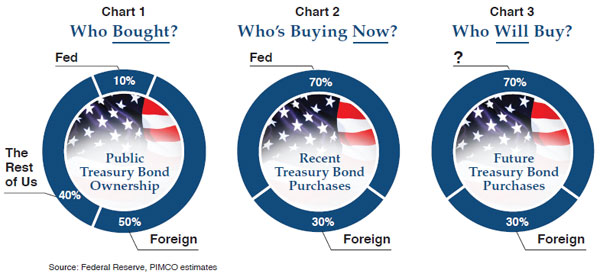

In Bill Gross’ latest commentary, he wonders aloud who will buy Treasuries when the Fed stops QE2 at the end of June.

What an unbiased observer must admit is that most of the publically issued $9 trillion of Treasury notes and bonds are now in the hands of foreign sovereigns and the Fed (60%) while private market investors such as bond funds, insurance companies and banks are in the (40%) minority. More striking, however, is the evidence in Chart 2 which points out that nearly 70% of the annualized issuance since the beginning of QE II has been purchased by the Fed, with the balance absorbed by those old standbys – the Chinese, Japanese and other reserve surplus sovereigns. Basically, the recent game plan is as simple as the Ohio State Buckeyes’ “three yards and a cloud of dust” in the 1960s. When applied to the Treasury market it translates to this: The Treasury issues bonds and the Fed buys them. What could be simpler, and who’s to worry? This Sammy Scheme as I’ve described it in recent Outlooks is as foolproof as Ponzi and Madoff until… until… well, until it isn’t. Because like at the end of a typical chain letter, the legitimate corollary question is – Who will buy Treasuries when the Fed doesn’t?

Click to enlarge

Hat tip S&A Digest for the quote.

It sure has been convenient that the amount of Treasuries purchased via the QE2 program ($600 billion) has been eerily close to the total level of Federal debt issued ($1.2 trillion I believe) minus the total level of private savings in the US ($600 billion if my memory serves correct).

Ed. note: Marc Faber discussed the end of QE2 – as well as QE3, QE4, and QE5 – in an excellent interview for The McAlvany Weekly commentary.

Recent Comments