Fantastic post over at Pragmatic Capitalism about what the current rally in the US dollar means in the ongoing inflation vs deflation tug-of-war:

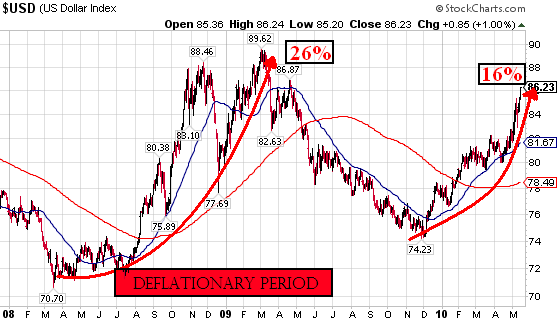

If the chart below doesn’t grab your attention then few things will. In my opinion, the performance of the dollar is the surest evidence of the kind of environment we’re currently in. The surging dollar is a clear sign that inflation is not the concern of global investors. This is almost a sure sign that deflation is once again gripping the global economy and should be setting off red flags for equity investors around the world.

The recent action in the dollar is eerily reminiscent of the peak worries in the credit crisis when deflation appeared to be taking a death grip on the global economy and demand for dollars was extremely high. The recent 16% rally in the dollar is a sign that investors are once again worried about the continuing problem of debt around the world and they’re reaching for the safety of the world’s reserve currency – the dollar. As asset prices decline and bond yields collapse this is a clear sign that inflation is not the near-term concern, but rather that the debt based deflationary trends continue to dominate global economic trends.

This is exactly the kind of market action we saw leading up to Lehman Brothers. In 2008 the dollar rallied as signs of deflation began to sprout up. This was an instant red flag for anyone who understood the deflationary forces at work (and a total surprise for the inflationistas). The dollar ultimately rallied 26% from peak to trough. Coincidentally, the dollar had rallied 16% from trough to peak just prior to the Lehman collapse when the dollar surge accelerated.

Source: Pragmatic Capitalism

You can read the rest of this deflationary warning at Pragmatic Capitalism – including the one chart that says it all.

As you probably know, I completely agree with TPC’s piece. We mused at the beginning of the year that the US dollar was the linchpin of the global financial markets.

If this dollar rally continues – in the short term the dollar is due for a breather, it’s been going straight up for 6 months – but after that, we may not be far away from seeing the dollar take out it’s previous 2008 highs. And by that time, we’d be likely to be in the midst of wicked deflation.

How can this be? How can the sickest currency in the world be rallying stronger than all others?

Because debt is going away to “money heaven” – most of it is going unpaid. When that happens, the supply of available dollars drops – which increases the value of the dollars that remain in circulation.

For a full review of the deflation investing argument, you’ll want to review this piece.

And if deflation takes hold, how should you invest? Check out guru Robert Prechter’s deflation investing advice.

Recent Comments