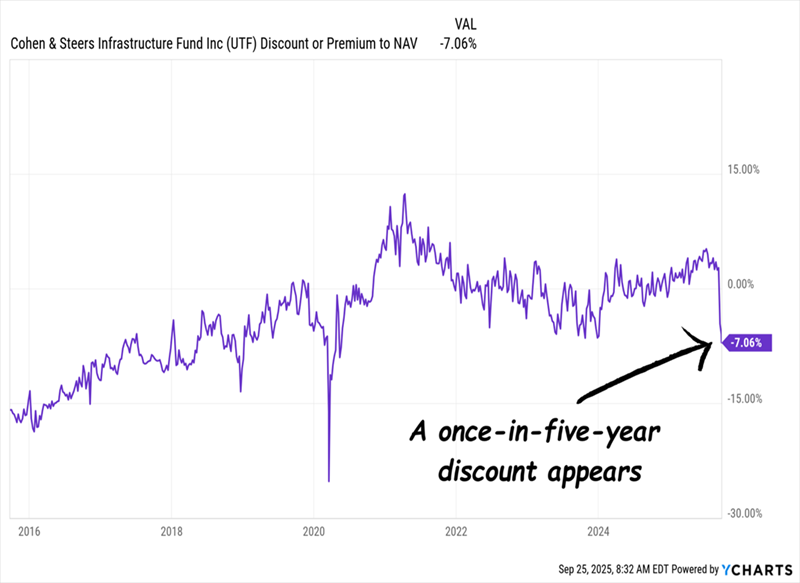

We’ve got a sweet deal on one of my favorite AI dividends (current yield: 7.9%). And it’s not just because of last week’s stock market drop—though that does help.

Truth is, the bargain on this stout fund has been hanging around for a while now. But it’s on borrowed time indeed. We need to make our move.

Forget NVIDIA: This Is the Best AI Buy on the Board

The AI play in question is the Cohen & Steers Infrastructure Fund (UTF). It’s the closed-end fund (CEF) behind that 7.9% dividend (which, by the way, pays monthly).

In addition to the dividend, we like UTF because it’s a “tollbooth” play on AI.… Read more

Recent Comments