Don’t be tricked by these manic markets. Let’s use this opportunity to “lock in” some inexpensive 7.7% dividend treats.

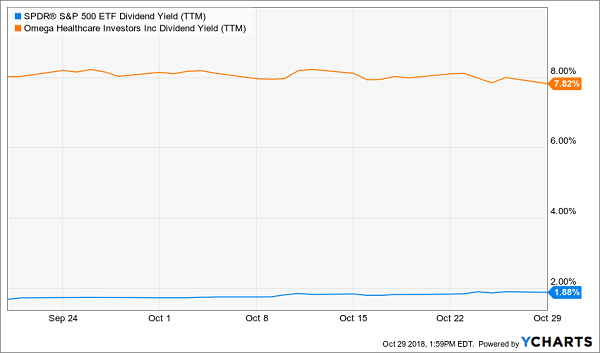

You probably know the mistake that most basic investors make. They fixate on the wrong charts and the wrong tickers. For example most “buy and hope” types are bemoaning the stock market’s near-10% correction:

Rocky Times for Buy and Hope Investors

Meanwhile savvier shareholders are focusing on dividend disparities like this one from Omega Healthcare Investors (OHI). The healthcare REIT (real estate investment trust) yields 7.8% today, which is more than four times what the slumping S&P 500 pays!

Four Times the Dividend Yield

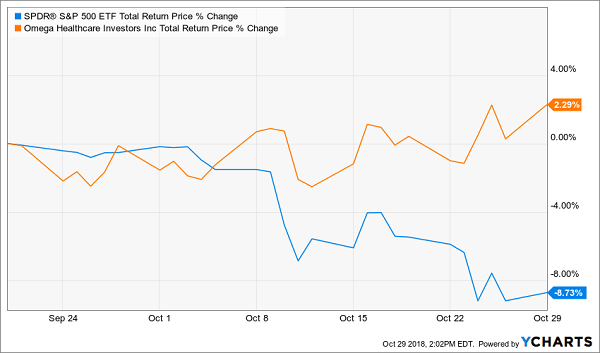

OHI investors might not even realize that the markets are down. And why should they? Their underappreciated dividend is finally gaining the respect it deserves from Wall Street:

What? OHI Worry?

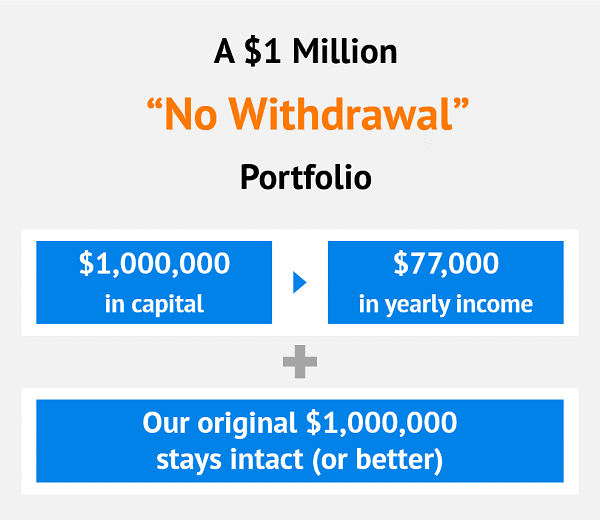

OHI is a staple of our acclaimed 8% No Withdrawal Portfolio because it is a dividend paying battleship. The firm collects rent checks from its skilled nursing facility (SNF) operators. Thanks to an aging America, there is plenty of demand for OHI’s facilities.

As a REIT, it is obligated to pay most of its profits to us shareholders in the form of dividends. This is why REITs often pay more than stocks-at-large, which also helps their prices hold up better during times of market turbulence.

Our portfolio (which I manage personally for my Contrarian Income Report readers) features REITs, stocks, bonds and other underappreciated vehicles that pay meaningful dividends. Our average yield today is an excellent 7.7%, which means a million dollar portfolio spread across our 19 holdings will generate $77,000 in yearly income. Plus the original capital will stay strong thanks to the durability of our holdings.

Now, every stock (or fund) is not going to stay afloat all the time. When investments trade publicly that means they are subject to public whims. Our 7.7% yields will eventually make our holdings popular – especially when markets are turbulent – but prices will wander where they will on any given day, week or month.

This is just fine for us. We can buy more dividends for our dollar if and when our stock and funds do pull back.

Now, which investments are worthy of No Withdrawal status? Here’s a three-step check to use on any dividend payer.

Step 1: Make Sure the Yield is Meaningful

I roughly define “meaningful” as 6% or better in a world where we can bank 3% or so from US Treasury bonds. Generally I look for an average between 7% and 8% so that we can achieve our $70,000+ annual income goals on a million dollar portfolio.

Can you talk me into a 5% payer? Sure – we actually own a few in our CIR portfolio. These investments tend to have especially intriguing price upside thanks to their cash flows, dividend growth and/or income potential.

Step 2: Make Sure the Dividend is Safe

For stocks, we generally like to see a “payout ratio” – the percentage of profits paid as dividends – below 50%. REITs can pay more – as high as 90%, even – and do so safely. Every company is unique so be sure to watch the trends as closely as you monitor the absolute ratios. When companies stretch to pay their dividends, their ratios will often rise to the high end of their historical norms (or worse, beyond!)

Also, cash is king. Traditional payout ratios focus on earnings, which are accounting creations. Focus on cash payout ratios instead.

(Note: Most financial sites do not have a good handle on these statistics for REITs. It’s best if we compute these ourselves rather than relying on other websites.)

Step 3: Project the Dividend’s Prospects

The financial world is rarely static, so we must also take our current snapshot of the business (or portfolio in the case of bonds) and project it into the months and years ahead. This may involve different considerations depending on the investment:

- For a bond fund, can it make money as interest rates rise?

- For a REIT, can it continue to raise its rents – even in a recession?

- For a commercial landlord, will its tenants continue to pay on time regardless of broader economic activity?

Today, I see eight great buys paying close to 8% a year in dividends alone. They span a variety of strategies, from fixed income to landlords to rising-rate friendly portfolios. All pay big dividends and all pass my three-step dividend safety test with flying colors.

The 8 Best 8% Dividends with Big Upside to Buy Today

Most Wall Street spreadsheet jockeys say we investors can’t have both the income and safety of bonds and the upside of stocks. We have to choose, or allocate, or whatever.

They’re wrong. My 8% “No Withdrawal” retirement strategy lets retirees rely entirely on dividend income and leave their principal 100% intact.

Well, that’s not exactly right. Their principal is more than 100% intact thanks to price gains like these! Which means principal is actually 100%+ intact after year 1, and so on.

To do this, I seek out stocks and funds that:

- Pay 7%, 8% or better dividends…

- That are well-funded…

- Trade at meaningful discounts to their intrinsic values…

- And know how to make their shareholders money.

And I talk to management, because online research isn’t enough. I also track insider buying to make sure these guys have real skin in the game.

Today I like three “blue chip” funds as best income buys. And wait ‘til you see their yields! These “slam dunk” income plays pay 8.5%, 8.7% and even 8.9% dividends.

Plus, they trade at 10-15% discounts to their intrinsic values today. Which means they’re perfect for your retirement portfolio because your downside risk is minimal. Even if the market takes a tumble, these top-notch issues will simply trade flat… and we’ll still collect those fat dividends!

If you’re an investor who strives to live off dividends alone while slowly but safely increasing the value of your nest egg, these are the ideal holdings for you. Click here and I’ll explain more about my No Withdrawal approach – plus I’ll share the names, tickers and buy prices of my three favorite closed-end funds for 8.5%, 8.7% and 8.9% yields.

Recent Comments