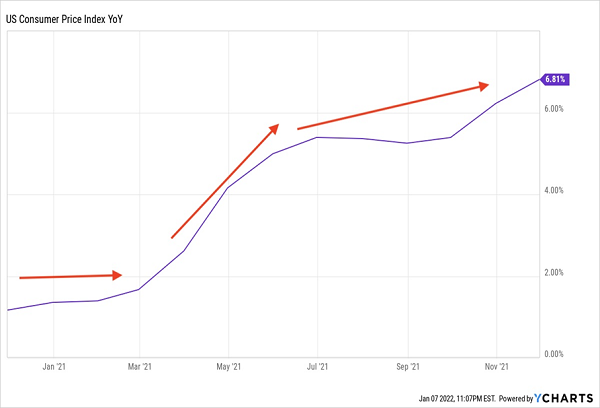

What Everyone Gets Wrong About the Inflation Rate

That’s not even the main thing about this inflation scare that everyone’s overlooking. Because the truth is, the numbers almost guarantee that it will ease up in the coming months.

Here’s what I mean: inflation really picked up in America in April 2021, after vaccines started rolling out and people tried to get back to some semblance of normalcy.

Inflation Rises in Early ’21 ….

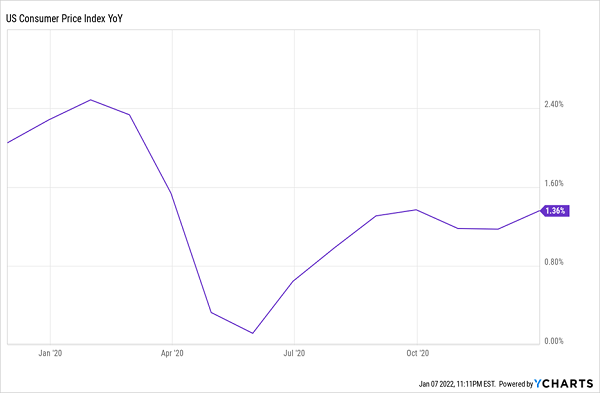

Of course, these are year-over-year numbers, so the rate of change depends not just on inflation in 2021, but in 2020, as well. And the chart from that pandemic-crushed year is, well, quite different.

… But That’s Mostly Because It Plunged a Year Earlier

See how inflation began to drop sharply in March 2020, leveling out only around August? Those low rates of inflation, when compared against 2021, made for alarmingly high numbers last year. But 2022’s figures will be compared to those high rates of growth in 2021, so it naturally follows that this year’s inflation will look tamer as we get into spring. And now, with Omicron spreading, there’s reason to think inflation will look tamer even before that.

The Fed’s Future Timetable

To be sure, the Fed will raise rates this year, but the market is now betting on a fast and sharp increase—and that’s looking less likely with the uncertainty Omicron brings and the easier comparables to 2021, whose effect we’ll soon start to see.

This also means that from now until spring we’re likely to have more market panics—some red days that are going to be great opportunities for us to buy high-yield stock-focused closed-end funds (CEFs) from the portfolio of my CEF Insider service.

As CEF Insider members know, some of the funds we hold have truly massive yields, like the Tekla Health Sciences Fund (HQL), which pays 9% as I write this and holds leading pharmaceutical stocks like Moderna (MRNA), Amgen (AMGN) and Regeneron Pharmaceuticals (REGN). That leaves HQL nicely dialed in to the trend toward higher healthcare spending which is pretty much locked in post-COVID-19.

In fact, today’s setup in the markets reminds me a lot of early 2016.

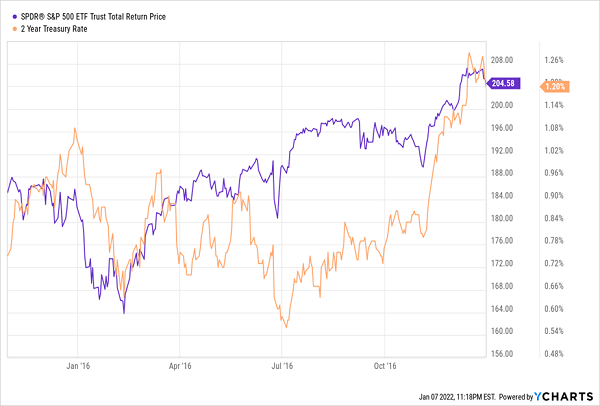

2016 Gives Us an Early Look at What’s Coming

As short-term interest rates rose (the orange line) after the Fed announced in late 2015 that it would start raising rates (after nearly a decade of keeping rates low), the stock market dipped … a little. Then it recovered and ended 2016 up 12%. Just six years later, it looks like history is repeating itself.

Yours Now: 19 CEFs Throwing Off Huge 7.5% Yields (+ My Top High-Yield Picks for ’22)

HQL, the CEF I mentioned earlier with the eye-popping 9% dividend yield, is a long-time holding in the portfolio of my CEF Insider service, and you can get my latest buy/sell/hold recommendation on that fund (and the 18 others CEF Insider holds!) with the no-risk 60-day trial I’m offering today.

The CEF Insider portfolio is a true income powerhouse, throwing off dividends so big you can use them to retire on without having to sell a single share of your investments! As I write, this unique collection of funds throws off an average yield of 7.5%!

That’s not all, because I also want to share with you my 4 top CEFs to buy for 2022. This quartet of dividend machines also boasts a massive payout—7.5% as I write this—and is primed for 20%+ price upside in the next 12 months, due to their bargain valuations!

All of this is waiting for you now: click here and I’ll give you full access to the CEF Insider portfolio and I’ll reveal my top 4 CEFs for the year ahead, which are yielding 7.5% and are ready to reward you with 20%+ price upside in the coming 12 months!

Recent Comments