With the market scraping all-time highs—and dividend yields scraping historic lows—you’re probably thinking there’s nowhere you can find big, safe dividends with at least some price upside right now.

Well, you’re far from alone. The good news is, there’s still one place where the undervalued dividend payers you crave are common.

Today I’m going to show you exactly where to find these buys, in a sector rife with bargain-priced high dividends yielding all the way up to 12.5%. That’s more than 10X what the average S&P 500 stock pays.

Step 1 of Our Dividend Bargain Hunt: Step Back … Way Back

This gives us a nice opportunity to hone our value-seeking skills, too, by doing one of my favorite things—drilling down into the latest earnings numbers, which is something too few investors do. That’s too bad, because they’re readily available, and they’re a good first stop in our hunt for undervalued dividend payers.

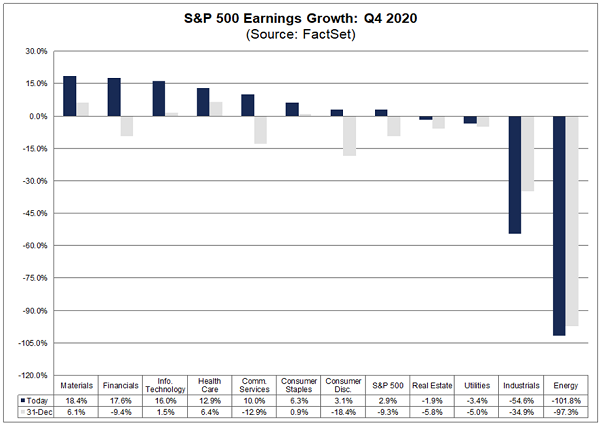

Earnings Beat Back the Pandemic

Earnings are up across the board in the fourth quarter, rising 2.9% overall—an exceptional performance given that lockdowns and social-distancing measures have hamstrung the economy. Minor declines in real estate and utilities, as well as big declines in industrials and energy, due mostly to the still-depressed price of oil, are the exceptions.

(Hint: keep an eye on real estate, with its barely noticeable loss above—that’s the first sign there could be value there.)

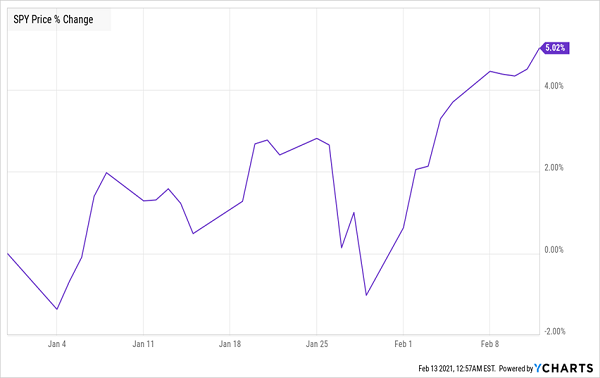

These numbers, by the way, help ease bubble worries, as a 2.9% earnings gain justifies the 5% rise we’ve seen in the S&P 500 this year, especially when you look forward—as the market always does.

A Sustainable Bull Run

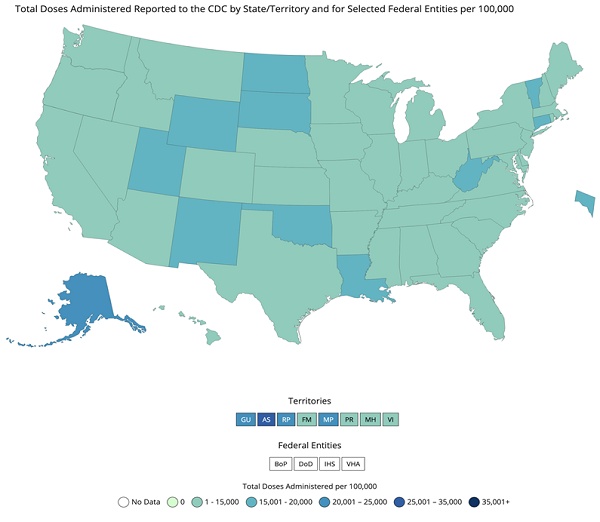

What’s really getting markets pumped is the vaccine rollout, which, while not as fast as one would hope, is showing real progress. As I write, 70 million vaccines have been distributed, meaning some level of immunity will be available for 30% of the population, and we already have about a quarter of the country with some level of immunity from prior infection.

Vaccine Distribution Is Bullish for an Open Economy

Source: CDC

The stock market loves this story, as it should; if companies could demonstrate revenue and earnings growth during a lockdown, with tourism down nearly 60% and unemployment still more than double what it was a year ago, shouldn’t companies demonstrate even more growth post-COVID?

This is driving enthusiasm and buying pressure, and the more vaccines are distributed, the more enthusiasm there will be. But there’s one sector where this enthusiasm is not translating into buying pressure—our not too hot, not too cold play from the earnings chart above.

Real Estate: The Last Stock-Market Bargain?

On paper, real estate has a lot going for it. Record-low interest rates mean real-estate firms (including publicly traded real estate investment trusts, or REITs) have access to cheap financing. And being one of the only sectors that hasn’t recovered since the pandemic started, going by the performance of the benchmark SPDR Dow Jones REIT ETF (RWR), means the sector is still ripe for bargain hunting.

Still Time to Buy In

Of course, that should lead us to ask: why haven’t more people bought in already?

The answer goes back to that drop in earnings. Social distancing and the fear of shopping in stores are still hurting real estate, as well as things like eviction moratoriums. Those factors, in turn, have slowed investors’ move back into the sector.

But the fourth quarter has come and gone, and what really matters is how earnings will look in 2021. With vaccinations rising and experts now forecasting that vaccines will be available to the broader public by April, there’s reason to believe retail shops, restaurants and even movie theaters will be opening before the summer. That means real estate companies should have fewer problems collecting the rent, and they should see more demand for their properties, too. This reopening, combined with a low bar from the year-earlier period, should make their profits look very strong in the last half of 2021.

That makes now a good time to get in.

This 12.5% Dividend Is Still Available at a Discount

Most folks would simply buy in through RWR, but we’re CEF investors! We don’t settle for 3.7% yields like the ETF pays when it’s so easy to go one step further and grab ourselves in a huge 12.5% payout.

That gaudy payout comes to us from the Brookfield Real Assets Income Fund (RA). The CEF, which has seen its portfolio almost fully recover from the pandemic, splits its investments between “essential” REITs like cell-tower operator American Tower Corp (AMT) and valuable infrastructure investments that are needed to keep the economy humming at all times and in all market conditions.

But despite its portfolio’s gains, RA still trades at a 4.1% discount to NAV as I write this, while RWR trades at no discount at all, because unlike CEFs, ETFs always trade at par. That makes the CEF option a no-brainer when investing in REITs or any other kind of stock or bond.

These 5 Funds Could Hand You Massive 28% Gains This Year

This fund’s 12.5% dividend is attractive by any measure. Heck, that payout is so big that it tops the market’s historical average total return (which clocks in around 7%) all by itself.

Thing is, this fund’s discount to NAV (or the percentage by which its share price trades below the value of its portfolio) is only about half of the fund’s usual discount, which is around 8%.

That smaller-than-usual discount could cap the fund’s upside in the coming months, even as the rest of the REIT market rebounds.

You can do a lot better with my 5 favorite REIT CEFs to buy now. They yield 8%, on average, including one REIT fund throwing off an incredible 9.1% payout.

Here’s why:

- These 5 CEFs trade at much bigger discounts than RA—discounts so big I expect 20% price upside, on average, from these 5 CEFs in the next 12 months. And that’s in addition to their 8% dividends! In other words, you could be looking at a 28% total return here!

- This “5-pack” of dividend CEFs gives you much more diversification than just betting on a single fund. It includes that 9.1%-paying REIT fund I just mentioned, along with CEFs that invest in large cap stocks, corporate bonds, biotechs and more.

This unique dividend portfolio is waiting for you now. All you need to do is click right here and I’ll give you all the details on these 5 powerful income (and upside) generators: names, tickers, complete dividend histories, best-buy prices and more!

Recent Comments