Everyone hates the US Dollar – again.

The Fed is openly signaling to the markets that it is not going to stand by the buck. The current headline article at Bloomberg.com pertains to New York Fed president William Dudley’s statements that inflation is too low, and unemployment is too high, for the Fed to stand by and watch as a passive observer. Get ready for more unconventional easing measures.

Which means the poor dollar is going to get thrown out the window as the Fed revs up the printing presses at full speed. There’s no hope for the buck!

Or is there? I feel like somebody’s gotta stand up for the greenback. I also think there are some key points that the mainstream financial media is ignoring in presenting this one-way trade.

So, here’s a three-fold contrarian case for the dollar.

1. Contrary to Popular Belief, the Dollar’s Trend is UP

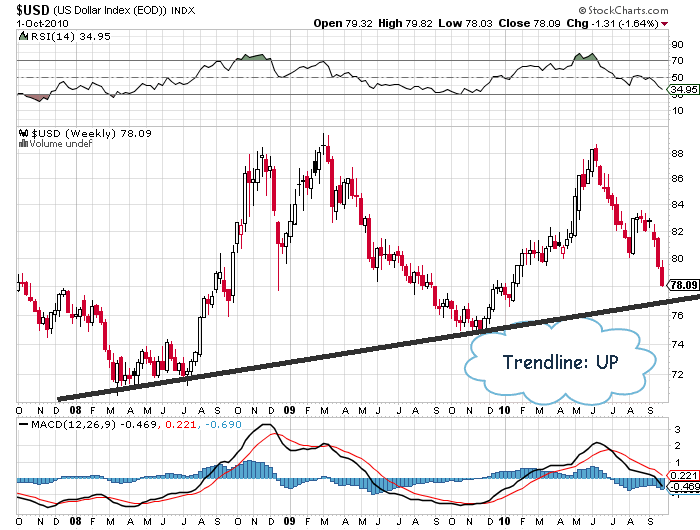

But don’t just take it from me – look at the chart:

Source: StockCharts.com

Source: StockCharts.com

Since putting in a significant double bottom in early-mid 2008, the dollar has trended upwards. We saw another major bottom in late 2009 (a time when pessimism on the buck was rampant – like today). And we’re heading towards a potential bounce off that lower trendline.

It’s worth noting that the dollar is trading ABOVE both of these significant lows today. If you merely read the financial press, and did not check a price chart, you’d think the dollar was trading at a multi-year/decade low.

Which tells us that…

2. Pessimism Towards the Buck is at an Extreme

Measuring and gauging investor sentiment usually consists of more art than science. As a result, I’ve found that it’s only a reliable indicator at extreme points.

But with the buck today, I think we’re at one. I saw data from Trade-Futures.com, which surveys traders on their bullish/bearish short term sentiment, reported as low as 5% dollar bulls right now. This contrasts with June readings that were above 90% dollar bulls! It’s ironic yet appropriate that you see the highest number of bulls at price highs, and the lowest number of bulls at price lows.

And there are no shortage of bearish stories emerging to “explain” the buck’s recent drop – such as this one from Bloomberg:

Dollar is “Ugliest” After Third Weekly Decline Versus Euro

“The dollar seems to be the ugliest girl at the dance,” said Lane Newman,director of foreign exchange at ING Groep NV in New York. “The main catalyst for dollar weakness would be communication from the Federal Open Market Committee this week that quantitative easing is on the table and the euro has gone from the worst currency to own to the best on the back of ‘anything but the big dollar.’”

And the 180-degree swing that Newman alludes to occurred in just 4 months!

A more plausible explanation, at least to me, is that the extreme sentiment this summer signaled a reversal in price action was coming – which has come to fruition. Now, we are at the exact opposite extreme – indicating another reversal may be imminent.

3. Credit is Still Contracting

Contracting credit is bullish for the dollar. Expanding credit is bearish.

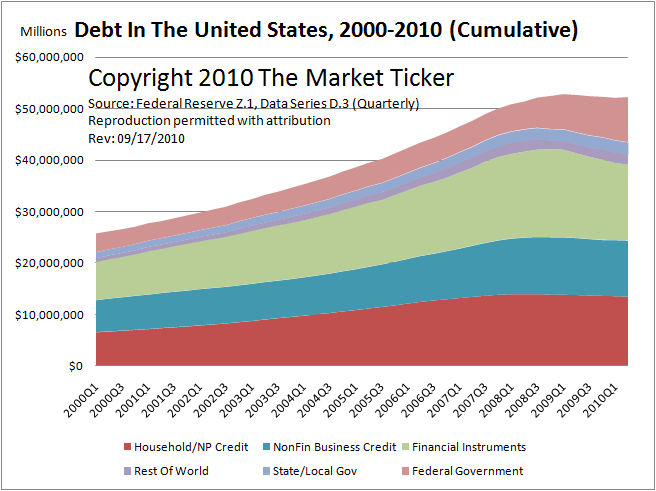

Starting in the early 2000’s, we saw a massive explosion in credit, which coincided with the dollar getting absolutely trashed. This trend staged a significant reversal in 2008 – credit began to contact:

Source: The Market Ticker

Why is this? Because when the supply of credit contracts, the supply of dollars contracts as well. And the value of each remaining dollar goes up as a result. Supply and demand.

The trend in contracting credit should provide support for the dollar for at least a few years to come. If/when this trend reverses, we’ll want to be concerned with the dollar’s fate. It doesn’t look like we’re there yet – though Federal debt could certainly be the wild card, as it’s the only sector (as seen in the chart above) that is expanding debt levels measurably.

Summing It Up

Despite the overwhelmingly negative sentiment towards the dollar, it’s still perched comfortably above its previous lows. This pervasive bearishness has set the stage for a potential short term pop in the dollar – one that could be quite spectacular.

I should clarify that I am by no means a long-term dollar bull. I agree with the argument that over the longer term, the dollar will approach its intrinsic value of zero. And I realize the dollar has been trashed since the inception of the Federal Reserve.

But, markets don’t move in straight lines. The dollar has been heading straight down since July – and it’s about time for a pop.

Recent Comments