Regular readers know that I’ve been anxious – TOO anxious – to short the S&P 500. The reflation rally was determined to “end when it ends” – and not a moment sooner.

Although we are still trading above the magical 200-day moving average, I have to believe that the odds are that the current trend is now DOWN. Why?

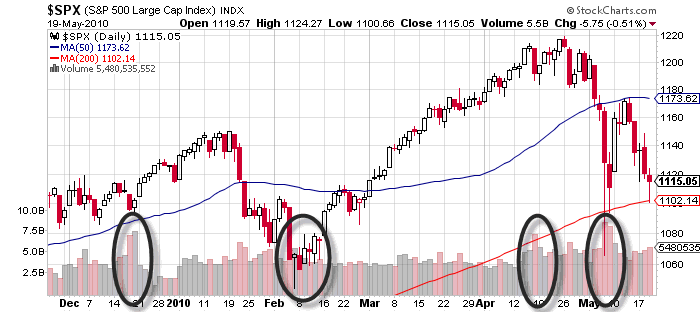

- There is more conviction on declines than rallies (see volume below)

- The market failed to rally to new highs after the sharp decline of a couple weeks back

- Our favorite leading indicators – China, oil, etc – have all turned south – WAY south

It’s been much higher volume on the drops than the rallies – which usually means the sellers are acting with more conviction than the buyers.

Summing it up: No trade is ever a sure thing. But at this juncture, I believe the odds of us heading to the downside – and more importantly, the potential magnitude of a decline – far outweigh upside odds and potential.

In geeky mathematical terms:

(Odds of decline) x (Size of decline) > (Odds of rally) x (Size of rally)

Which means…we’re going short the S&P…again…via the futures markets!

If you are also thinking about shorting the S&P – but want to do it via the comfort of your online stock trading account (a la Scottrade) – check out SDS, the double-short inverse ETF on the S&P.

Just make sure you go LONG SDS in order to go SHORT the S&P – it’s an inverse fund that will rally (and probably rally like hell) if the S&P gets flushed down the crapper.

SDS looks poised to break out of it’s bullish “falling wedge pattern”.

SDS looks poised to break out of it’s bullish “falling wedge pattern”.

Source: StockCharts.com

Recent Comments