Top posts from the past week:

- The Case for Shorting Long Dated US Treasuries

- Why the Yen and Dollar are Rallying

- GoldMoney: Gold’s New Highs vs. Other Currencies

- Jim Rogers on CNBC: October 22, 2008

- Foods and Softs Outlook

A review of my futures trades from the previous week:

- Covered my Swiss Franc long – Turns out I didn’t want a dollar neutral trade after all. The Swiss Franc kept on dropping, and I got out.

Other existing positions I’ve got:

- Short the British Pound – Last time I shorted the British Pound, it turned out to be a quite profitable trade. The fundamentals of the Pound Sterling are terrible, and I think it’s possible we could see the Pound at $1.50 over the next 12 months…or maybe over the next week at this rate.

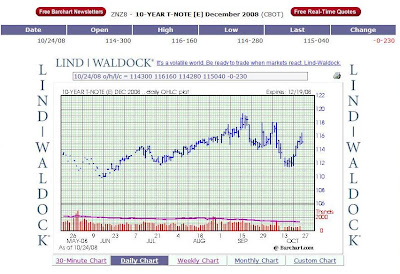

- Short a couple of 10-Year Treasuries – Treasuries have performed quite poorly over the last two weeks, and Jim Rogers described them as the “last bubble left”. Have they topped? I think they may have – and boy have they got some room to fall if interest rates skyrocket like I think they will. Although trending up since I shorted (what else is new), the chart still looks bearish, with lower highs and lower lows.

My wish list (waiting for an uptrend…and we could be waiting for awhile):

- Sugar

- Cotton

- Coffee

- Natural Gas

- Silver

Open Positions

| Date | Position | Qty | Month/Yr | Contract | Entry Price | Last Price | Profit/Loss |

| 10/10/08 | Short | 1 | DEC 08 | British Pound | 1.6870 | 1.5804 | $6,662.50 |

| 10/15/08 | Short | 1 | DEC 08 | T-Note (10yr) | 111-250 | 115-105 | ($3,546.88) |

| 10/13/08 | Short | 1 | DEC 08 | T-Note (10yr) | 112-185 | 115-105 | ($2,750.00) |

| Net Profit/Loss On Open Positions: | $365.63 | ||||||

| Account Balances | |

| Current Cash Balance | $48,710.90 |

| Open Trade Equity | $365.63 |

| Total Equity | $49,076.53 |

| Long Option Value | $0.00 |

| Short Option Value | $0.00 |

| Net Liquidating Value | $49,076.53 |

Cashed out: $20,000.00

Total value: $69,076.53

Weekly return: 0.5%

YTD return: -10.4%

***”Cash out” mostly means taxes, but lately I’ve also been using it for living expenses, and also to finance a time management software startup I’m working on.

Recent Comments