The old joke is that Japan’s Central Bank is so incompetent, it was unable to devalue its own currency during its Lost Decade (or Two), despite its best efforts.

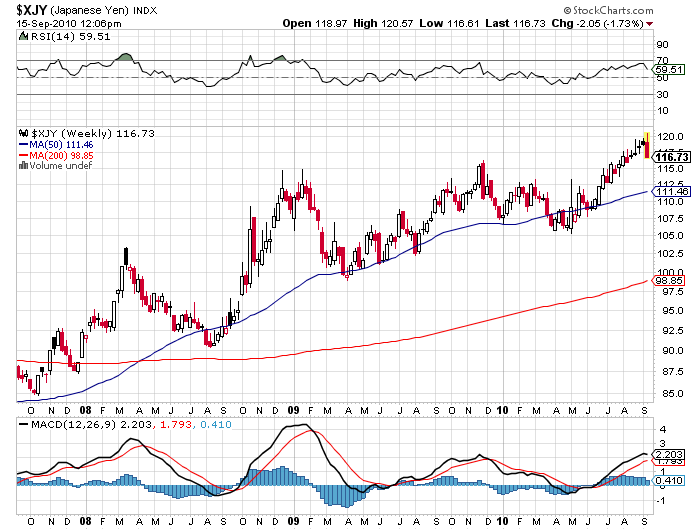

But that’s not stopping Japan’s finance ministry from giving its favorite pastime another go. The yen has hit a 15-year high against the dollar – which is especially impressive, as the dollar is sitting well above its 2007 and 2009 lows. This prompted the Japanese government to try and halt the yen’s inexorable rise:

Japan yesterday unilaterally sold the yen against the dollar for the first time since 2004. Chief Cabinet Secretary Yoshito Sengoku said the finance ministry “seems to think” 82 yen per dollar to be the line of defense, after it reached 82.88 yesterday. Government officials speaking on condition of anonymity have previously said volatility was a bigger concern than the level. Officials said Japan may continue selling the yen in the U.S. and into today’s Tokyo trading if needed.

Prime Minister Naoto Kan was under pressure from business leaders to stop the yen’s gains from undermining the exports propelling Japan’s growth. It may do little for the economy because Japan alone won’t be able to keep the yen from rising, said analyst Tohru Sasaki. (Source: Bloomberg)

Will this umpteenth time be a charm?

How ironic is it that the currency markets, which previously were driven by positive fundamentals – ie. governments that protected their currency and kept interest rates at respectable levels were usually “rewarded” with a strong currency.

Now, it’s all about the negative, DEFLATIONARY factors that drive currency prices up! Who cares about high interest rates – and please, print as much as you’d like – because the deflationary effects of a reduced supply of currency in the system has thus far overwhelmed any efforts of central governments. With Japan being the prime example. The currency that deflates the fastest, rises the fastest!

When the winds shifted in the US in 2007 from inflationary to deflationary, we saw the same thing – the dollar rallied DESPITE the best efforts of the Fed and Rudderless Helicopter Ben:

The dollar’s been just fine throughout QE and “QE 1.5”, thank you very much (Source: StockCharts.com)

The dollar’s been just fine throughout QE and “QE 1.5”, thank you very much (Source: StockCharts.com)

With all sovereign governments seemingly in a race to the cellar, the interesting thing to watch will be gold. I have to admit, gold has surprised me to this point, as I was skeptical it’d be able to rally along with the dollar. It has.

But is gold necessary if the dollar continue to hold its value OK? Sure, as a safe haven, its always good to own some as insurance. But part of me is wondering if the current move in gold is anticipating SUCCESSFUL devaluation efforts from Japan, the US, Europe, and the rest of the world.

Thus far, we haven’t seen any evidence that these central banks can successfully devalue in the face of deflation. So for now, I’ll remain a bit skeptical of gold at these prices (as a speculation, of course).

Recent Comments