Now THAT’S the way you trade!

Two solid weeks in a row – I’m feeling good about things, back in control, following trends like I should be.

A review of my trades from the week that was:

- Closed out my Coffee long position – I closed this out on Thursday just north of the 143 mark, because – well – coffee just didn’t feel right. I bought in anticipating a possible breakout – didn’t get it – and figured best to close out my position. Much to my immediate chagrin, coffee rallied up above 146 soon after I closed the position. But was down 4.10 yesterday. Coffee is so volatile it’s unbelievable. This is truly a “close your eyes and buy” bull market, and I just don’t have the stomach or capital for this right now.

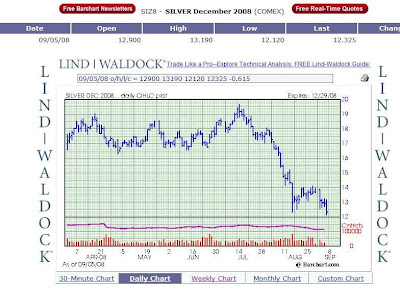

- Also closed out my Silver long position – Really, I had to come to grips with the fact that I didn’t time the bottom properly, that I was dumb for trying, and that I should wait for an uptrend before having a long position in Silver.

- Went long the Japanese Yen -As we discussed earlier in the week, the Yen has held up remarkably well in the face of this dollar rally. We finally got the breakout to the upside I was looking for on Thursday.

Other existing positions I’ve got:

- Short the British Pound – This trade continues to look good – the British Pound has been down basically every single day against the dollar for at least the last month. I’m happy that I closed my eyes and added another short contract last week.

My wish list (waiting for an uptrend):

- Sugar

- Cotton

- Coffee

- Swiss Franc

- Silver

Open Positions

| Date | Position | Qty | Month/Yr | Contract | Entry Price | Last Price | Profit/Loss |

| 08/29/08 | Short | 1 | SEP 08 | British Pound | 1.8190 | 1.7654 | $3,350.00 |

| 08/12/08 | Short | 1 | SEP 08 | British Pound | 1.9042 | 1.7654 | $8,675.00 |

| 09/04/08 | Long | 1 | DEC 08 | Japanese Yen | 0.9340 | 0.9339 | ($12.50) |

| Net Profit/Loss On Open Positions: | $12,012.50 | ||||||

| Account Balances | |

| Current Cash Balance | $50,069.73 |

| Open Trade Equity | $12,012.50 |

| Total Equity | $62,082.23 |

| Long Option Value | $0.00 |

| Short Option Value | $0.00 |

| Net Liquidating Value | $62,082.23 |

Cashed out: $18,000.00

Total value: $80,082.23

Weekly return: 7.4%

YTD return: 5.0%

***”Cash out” mostly means taxes, but lately I’ve also been using it to pay down my credit cards a bit. Why credit card debt? I’m financing a startup and trying to outpace my CC interest rate in the futures markets – kids, don’t try this at home.

Recent Comments