Tuesday night, our Sacramento-based Casey Research investment group had the privilege of hosting Ron Parratt, CEO of AuEx Ventures, for a presentation and discussion about his company, and the challenge and adventure that is junior gold exploration.

Tuesday night, our Sacramento-based Casey Research investment group had the privilege of hosting Ron Parratt, CEO of AuEx Ventures, for a presentation and discussion about his company, and the challenge and adventure that is junior gold exploration.

First a quick primer on junior gold exploration for those not familiar with this field. Unlike gold majors, who have actual gold reserves to pull out of the ground, juniors have not yet found any gold. An investment in a junior is, in overly simple terms, essentially a bet that they will find gold before they run out of capital, and/or over dilute their shareholder base.

With that said, why would somebody want to invest in a junior, when they could just invest in one of the big gold producers and have a much safer investment?

Primarily because the upside potential is so tantalizing. The share price of a junior can do a moon shot if things go well – on the flip side of the coin, though, share prices are also very vulnerable to the downside. Ask anyone who has been invested in the juniors this year (your author included) – it has not been a fun ride so far this year.

Personally, I see three attractive aspects of investing in juniors:

- The majors have been under-investing in exploration for decades, as a result of the gold bear market from 1980-2000. Even today, with the price of gold nearly tripled off its lows from earlier this decade, mining input costs are also way up, so the major gold producers are not making as much money as you would have imagined with gold at these prices. How are majors going to replenish their gold reserves? Probably by buying promising juniors.

- I would rather bet on a talented entrepreneur and geologist – like Ron Parratt – finding something substantial, than a large bureaucratic company. I believe that talented, motivated people can accomplish amazing things when given room to operate freely.

- If you can find a junior led by someone you trust and believe in, that’s very powerful.

Now back to Ron and AuEx.

Ron is a very experienced explorer with exceptional qualifications. In 2003, he ventured on his own and co-founded AuEx Ventures, based out of Reno, NV. AuEx employs a joint venture model to exploration, where they will team up with a gold major on a given project, which allows AuEx to leverage their expenditures and minimize share dilution.

That is, their partner will pick-up a significant amount of the investment tab, in exchange for a share of the projects profits. This kind of leverage allows AuEx to have it’s hand in many more projects than it could handle by itself.

Similar to the way an investor in gold juniors will keep a very diversified portfolio – with the idea being most will fail, but the few winners will carry the day for you – Ron takes the same approach with AuEx.

The JV approach in their own words:

At AuEx we believe that the joint venture business model is the most effective approach to the conduct of business in the mineral exploration industry. AuEx adopted the JV model because we are committed to minimizing risk by leveraging out that risk to select partners. Significant bi-products of the JV process include; (a) the protection of the corporate vehicle through minimal share dilution, (b) diversification of the Company’s exploration programs, (c) annexation of partners’ technical strengths and knowledge base and (d) the attraction of additional resources to multiply AuEx’s exploration efforts.

I asked Ron what his general strategy towards JV’s was, and he said basically they try to keep as much of the project as they can, which giving up as little as they can.

A quick, important aside about Ron: he comes across as an extremely honest, hard-working, talented guy who is great at what he does. Exactly the type of CEO you want to invest in. He owns a healthy equity stake, and is focused on constantly creating shareholder value – and you can’t argue with his track record there (side note: he mentioned his initial friends/family round was issued ~$0.12/share – those folks are sitting pretty now).

Ron, a pretty even keel guy, really beams with excitement when talking about AuEx’s Long Canyon project, which is looking very, very good. The bulk of the company’s value is contained in Long Canyon, and good progress continues there.

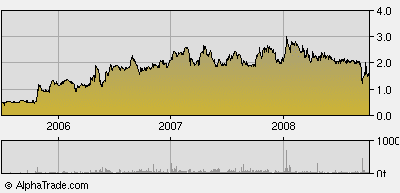

AuEx’s share price has taken a hit since topping the $3 mark earlier in 2008. According to Ron, business fundamentals are better now than when the share price peaked back in January.

All in all, I have the feeling that the recent pullback in AuEx’s share price presents a great opportunity to invest in a world-class explorer like Ron. I don’t own any shares yet, but plan to pick some up later this week. I’d encourage you to consider AuEx as a worthy addition to your mining portfolio.

Editor’s Note: This article was also published by Seeking Alpha.

Recent Comments