We’ve been getting a number of questions from CEF investors in the last few weeks about return of capital, or ROC.

This is a measure that shows up regularly with CEF dividends—and it makes many folks wonder if their funds are simply handing back the money they’ve invested as part of their payout.

(Note that much of what we’re going to discuss below is tax related. I’m not a licensed tax professional, so I can’t give you tax advice. You should consult a tax professional for details on your own personal situation.)

First, let’s be clear that all CEFs that are publicly traded on US exchanges are actively investing in something, with funds specializing in municipal bonds, real estate, stocks, preferred shares, real estate investment trusts (REITs) and other assets. Truth is, you can access a wide cross-section of the economy through CEFs.

What’s more, after the bear market of the last year, there are plenty of bargain-priced assets out there for CEF managers to pick up—and many are hard at work doing exactly that. This is helping push up the returns of CEFs from across the economy.

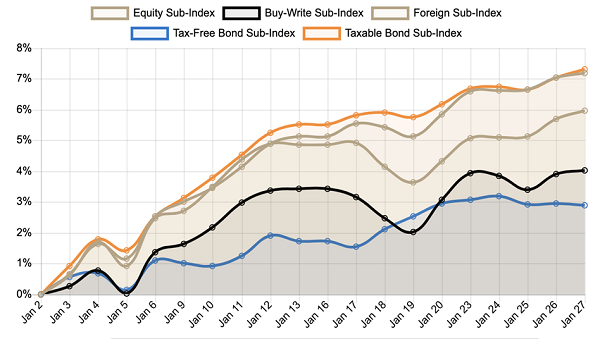

CEFs Start January Strong

Source: CEF Insider

Even so, some CEF investors’ concerns about ROC remain. But the truth is, ROC is actually a benefit of CEFs. Let’s examine why.

Return of Capital = A Smart Tax-Management Strategy

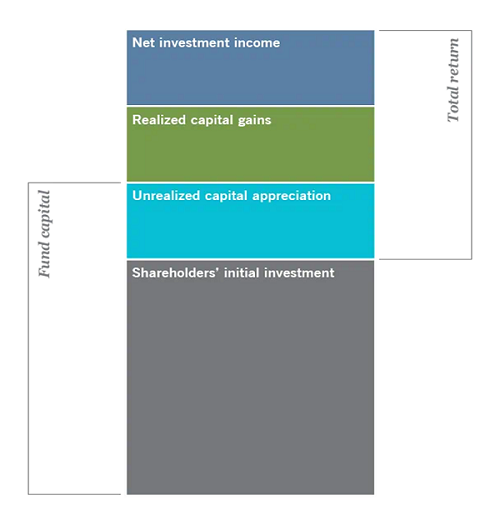

Source: Nuveen

CEF managers are required to distribute net investment income (i.e., dividends from stocks the fund owns, and interest payments on debts it holds) and realized capital gains (i.e., profits from selling stocks) at the end of the year as dividends.

But the fund can also choose to hand over unrealized capital gains and shareholders’ initial capital. Both of these—emphasis on both—are forms of ROC.

How can a fund return unrealized capital appreciation on an asset? Remember that funds own dozens or hundreds of assets, and they can sell one at a loss, use that loss to offset capital gains and then wait the time required by regulators (30 days in most cases) to buy that asset again.

Or the fund can buy another similar asset immediately. Do this aggressively enough and you can produce negative realized capital gains (losses) that are enough to offset your profits and, as a result, qualify as ROC instead of realized capital gains or net investment income.

Why would you do this? Taxes.

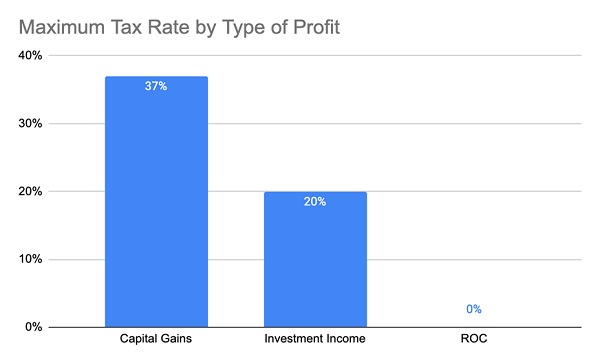

Source: CEF Insider

Capital gains can be taxed at a maximum of 37%, and net investment income, qualifying dividends and other kinds of passive income streams (we’ll call them all “investment income”) can be taxed up to 20%. ROC cannot be taxed.

If a fund can use its balance sheet to transform real profits into ROC for tax purposes, and if it can do this legally, it can save investors a lot in taxes. A tax-advantaged fund that earns you $100,000 in income comes with a 0% tax bill if it’s all classified as ROC, while a fund that ignores this strategy and gives you nothing but capital gains will come with a $37,000 tax bill.

And that’s just the start of the advantages a tax-advantaged CEF can provide.

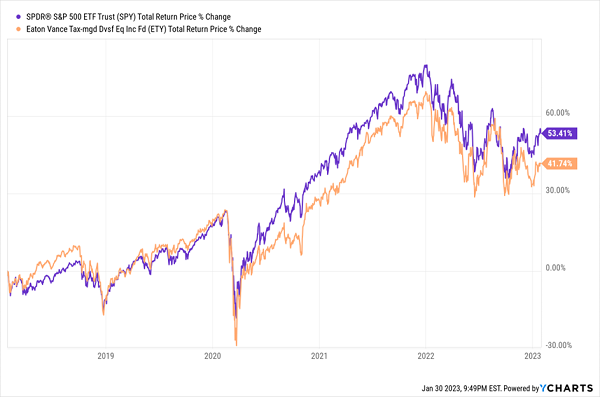

Those tax advantages extend even to underperforming funds, like the Eaton Vance Tax-Managed Diversified Equity Income Fund (ETY), a large cap–heavy CEF that holds mainstays of the S&P 500: Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL)—are the fund’s top holdings. ETY, represented by the orange line below, has underperformed the S&P 500 by a small margin over the last five years, which sounds bad on the surface.

ETY … an Underperformer?

Now, ETY’s 8.44% income stream, as of the time of this writing, is tax advantaged, with 86% of its dividend classified as ROC. If you bought the S&P 500 index fund, you might think you’ve won out. And in many cases, that’s true! But for a lot of American taxpayers, especially those in the top tax bracket, it isn’t true. The ETY investor would do better.

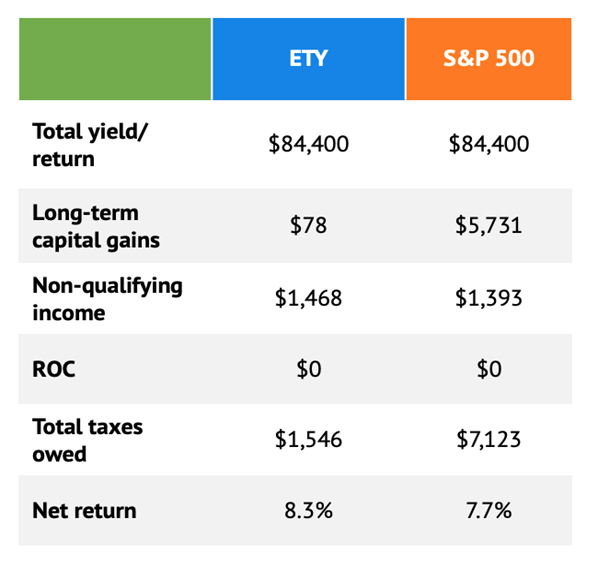

Here’s a look at how the same return from each fund would be taxed, based on a million-dollar investment, for those in the highest tax bracket:

For those in the top tax bracket, an investment in ETY earns an 8.3% net return, based on recent ROC levels, while an investment in the S&P 500 earns a 7.7% net return when both funds have similar returns in the market.

In other words, ETY can underperform the market by a margin of almost 10% and still, thanks to these tax benefits, give its investors an edge over an index fund. This is one reason why CEFs are favored by wealthy investors: In addition to price upside and high yields, they offer considerable tax advantages, too.

Revealed: 5 “Tax-Smart” CEFs Yielding 9.1% (With Double-Digit Upside)

The best part of CEFs is that they manage our tax liability for us. It would be near-impossible for us to do this on our own, but it’s second nature for the pros running our funds—and handing us our rich 8%+ CEF payouts!

And I’ve got five of my very best CEFs waiting for you now. Taken together, they hand us a stout 9.1% dividend yield. And with the deep discounts they offer, I see them poised to rise 20%+ in the year ahead, too!

Recent Comments