Hey, have you noticed muni bonds lately? They’re crashing!

Muni bonds fall off a cliff (Source: StockCharts.com)

Muni bonds fall off a cliff (Source: StockCharts.com)

We shall see where they go from here – but the recent rally sure looks like it your standard fare retracement/dead cat bounce – paving the way nicely for the next leg lower.

DailyWealth’s Dan Ferris believes this is a very scary chart for income investors:

Municipal bonds are crashing because the financial crisis has caused tax receipts around the country to drop… and because many states and cities have borrowed too much money.

These problems have been building for some time… According to credit-ratings agency Fitch, municipal bond ratings downgrades have outnumbered upgrades for seven consecutive quarters. That means the debt-repaying ability of states, cities, and towns across America has been falling for almost two years.

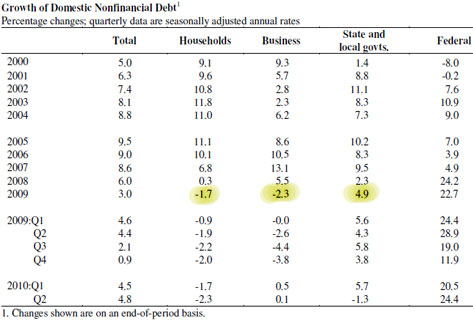

You can see this growth in government borrowing very clearly in reports from the Federal Reserve, called Flow of Funds. Below is the part of the Flow of Funds report that shows growth in debt for households, nonfinancial businesses, state and local governments, and the Federal government.

Take a look at the highlighted numbers… In 2009, households and businesses reduced debt at rates of around 2% per year. States grew debts by 4.9%, even though continued high unemployment rates caused by the financial crisis are virtually guaranteed to make it too hard to collect enough taxes to repay those debts. (The Federal government is even worse, increasing its debt by 22.7% last year, and at annualized rates as high as 24.4% per year in 2010.)

If you bought municipal bond funds – or almost any fixed-income investment – two years ago, congratulations. You’ve likely booked big capital gains in addition to outsized yields.

But like so many homeowners, commercial real estate owners, and financial institutions in the United States, many municipal bond issuers have borrowed more money than they’re able to pay back. And the market looks like it’s finally waking up to that fact.

It’s time to take some of your fixed-income bets off the table.

Source: DailyWealth

The folks at Elliott Wave International agree – deflation guru Robert Prechter has been warning of looming municipal bond problems for months:

This November, the whole world tuned in as the greater part of the U.S.A.’s 50 states turned red — and no, I don’t mean the political shift to a republican majority during the November 2 mid-term elections. I mean “in the red” — as in, financially fercockt, overdrawn, up to their eyeballs in debt.

Here are the latest stats: California, Florida, Illinois, and New Jersey now suffer “Greek-like deficits,” alongside draconian budget cuts, job furloughs, suspensions of city services, and the growing “rent-a-cop” trend of firing city workers and then hiring outside contractors to fill those positions.

Next is the fact that the municipal bond market has been melting like a snow cone in the Sahara desert. According to recent data, 35 muni bond issues totaling $1.5 billion have defaulted since January 2010, three times the average annualized rate going back to 1983. Also, in the week ending November 19, investors withdrew a record $3.1 billion from mutual and exchange-traded funds specializing in municipal debt, triggering the largest one-day rise in yields since the panic of ’08.

In the words of a recent LA Times article “It’s a cold, cold world in the municipal bond market right now.”

While actual defaults may take longer than most anticipate – as an astute reader recently pointed out to me with regards to California – I’m not sure I’d want to stand in the way of this potential freight train.

Of course, everyone must balance the risk/reward of these tax free income sources. For me personally, a man of modest means (I know it’s hard to believe – though I’ve got big aspirations, trust me :)) I’d prefer to sit on plain cash and forgo a few points a year of interest.

More on muni bonds:

- The coming state and local government trainwreck

- Robert Prechter on why you should run from “safe” muni bonds

Recent Comments