Sugar Futures Surge to a 6-Month High

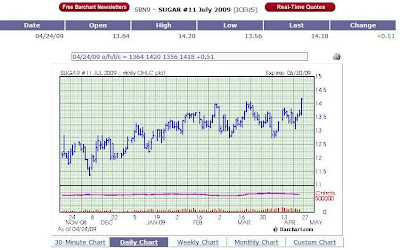

Sugar futures rallied nearly 4% on Friday, over half a cent, to close the week at 14.18. Looks like we’ve got a new breakout to the upside!

Sugar futures continue their steady climb. (Source: Barchart.com)

The market continued to focus on the news that India may turn into a net importer of sugar this year. Indian production is falling to a 4-year low, which, surprise surprise, is spurring prices up. Don’t worry though, Indian politicians are on the scene, with rhetoric and threats of banning futures trading to “halt” this price rise – ha!

Also bullish for sugar is continued strength in oil prices, which means Brazil will use more of its sugar for fuel. Last report I recall reading had Brazilian ethanol profitable at roughly $50 oil, so that’s the number I keep an eye on.

Finally demand for sugar is still projected to outpace supply this year, so we’ve got some strong underpinnings for a sustained rise in sugar in the months to come.

OJ Takes a Breather

Orange juice futures took a bit of a breather this week. Appears to be just a technical correction and profit taking, as I was not able to find any fundamental news to challenge our initial hypothesis for going long OJ.

Orange juice cooled off this week.

Other Commodity and Economic News

- Oil supply is coming offline at a breathtaking clip

- Natural gas is nearing its cost of production

- How bad will the financial crisis get?

Current Futures Positions

Rolled the May contract over to July earlier in the week. Other than that, not much new.

Thinking about adding to OJ, sugar positions on further strength.

Date Position Qty Month/Yr Contract Entry Last Profit

04/08/09 Long 1 JUL 09 Orange Juice 81.95 85.00 $457.50

02/27/09 Long 1 JUL 09 Sugar #11 13.79 14.12 ($672.00)

Net Profit/Loss On Open Positions $1,286.30

Current Account Value: $26,020.69

Cashed out: $20,000.00

Total value: $46,020.69

Weekly return: 0.1%

2009 YTD return: -48.8% (Don’t call it a comeback!)

Total value: $46,020.69

Weekly return: 0.1%

2009 YTD return: -48.8% (Don’t call it a comeback!)

Prior year’s results:

2008: -8%

2007: 175%

2006: 60%

2005: 805%

Initial stake: $2,000.00

Recent Comments