The market consistently rewards faster earnings growth in stocks, even with more income-oriented names. Higher profits can lead to higher future dividends, which in turn helps investors build wealth, even as inflation is rising.

I’ve found two companies with hefty dividends that more than doubled earnings per share in the latest quarter. However, chasing the highest growth from one quarter to the next doesn’t always pay, if those profits aren’t passed down to investors as dividends on a consistent basis.

Earnings Growth Could Stem Tide of Dividend Cuts

Ellington Financial LLC (EFC) is a specialty finance company with over $7 billion in assets that invests in everything from mortgage backed securities, to collateralized loan obligations and distressed corporate debt. The stock has fared well in 2018, gaining 20% and still offers investors a juicy 9.9% dividend yield.

Ellington earned $0.69 a share in the second quarter, representing 331% year-over-year growth. Growth in the period was driven by both realized and unrealized gains in the company’s credit portfolio, which increased 9% in size to $1.12 billion.

Ellington is currently earning enough to cover its quarterly dividend of $0.41 a share, but management has cut the payout four times in the past four years.

It should come as no surprise then, the company still trades at a 15% discount to its estimated book value at the end of July. Chief executive officer Lawrence Penn saw value in the stock in May, purchasing $400,000 worth on the open market. Management also bought back $3.6 million worth of stock last quarter and has a further 1.55 million shares under its current repurchase authorization.

The buyback program was accretive to Ellington’s book value in the second quarter and the 15% discount could shrink over time if management continues to deliver higher profits and rebuild the dividend.

Power to Increase Static Dividend

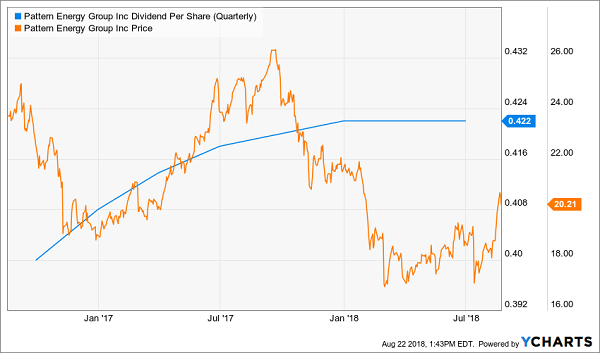

Pattern Energy (PEGI) is a power generation company with two dozen solar and wind projects across North America. Shares have lost 11% over the past year, which also coincides with the timing that management snapped its streak of increasing the company’s dividend 16 consecutive quarters.

Pattern Energy delivered a profit of $0.38 a share in the second quarter, up 137% from the previous year. Revenue also increased 30% year-over-year. Growth in the period was driven by a 7% increase in gigawatt hours sold in the period and the company’s cost-cutting efforts.

However, the most important number at Pattern Energy is cash available for distribution (CAFD), which increased 19% in the second quarter to $0.60 a share. That’s more than enough to cover the current quarterly dividend of $0.422 a share and management is more than halfway to its 2018 CAFD guidance of $151 to $181 million, representing 14% growth from the previous year.

Only time will tell if this higher cash flow will lead to a resumption in the company’s dividend increases in the future.

Of course everyone likes to see earnings double from one year to the next, especially when a company already yields north of 8%. However, most of the time, a company’s short-term growth isn’t sustainable or the higher profits don’t flow through as dividends as quickly as we’d like.

Since share prices move higher with their payouts, there’s a simple way to maximize our stock market returns: Buy the dividends that are actively growing the fastest. And don’t be fooled by modest current yields. They often don’t capture the growth potential (and it’s the dividend’s velocity that really makes us big money – not its starting point).

7 Fast Dividend Growers with Bright Futures and 100%+ Upside

So how do we buy high velocity dividends, the aristocrats of tomorrow? It’s a simple three-step process:

Step 1. You invest a set amount of money into one of these “hidden yield” stocks and immediately start getting regular returns on the order of 3%, 4%, or maybe more.

That alone is better than you can get from just about any other conservative investment right now.

Step 2. Over time, your dividend payments go up so you’re eventually earning 8%, 9%, or 10% a year on your original investment.

That should not only keep pace with inflation or rising interest rates, it should stay ahead of them.

Step 3. As your income is rising, other investors are also bidding up the price of your shares to keep pace with the increasing yields.

This combination of rising dividends and capital appreciation is what gives you the potential to earn 12% or more on average with almost no effort or active investing at all.

Which future aristocrats should you buy today? Well you know us – we’ve got three best buys – plus four more bonus dividend growth stocks – that should safely double your money every three to five years.

It’s a simple formula – their dividends are doubling every three to five years, which means their prices will rise in tandem. At the same time, we’ll collect their dividend payments today and enjoy an even higher income stream tomorrow.

This dividend growth strategy has produced amazing 23.7% annualized returns for our Hidden Yields subscribers since inception. In three years, we’ve crushed the broader market (the S&P 500 returned 16% over the same time period.)

If you achieve returns of 23.7%, you’ll double your money every three years. So if you haven’t been following this strategy, why not? The best time to get started is right now – before the seven dividend growers we mentioned begin to move. Click here and we’ll share their names, tickers and buy prices with you right now.

Recent Comments