Buy.

Or hold – and buy when the uptrend resumes.

Sure this correction hurts. But corrections happen, and gold/silver were going parabolic for a bit – and anything that goes parabolic corrects eventually.

For a big picture view – let’s turn off CNBC and review the facts.

First, let’s discuss all of the fundamentals that originally drove the upward moves in precious metals that are no longer in place.

(crickets)

Actually, things have gotten worse, not better, in the macroeconomic picture. Fannie and Freddie are likely worth less than zero – and Hank and Co have given both a license to print US dollars.

And speaking of insolvency, have you checked out the US governments obligations recently?

I’m not holding my breath that future president OBAMA! (hat tip: Porter Stansberry) is going to slash government spending, reduce tax rates to spark economic growth, and improve our future charity obligations (Social Security, Medicare, etc).

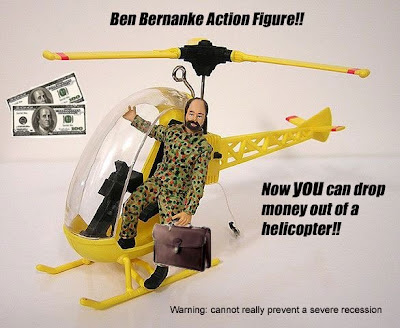

In fact, the only true threat I see to the gold/silver bull case is a deflationary scenario where everything goes down. But if you believe in our government’s determination and ability to print money, you’ll probably agree that we’ll rev up the helicopters and use the miracle of the printing press to inflate our way out of anything Mr. Market tosses our way.

And inflation is out of the gates early – highest inflation levels in the US since 1991, even after the government’s bogus adjustments.

Further reading:

- Franklin Sanders: Either this is the Greatest Silver and Gold Buying Opportunity of All Time, or the End of a Bull Market

Recent Comments