Not much of note today, as we saw a very lazy summer trading day. Are some fireworks just around the corner?

Some thoughts for the rest of the trading week:

- NYSE decliners led advancers today by about 2 to 1 (Source: Seeking Alpha) – a sign of things to come?

- Earnings season is kicking off – it’ll be interesting to see if fairly bullish expectations are beaten. I’m thinking they are probably too high – we’ll see.

- I’m glad we covered our last short contract over a week ago at the 1026.50 (September E-Mini S&P futures)! I hated the decision at the time, but felt like it was the right thing to do with overwhelming pessimism around.

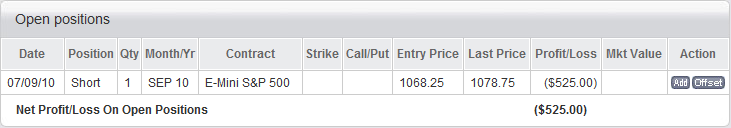

- When this rally covered back about half of the losses, I went short again at the 1068.25 mark. Obviously it was too early, but I felt that the risk/reward was favorable (See: Why I Can’t Wait to Short the S&P 500 Again)

- This mini-rally has again seen weak and declining volume. I know it’s summer, but we are seeing less volume on rallies than we are on declines (see chart below).

- As mentioned last week – we’ve retraced about 50% of the last decline. Optimism may not be “back”, but it’s at least out of the gutter. So while we could see a further rally from here, it’s not required. The stock market could turn back down again at any moment.

- And don’t forget – we are still below the 200-day moving average on the S&P (red line below). When this condition exists, you’re usually best off being either short the market, or out of it.

Base chart courtesy of StockCharts.com (with my pretty edits)

Base chart courtesy of StockCharts.com (with my pretty edits)

Recent Comments