The big financial news today is that Germany is taking steps to ban naked short selling. This was the “reason” stocks and the Euro were down today – at least according to the financial media.

Which got me thinking – governments usually enact these types of bans in times of desperation. At least that was my initial inclination.

So does Germany’s ban on naked short selling indicate the worst is yet to come for Germany’s stock market? In other words, is it analogous to a Central Banker standing up and reiterating their intention to protect their currency – which usually means it’s about to be devalued!

Thanks to the wonders of the Internet, and especially Google, I took a trip down naked short selling memory lane this afternoon – here’s what I found:

November 13, 2008: Australia acts to ban ‘naked’ short selling

Australia moved Thursday to put a permanent ban on the most controversial form of short-selling and imposed tough new disclosure rules, in a crackdown on hedge funds aimed at restoring confidence in markets.

How’d Australia’s ban work out?

Australia banned naked short selling – after stocks had been slammed. (Source: StockCharts.com)

Australia’s ban came after the stock market had been creamed. And it did not turn it around either – with the ultimate lows coming 4 months later, more out of exhaustion than anything else.

And how about this gem here?

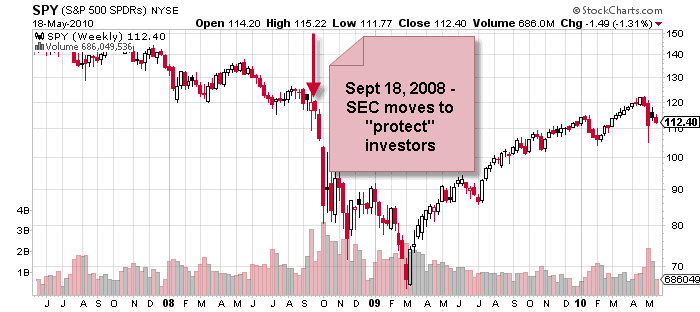

September 17, 2008: SEC Issues New Rules to Protect Investors Against Short Selling Abuses

The Securities and Exchange Commission today took several coordinated actions to strengthen investor protections against “naked” short selling. The Commission’s actions will apply to the securities of all public companies, including all companies in the financial sector. The actions are effective at 12:01 a.m. ET on Thursday, Sept. 18, 2008.

“These several actions today make it crystal clear that the SEC has zero tolerance for abusive naked short selling,” said SEC Chairman Christopher Cox. “The Enforcement Division, the Office of Compliance Inspections and Examinations, and the Division of Trading and Markets will now have these weapons in their arsenal in their continuing battle to stop unlawful manipulation.”

Of course, the SEC “protection” must have translated into safety for investors, right?

Well played, SEC – well played.

These two examples appear to be foreboding for German equities. Namely that, despite a mega-rally over the past year plus, the social mood is still negative enough to once again throw stones at the “evil” naked short sellers. Which, at least lately, appears to occur during a major downtrend – not at a major bottom.

With the mood being so negative this early into a pending stock market decline, you have to wonder how ugly it’s going to get by the time we reach the ultimate bottom of this bear market.

One thing is assured though – we can be assured of more foolish actions from sovereign leaders before it’s all said and done!

Recent Comments