Our buddy Brian Hunt pointed out in yesterday’s DailyWealth that gold stocks are breaking out.

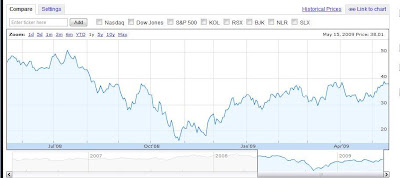

GDX, the ETF for gold stocks, has more than doubled off it’s late October lows, and is not perched at its high water mark since August 2008.

Gold stocks are on the move

So should we sell in May and go away? Or is the trend our friend? So many cliches to choose from – only one can be right!

I think you’re nuts to close any gold related positions right now. Gold stocks appear to be leading the price of bullion, which is often a bullish sign. Remember that the paper market for gold is easily manipulated – follow the phyical market.

Those of you who did just that back in December – when the paper price of gold were bottom, get gold buyers were snapping up the barbarous relic in record numbers – are probably sitting pretty right now.

Now remember that gold stocks are leveraged on the price of gold. If the price of gold doubles, gold stocks will do more than double – they will go to the moon. That’s because they’re doubling their sales price, while costs remain more or less the same (assuming oil does not rise in parallel).

So what if you want to get really, really stinking rich? One way to play it – with a small speculative portion of your portfolio, of course – is by investing in junior gold producers. They are some of the most volatile stocks in the world, but if gold skyrockets, these juniors are going to do some absolute moonshots.

One junior that is extremely worth of your consideration is AuEx Ventures. Last fall, our local Casey Research group hosted Ron Parratt, CEO of AuEx – I was so impressed that I bought some shares the next day, which I still own. Here’s a full write up about AuEx if you’re interested in learning more.

If you’re looking for some guidance in navigating the potentially profitable but trecherous waters of junior gold miners, I’d recommend you take a look at International Speculator, a reserach service provided by Doug Casey’s guys. I’ve subscribed to it over a year now.

The thesis is that if gold hits a real mania stage, the juniors will be the ones doing real moonshots, because they are highly leveraged to the price of gold for a number of reasons – maybe first and foremost, because the large gold producers are not doing much of their own exploration any more, they buy up juniors with promising finds. So if things get out of hand, as Casey’s guys are predicting, they believe the junior market will turn into something like the tech bubble in ’99.

Recent Comments