What do Exxon Mobil (XOM), Colgate-Palmolive (CL) and Walmart (WMT) have in common?

Their dividend growth is running on fumes.

Sure, they’re all still members of the Dividend Aristocrats – that social club of companies that have raised dividends for at least 25 consecutive years. But Exxon, Colgate and Walmart all have kept their streaks of dividend increases alive within the past year by hiking their payouts by less than 3% apiece.

Sad!

If you’re looking for serious dividend potential, I can introduce you five income gushers that are doling out annual payout increases of 20% or more. But first, let’s quantify how why dividend growth is the single most important factor for you portfolio.

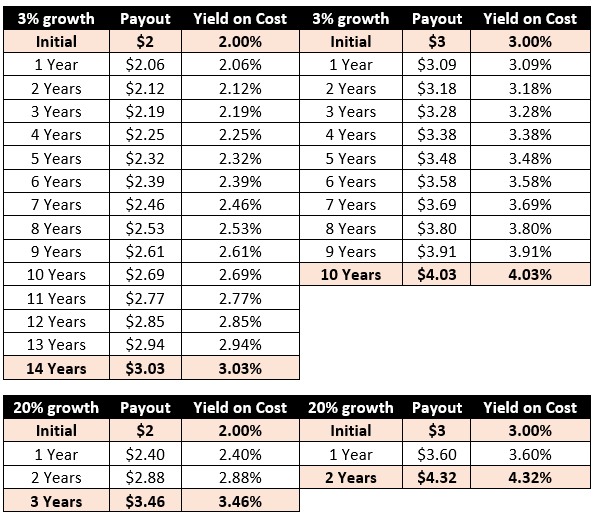

Here’s the difference between gasping, washed up aristocrats raising their payouts by just 3% versus true dividend growers boosting their payouts by 20% annually:

Dividend Growth on $100/Share Cost Basis

It takes 14 years for a 2% yielding stock to turn into a 3% yielder at 3% income growth, and still a decade for 3% to turn into 4%. In contrast, a 2% yield doubles to 4% in less than four years when it’s being raised by 20% annually!

Think it’s impossible to find 20% dividend growth? It is if you confine your search to the dead-money Dividend Aristocrats! Instead, consider these “bull market payouts” that are delivering annual dividend hikes of 20% to 40%.

Vail Resorts (MTN)

Dividend Yield: 2.01%

5-Year Average Dividend Growth: 40.8%

Most Recent Hike: 29.6%

Vail Resorts (MTN) might not be the most recognizable name in dividend (or any other kind of) investing, but those who have bought into the under-the-radar entertainment and lodging play have enjoyed a ridiculous 340% return … in capital gains alone!

Vail is a three-pronged business that operates under …

- Mountain: 10 mountain resorts and three urban ski areas, with operations that include “lift ticket, ski & snowboard school, dining and retail & rental business.”

- Lodging: Luxury hotels, condos, destination resorts and golf courses.

- Real Estate Development: This segment buys, holds, develops and sells real estate around the company’s resort communities.

Vail Resorts – which operates in Vail, but also Lake Tahoe, and various sites in Colorado, Utah, Nevada, British Colombia and even Australia, among other areas – is simply crushing the explosion of the “experience economy.” People are shifting to valuing experiences over things, and as a result, travel-related stocks like Expedia (EXPE) and Cedar Fair (FUN) have gone bananas. That includes MTN, which offers everything from skiing and mountain biking to golfing and guided hikes.

Vail’s profits have exploded by nearly 300% in the past three years, while free cash flow has rocketed by 150%. And the company hasn’t been shy about returning that cash. While MTN’s yield is just a hair north of 2%, it has ratcheted up its dividend from 19 cents to $1.05 cents in just five years – a 450% improvement that has outpaced its red-hot stock!

Vail (MTN) Scales the Dividend Growth Mountain

First Merchants Corporation (FRME)

Dividend Yield: 1.79%

5-Year Average Dividend Growth: 43.1%

Most Recent Hike: 28.5%*

First Merchants Corporation (FRME) is a mid-cap regional bank that’s located in Muncie, Indiana, and it couldn’t be a more boring company to talk about.

FRME operates under a trio of names – First Merchants Bank, Lafayette Bank and Trust, and First Merchants Private Wealth Advisors. It boasts just 106 locations across Indiana, Illinois and Ohio, offering financial services such as checking, savings, mortgages, and safety deposit boxes.

What makes First Merchants stand out is its insatiable thirst for M&A. This year alone, the bank has made deals for Fort Wayne, Indiana-based Alliance Banks and Upper Arlington, Ohio-based The Arlington Bank this year alone. FRME is devouring its way to growth, and that has produced a steady surge in profits over the past five years that has sent its shares up more than 200%!

That pales in comparison to its breakneck dividend expansion of 500% over the same time!

Like most banks, First Merchants was forced to cut its payout amid the 2007-09 financial crisis, so it had some pretty easy comparisons. But the dividend is far more secure at this point, and still isn’t even near pre-Great Recession levels.

FRME has actually approved two dividend hikes over the past year, for a combined year-over-year improvement of 28.5% in its annual payout.

First Merchants (FRME) Bounces Back With Bountiful Dividend Hikes

American Tower (AMT)

Dividend Yield: 1.95%

5-Year Average Dividend Growth: 21.7%

Most Recent Hike: 21%*

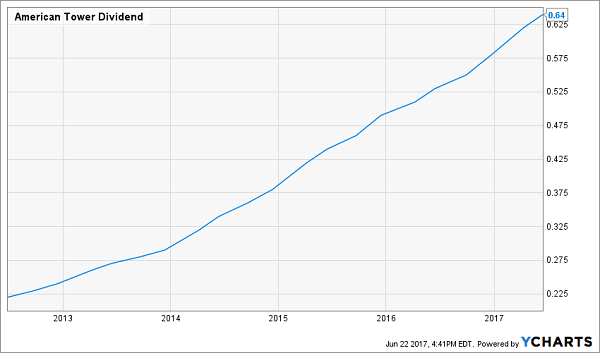

Of course, First Merchants doesn’t hold a candle to American Tower (AMT) when it comes to an itchy dividend trigger finger. AMT has raised its quarterly payout every single quarter since it started making regular payments after its conversion to real estate investment trust (REIT) status in 2011.

American Tower is a REIT that provides wireless communications infrastructure (namely towers) primarily in the U.S., but the company is expanding internationally. Right now, it boasts a total of 15 countries – from Germany to India to Uganda – across five continents. The company’s global portfolio at the moment consists of nearly 150,000 communications sites that it leases out to the likes of AT&T (T) and Verizon (VZ). It also provides services such as outdoor distributed antenna systems and in-building systems.

AMT boasts ever-rising funds from operations (FFO), and despite trading near all-time highs, it still trades at roughly 20 times FFO and pays out less than half its FFO out as earnings. In other words, the dividend is more than stable – it has room to grow like a weed!

American Tower (AMT) Hasn’t Missed a Beat

Celanese Corporation (CE)

Dividend Yield: 2.95%

5-Year Average Dividend Growth: 41.9%

Most Recent Hike: 27.8%

Celanese (CE) is cool.

This lesser-known materials company has a wide-ranging business that includes chemicals, engineered materials, even food ingredients. On its face, it’s boring – until you see all the applications its products have.

Celanese’s polymers are used to help construct military fighter craft to keep them lighter yet tougher; its acetate films are used from everything to ski goggles to flatscreen panels; it even produces Sunett, “a high intensity sweetener that is 200 times sweeter than sugar with a fast onset of sweetness and no lingering aftertaste.”

Sweet.

While investors typically think of DuPont (DD) and Dow Chemical (DOW) as the kings of chemicals, the real money has been in Celanese, whose total returns have outshone both industry titans over the past few years.

Celanese Has the Formula for Superior Total Returns

Celanese’s dividend has gone through the roof over the past few years, but even better is that dividend growth is accelerating. The company’s dividend increase to 46 cents per share earlier this year was a roughly 28% hike after two years of 20% improvements.

Extra Space Storage (EXR)

Dividend Yield: 3.99%

5-Year Average Dividend Growth: 31.3%

Most Recent Hike: 32.2%

I love self-storage REITs.

Self-storage is one of the best areas of real estate thanks to a combination of macroeconomic factors, as well as just the simple day-to-day of the business.

Self-storage facilities do well whether the economy is booming or busting; great conditions spur consumers to buy way more than they actually have room to spare, while poor conditions tend to force people to downsize their housing, and all their things have to go somewhere. Not to mention, self-storage is always in demand thanks to unfortunate but constant events such as divorces and even death.

On the business side, self-storage involves very little in the way of capital expenditures, and technology is helping to improve efficiency in the space to create even better margins.

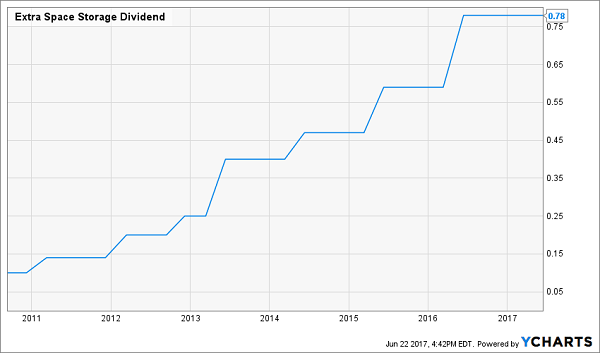

Extra Space Storage (EXR) is one of the largest players in self-storage, boasting 750,000 units in 1,450 facilities across 35 states. And while most people tend to think of “Storage Wars” when imagining self-storage customers, EXR also provides solutions for businesses and industries looking to store everything from sensitive files to pharmaceutical samples.

Extra Space’s (EXR) Self-Storage Dividends Help Pay the Rent

EXR has been a dividend growth giant, nearly quadrupling its payout since 2012 amid brisk improvement on both the top and bottom lines. Meanwhile, no matter how much Extra Space lifts its dividend, its ability to back it never wavers; adjusted FFO of $1.03 last quarter was more than enough to pay out its 78-cent dividend. That’s par for the course for this dividend machine.

Live Off Dividends Forever With This “Ultimate” Retirement Portfolio

You absolutely must have dividend growth if you want to retire in style. But you also need substantial, high-single-digit yield … and even at breakneck growth rates, it’ll take these companies many years to hit the 7%, 8% and even double-digit payouts you’ll need if you want to retire without ever touching your nest egg.

The “ultimate dividend stocks” in my 8%-Yielding “No Withdrawal” Portfolio are already right where we want them to be.

Market pundits love to parade around “safe” blue-chip stocks and funds that yield 3%, maybe even 4% on a good day. That math doesn’t add up! On a nest egg of $500,000, a 4% return nets you just $20,000 in annual income!

Does that sound like a great retirement … or does that sound like barely getting by?

My “No Withdrawal” Portfolio guarantees that you won’t have to settle for less during the most important years of your life by providing an 8% yield you can live off while growing your nest egg. I spent several months digging through a number of high-dividend dead ends, but I’ve weeded out dozens of losers and assembled an “ultimate” dividend portfolio that provides you with …

- No-doubt 6%, 7% even 8% yields – and in a couple of cases, double-digit dividends!

- The potential for 7% to 15% in annual capital gains

- Robust dividend growth that will keep up with (and beat) inflation

I love this all-star roster of stocks! It has REITs. It has preferred stocks. It has closed-end funds. In other words, it has built-in diversification, providing you with protection against some of the worst-case scenarios the market can throw your way!

Even then, this safe portfolio still yields 8% as a whole, letting you live off dividend income alone without ever touching your nest egg. So whether you need to make a big one-time buy like a house or even an emergency expense, you don’t have to worry about your retirement account going to ruin!

Don’t scrape by on meager blue-chip returns and Social Security checks. You’ve worked too hard to settle when it matters most. Instead, invest intelligently and collect big, dependable dividend checks that will let you see the world and live in comfort for the rest of your post-career life.

Let me show you the path to the retirement you deserve. Click here and I’ll provide you with THREE special reports that show you how to build this “No Withdrawal” portfolio. You’ll get the names, tickers, buy prices and full analysis of their wealth-building potential!

Recent Comments