I keep saying it because it’s true and critical to your retirement wellbeing (or lack thereof) – don’t take any dividends for granted today!

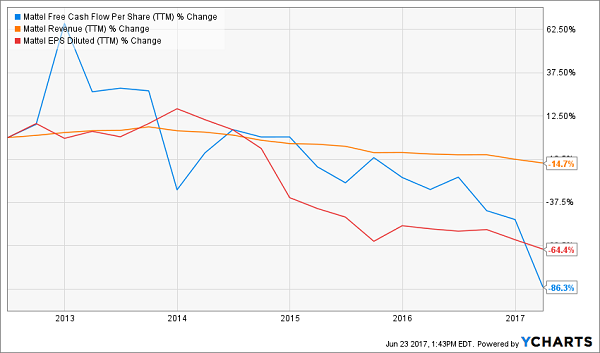

In a minute I’ll outline a 3-step “dividend disaster” test that you can quickly run on the stocks you own. I want to make sure you don’t hold the next Mattel (MAT) simply because “its yield looked good” or “so-and-so guru recommended it.”

First-level income hounds piled into Barbie’s plastic 6% yield. But when the firm “surprisingly” announced a sharp 61% dividend cut two weeks ago, shares completed a 36% dive:

6 Years of Dividends, Gone

Our Contrarian Income Report portfolio was, yet again, unique in our handling of this ticking toy bomb. Not only did we reject adding Mattel to our portfolio, but we actually called it out in our special report: The Dirty Dozen: 12 Dividend Stocks to Sell Now.

Mattel’s ubiquitous brands like Fisher-Price and Barbie will always be worth something, and the company isn’t ignorant to technology, offering products such as the voice-controlled smart-baby monitor Aristotle. But the loss of the Disney (DIS) Princess license to rival Hasbro (HAS) in 2014 was a shot to the gut, and Mattel doesn’t have a knockout brand like Hasbro’s Marvel line, which seems to have unlimited potential.

Mattel’s dividend is in serious danger of a cut, and if the company continues its current failure spiral, one could see Hasbro or private equity taking Mattel out of the picture via acquisition.

I realize it was “more work” to research the rotten toy trends that would eventually undercut this payout. But wouldn’t you rather put in the time upfront than be blindsided? After all, Mattel shares are down 36% in the last year. Investors who bought them for their 6% yield then have since lost six years worth of payouts while collecting just one.

If you’re interested in avoiding the next Mattel and running a quick “dividend disaster” check on the stocks you currently own, here’s a 3-step test you can follow today.

Step 1: Check the Industry (and Don’t Buy a Dying One)

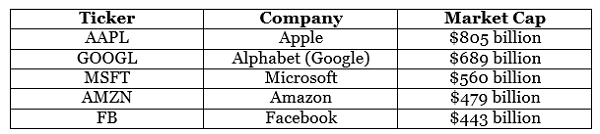

As we discussed two weeks ago, business disruption is accelerating today as entire industries are being eaten alive. There are five locomotives steamrolling business models across the country (and globe). They are currently the five largest firms by market cap:

2017’s Five Business Bullies

Notice a pattern? All five are tech titans. More specifically, they are the five best companies at writing software – which they use to scale their own businesses, at the expense of countless others.

Here are three entire industries – and payouts – that you should generally stay away from today because they are being steamrolled on the tech train tracks:

- Retail and Retail REIT Dividends

- Consumer Staple Dividends

- Restaurant Dividends

For a discussion of “why”, please click here to review our discussion of the rotten trends in each sector. Now, let’s look at individual companies.

Step 2: Check the Earnings and Cash Flow Trends

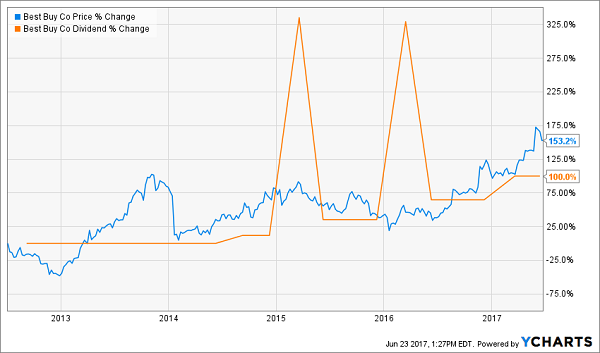

Exceptions to the rule above? Of course. For example, Best Buy (BBY) has “defied Amazon’s gravity” and continued to not only survive but also thrive.

Best Buy Defies “Death by Amazon” for 100%+ Gains

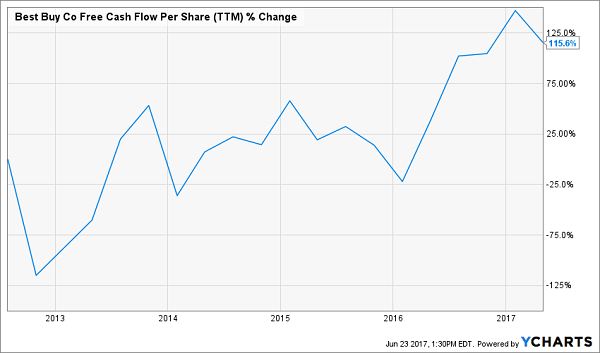

How’s an investor to know that Best Buy is an exception? Simple – look at its free cash flow (FCF) trend, which drives its dividend growth (and stock price):

Best Buy’s FCF Growth Drives its Dividend Growth

Fine, but how do we know that this retailer’s cash flow will keep humming while other retailing giants are eaten alive by the Amazon and broader Internet at large? That’s where a bit of “second-level analysis” makes all the difference.

In Best Buy’s case, a prescient investor would have been bullish on the firm’s online “price-match” policy, which kept in-store customers from buying elsewhere via their phones. He or she also would have also appreciated the retailer “doubling down” on the quality of its physical stores (which Amazon doesn’t have). And the Best Buy bull no doubt would have known that turnaround CEO Hubert Joly, who took the helm in 2012, was the key to everything.

On the other hand, the bearish case for Mattel was obvious well ahead of its actual dividend cut. It had already hit the dividend disaster trifecta, with sales, earnings and cash flow all in a downward spiral:

Mattel’s Foreboding “Dividend Disaster Trifecta”

Don’t have access to these types of charting tools? While I’d always recommend doing your own research, here’s a free resource that will give you a quick “health check” on the dividends paid by the 1,200 largest U.S. companies.

Step 3: And When in Doubt, Check DIVCON

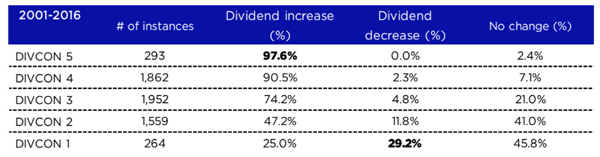

DIVCON is a five-tier rating system that provides a snapshot of dividend health for individual companies. It’s offered as a free resource by ETF shop Reality Shares (which provides one of my favorite dividend growth ETFs).

The test combines and weights seven factors (such as cash flow, earnings growth, and shareholder payouts) to provide a comprehensive snapshot of a company’s dividend health.

DIVCON 5 is the best bucket. It means the dividend is in good shape, and there’s a 96.6% likelihood that it’ll be increased in the next year.

DIVCON 1 is the danger zone. It means the dividend is more likely to be cut than increased in the next 12 months.

Over the past 15 years, investors who would have traded off DIVCON ratings – buying the fives, and selling or shorting the ones, would have done quite well:

DIVCON’s Dividend Prescience 2001 – 2016

Current “DIVCON 1s” include some of our most panned payouts like FirstEnergy (FE), Mosaic (MOS) and Exelon (EXC). (You can access DIVCON’s scores for free right here.)

Read the Rest of My “Dirty Dozen” Report, Yours Free

It’s not all doom and gloom in the dividend world. I do have a few select opportunities that are just begging for your investment dollars – some paying secure dividends of 8% or better!

Unlike Barbie’s plastic payout, these dividends are real and spectacular.

But sadly, as I mentioned, many of the juiciest dividends are ticking time bombs just waiting to go off. That’s why I put together a full report on the biggest offenders entitled The Dirty Dozen: 12 Dividend Stocks to Sell Now.

This report reveals the other 11 biggest potential disasters on my watchlist, including some of the most popular names on the street. Can you guess…

… the iconic retailer paying over 6% while operations are in terminal decline?

… the supposedly stable utility company whose coal and nuclear plants have quietly lost nearly 90% of their value in recent years?

… the respected retail REIT that finds itself (and its dividend) in a fight for its very survival because of the unstoppable online shopping trends I mentioned earlier?

Make sure you’re not holding any of these losers when they finally make the decision to cut payouts and share prices plummet! Click here to read my full Dirty Dozen report, and I’ll also share my favorite safe 8% yields to buy right now.

Recent Comments