Top posts from the past week:

- Jim Rogers on Bloombert: November 3, 2008

- Is Sugar Breaking Out?

- US About to Flood the Market With Treasuries

A review of my futures trades from the previous week:

- No trades last week – again!

Other existing positions I’ve got:

- Short the British Pound – Last time I shorted the British Pound, it turned out to be a quite profitable trade. The fundamentals of the Pound Sterling are terrible – and that huge rate cut just delivered by the Bank of England will not help protect their currency.

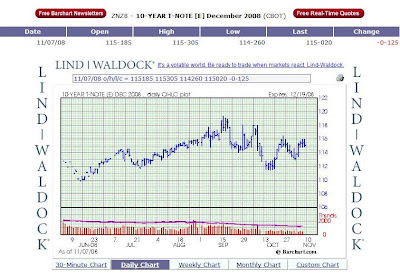

- Short a couple of 10-Year Treasuries – Treasuries have performed quite poorly over the last month or so, and Jim Rogers described them as the “last bubble left”. Have they topped? I think they may have – and boy have they got some room to fall if interest rates skyrocket like I think they will. Although trending up since I shorted (what else is new), the chart still looks bearish, with lower highs and lower lows. Some significant potential resistance coming up around 112.

My wish list (waiting for an uptrend…and we could be waiting for awhile):

Open Positions

| Date | Position | Qty | Month/Yr | Contract | Entry Price | Last Price | Profit/Loss |

| 10/10/08 | Short | 1 | DEC 08 | British Pound | 1.6870 | 1.5618 | $7,825.00 |

| 10/15/08 | Short | 1 | DEC 08 | T-Note (10yr) | 111-250 | 114-275 | ($3,078.13) |

| 10/13/08 | Short | 1 | DEC 08 | T-Note (10yr) | 112-185 | 114-275 | ($2,281.25) |

| Net Profit/Loss On Open Positions: | $2,465.63 | ||||||

| Account Balances | |

| Current Cash Balance | $48,710.90 |

| Open Trade Equity | $2,465.63 |

| Total Equity | $51,176.53 |

| Long Option Value | $0.00 |

| Short Option Value | $0.00 |

| Net Liquidating Value | $51,176.53 |

Cashed out: $20,000.00

Total value: $71,176.53

Weekly return: -1.6%

YTD return: -7.4%

***”Cash out” mostly means taxes, but lately I’ve also been using it for living expenses, and also to finance a time management software startup I’m working on.

Recent Comments