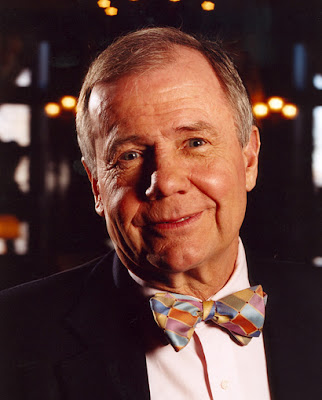

Here’s a recent interview of Jim Rogers on FT.com (Financial Times) on November 17, 2008. It’s a four-part interview, with a total running time of about 16-17 minutes.

Below are my notes from the interview.

Part 1 – Global recession will be long and deep.

- He has not yet exited his US dollar positions, as he believes the current rally is an artificial one driven by short covering.

- It could go longer and higher than anyone expects.

- Reiterated his opinion that the US dollar is a flawed and maybe doomed currency.

- We’re going to have the worst recession since World War II

- Likely we’ll see exchange controls at some point in the US

Part 2 – Market correction is good for commodities.

- The way to make money now is to buy the things where the fundamentals have been unimpaired.

- Not only are the fundamentals of commodities unimpaired, but they have been strengthened, as supply is going to take a serious hit across the board as a result of tight credit markets.

- “Farmers can’t get loans for fertilizer now.”

- In the 30’s, commodities hit bottom first because there was no supply. The same thing happened in the 1970’s – again because there was no supply.

Part 3 – China economic story still intact.

- “Selling China in 2008 would be like selling America in 1908. You might have looked good in the short term…but who cares?”

- He bought more Chinese shares in Oct/Nov of this year.

- Also believes the fundamentals of China will come out of this recession unimpaired.

Part 4 – Inflation is coming – you’d better own real assets.

- We’re following the mistakes of Japan by bailing everyone out.

- This is the first time in world history that every government in the world is printing money.

- It will lead to much, much higher prices.

- Don’t sell your gold, cotton, or sugar, because prices will be much, much higher in a few years.

- We are not experiencing deflation – this is forced liquidation. We’re fighting the wrong battle by fighting deflation.

Editors note: Click here to read more recent coverage of Jim Rogers.

Want to be alerted about Jim Rogers coverage as it happens? Send an email to “Brett(at)CommodityBullMarket.com” and put “Rogers updates” in the subject line – we’ll add you to our email alert list.

Recent Comments