While most income investors stare at their portfolios, searching for the next shoe to drop, we contrarian yield collectors were treated to a rare treat this week. A dividend increase—from an income fund that now yields 8%!

We’ll talk specifics in a moment, but let’s start with the cash flow stream. This fund buys “preferred” shares, a brand of stock that most mainstream investors are not familiar with. The “first-level” types typically limit themselves to the common shares of stock, which are what you receive when you place an order to buy with your broker.

Preferred are there, too, if you know where to look. Corporations issue them periodically to raise cash. These issues generally pay dividends that receive priority over those paid on common shares (a nice benefit during brittle economic times like these.)

The dividends on preferreds are usually higher than their common cousins, too. In this “zero interest rate” world, that’s a pretty sweet quality.

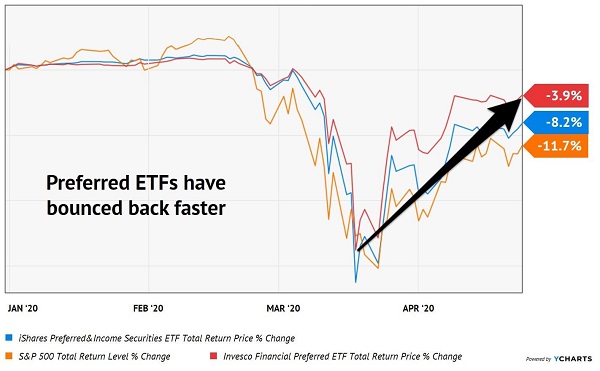

There are two popular preferred ETFs from Invesco and iShares that pay more than 5%. These big yields have helped these funds “bounce back” faster than the broader market, with both outpacing the S&P 500 year-to-date:

2 Popular Preferred ETFs Beating the Market

While relative returns are nice, you are probably looking for further “follow through” potential. After all, why would I mention a fund that is down if that didn’t mean it was ready to rally?

Plus, didn’t I say “8% yields” earlier?

For more upside, higher yields and that sweet dividend raise I mentioned earlier, let’s turn our attention away from ETFs and towards my favorite preferred CEF (closed-end fund). CEFs are the inside secret of income aficionados like us. Few subscribers ever return to mainstream ETFs after getting a taste of this (vastly underreported) dividend good life!

Our Contrarian Income Report go-to is the Flaherty & Crumrine Dynamic Preferred and Income Fund (DFP). Don’t let the sleepy name put you to sleep. This is the 8% payer that just raised its dividend a few days ago.

The managers and analysts at Flaherty & Crumrine run their own internal credit research. They are experts at “avoiding strikeouts,” which, again, is key in today’s soon-to-be-bankruptcy-laden world. Only high-quality preferred securities make it into DFP.

Preferred security selection is no joke. Heck, I get what they’re doing in terms of building their own database with specific terms, interest rates, credit quality, and so on—and I’m happy to “outsource” this research to F&C!

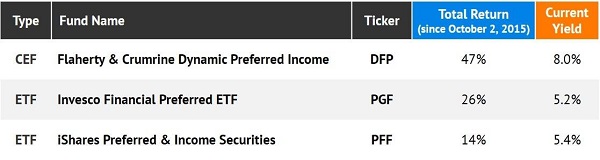

The firm charges a 1.06% expense fee, which would be quite high if it were an ETF, not a CEF. However, when it comes to picking preferreds, we get what we pay for. Since we added DFP to our CIR portfolio way back in October 2015, we’ve collected $8.39 in dividends—38%!—on our initial $22.26 purchase.

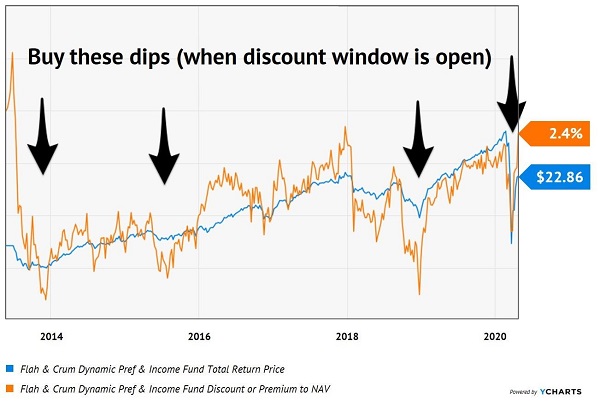

Meanwhile our fee was essentially “comped” because we were able to buy the fund at a discount to its net asset value (NAV) back then. (Remember, fees for CEFs are debited directly from their NAVs. Every yield you see quoted is net of these fees.)

And because CEFs can trade at discounts to their NAVs, a benefit of the inefficiencies we can “exploit” in this underappreciated market, we can get our fees comped by purchasing funds when they trades at discounts to their NAVs.

Circling back to my comment about getting what we pay for, that was perhaps a bit harsh with respect to the ETFs. They are not bad funds, they are just not as good as the one run by our folks at F&C. Since that October 2015 date, here are the total returns (including dividends) for DFP versus two well-known ETFs that specialize in preferreds:

When DFP is discounted, it’s the cornerstone of any dream retirement portfolio. The fund pays 8% and if you buy it at a big discount it tends to coincide with the dips in price nicely. DFP is a great fund but it does go on sale every few years, for whatever reason (well, we know why—investors are crazy).

Buy These Discounts in DFP

Unfortunately, the fund has already bounced back from its pandemic sale, and it could be another year or two until we see DFP at a discount again. That’s OK because we have plenty of dream retirement stocks and funds to buy right now. I’m talking about immediate yields as high as 15% per year, and that’s not even considering price upside potential. Click here for 3 more of my favorite contrarian income investments yielding up to 15% right now, including names, tickers, current yields and more.

Recent Comments