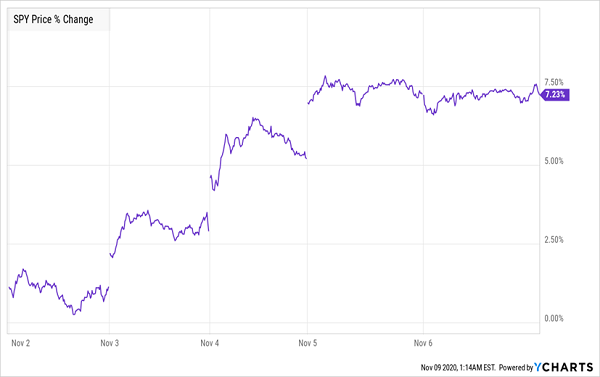

Plenty of people blindly buy into the line that market volatility is a bad thing.

It’s easy to see why, after last year’s crash dented retirement savings around the world. Contrarians like us, of course, fight against the emotional pull to retreat when volatility stirs—and buy into a pullback instead.

The last year’s market run is proof this approach works. And it’s nothing new: we’re simply following the old Warren Buffett adage and buying when others are fearful. But it’s what we plan to buy now that separates us from the crowd, as I’ll show you in a moment.

It’s Not You—the Market Is More Skittish Than Before

One thing we can be clear on is that, yes, the market is more volatile these days.… Read more

Recent Comments