Today I want to get into a question that comes up on the regular in 8%+ yielding CEFs:

What if you run across two of these income generators that seem to be equal in pretty well every way. Can you just buy one or the other?

Truth is, sometimes you can and sometimes you can’t, but it’s not always clear when simply closing your eyes and picking one fund is the right move. That’s because with CEFs, there are a lot of moving parts one needs to pick apart and look at carefully.

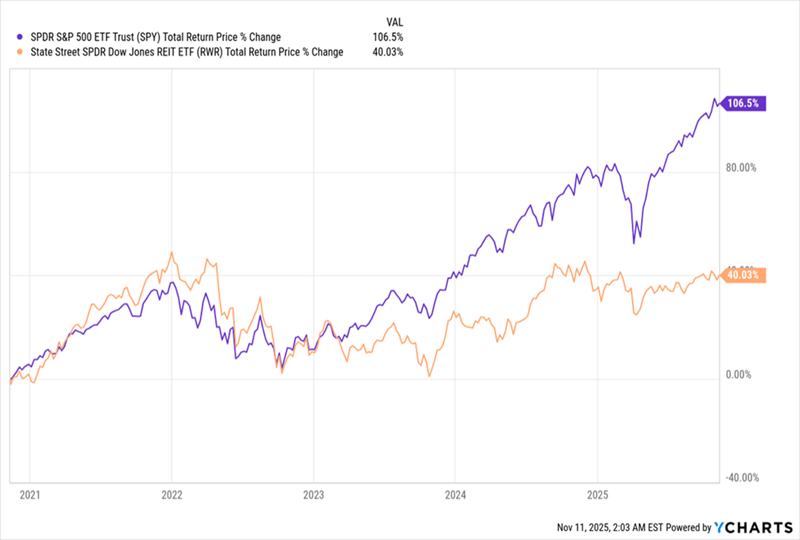

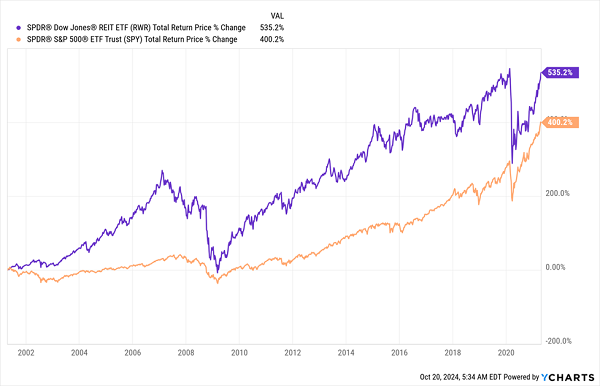

Let me show you what I mean with two CEFs holding real estate investment trusts (REITs)—publicly traded “landlords” holding properties ranging from senior-care facilities to malls and warehouses.… Read more

Recent Comments