For a long while, it felt like the resumption of the stock market decline would never come. But now, it appears that US equities – the final holdout of the ’09-10 “reflation rally” – are once again under some serious pressure.

When we last chatted, we wondered if the S&P’s kiss of the 1122 mark – about a 50% retracement of the previous decline down to 1040 – was it. Based on today’s market action, it’s looking like that may be the case:

Thus far our Seeking Alpha contrarian indicator looking like it’s “1 for 1” in calling short term excessive bullish sentiment. A bit of redemption for us bears!

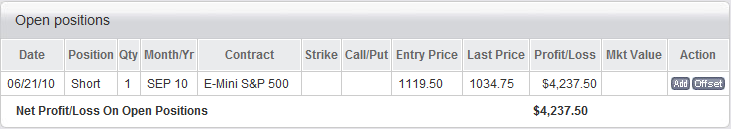

And as for an update to our short position – we previously had one winner, and one disaster – and this one fortunately is looking like a winner, getting back all of the gains and even a little more of our previous loser. So we’re 2 for 3 as of now…though not as well of, I should add, as we’d be had we just held that initial position the whole time.

Moral of the story: In a bear market, just get short and stay short…as long as the trend is in your favor.

So, we’ll try not to get “too cute” with this position. Sure, the market could bounce tomorrow and retrace some of these losses. Then again, it may not. Bear markets, as we’ve discussed, often dish out the most pain when markets are already oversold.

Instead, the strategy will be to watch this position – and, look for potential rallies to add to the winning position. Ideally, we’d love to add a few as the market tanks down to the levels we’re anticipating (taking out the March ’09 lows).

One more important development today – volume picked up a bit (something we were looking for to reinforce our bearish hypothesis), and breadth was also very negative. From CNN Money:

Market breadth was negative and volume was moderate. On the New York Stock Exchange, losers beat winners 11 to one on volume of 1.6 billion shares. On the Nasdaq, decliners topped advancers eight to one on volume of 2.58 billion shares.

Fasten your seatbelts! If we break through that 1040 support level decisively, this could be a doozy of a decline.

Recent Comments