Plenty of folks are starting to look toward the new year, and I’m getting a lot of questions about my outlook for high-yield closed-end funds (CEFs) for the rest of ’22 and into ’23.

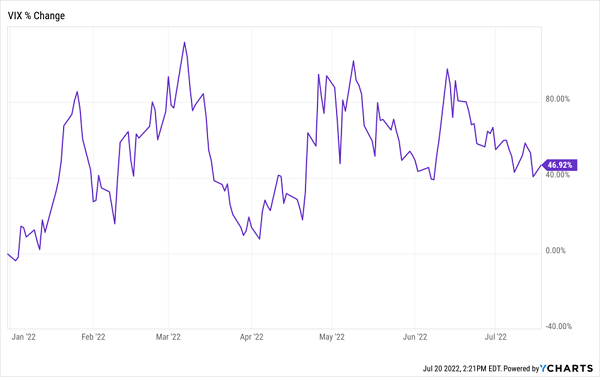

Of course, no one has a crystal ball when it comes to CEFs, stocks or the economy in the short run, but my take is that we’ll likely see continued volatility in the back end of 2022, with better conditions in 2023, as the so-called “terminal rate” of the Fed’s hiking cycle comes into view.

Luckily, there are CEFs out there called covered-call funds that are purpose-built for this environment, handing us safe 7%+ dividends that actually get stronger when volatility picks up.… Read more

Recent Comments