At my CEF Insider service, I regularly write about the most effective ways to get big dividends—often double-digit yields—from closed-end funds (CEFs) holding some of the world’s best stocks.

I’m talking about companies like Microsoft (MSFT), Apple (AAPL) and Visa (V) here—three common holdings among equity CEFs.

But you can’t just dial up any of these high-yielding funds (CEFs typically yield north of 7%) and call it a day. To get the most out of your CEF investments, you need to invest a bit of time and effort.

Well, how about this: I’ll save you the work and show you a simple three fund portfolio you can create today that gets you a 7.7% income stream and the confidence to hold these funds for decades to come.

To be clear, this isn’t the best or most optimal CEF portfolio: while $77,000 from a million-dollar investment sounds like an impressive yield, those of us who are familiar with CEF investing are used to getting much more.

Even so, that $77,000 thoroughly outruns the $13,200 per year you’d get from an index fund like the SPDR S&P 500 ETF Trust (SPY) or the Vanguard S&P 500 ETF (VOO).

Plus, unlike those stock-only funds, our “three-buy” portfolio gets you exposure to those same firms and more, including municipal bonds (known for their low volatility and less than 0.01% default rate), as well as real estate, with exposure to thousands of buildings through one of the funds I’m about to show you.

So let’s dig in with a portfolio you can build today just by logging into your brokerage firm and clicking “buy” (these funds trade on exchanges during normal trading hours, just like their better-known siblings, ETFs).

High-Yield CEF Pick #1: A Century-Old Stock Fund

The Adams Diversified Equity Fund (ADX) has been around so long that generations of people have owned it. That’s because ADX is the oldest CEF in the world, launched before the Great Depression (in 1929) and tracing its roots to the Adams Express Company, a one-time pony-express competitor to Wells Fargo & Co. (WFC) that operated during the Civil War.

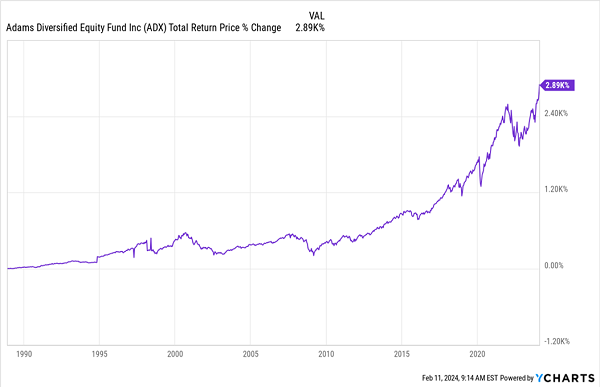

ADX has a mandate to pay out a yield of at least 6% (it yields 6.9% at the moment), and sometimes pays out much more in the form of special dividends paid out in December. ADX’s long history also means long-term holders have earned rates of return measured by thousands of percentage points.

ADX Generates Big Profits for Long-Term Holders

Buy ADX now and, if you’re being especially cautious, plan on a 6% yield on your investment.

Meanwhile, you have a highly qualified management team trading high-quality stocks like Microsoft, Apple and Visa (all top-10 holdings) alongside other great names like Alphabet (GOOGL), NVIDIA (NVDA), Amazon.com (AMZN), UnitedHealth Group (UNH) and Procter & Gamble (PG).

These are the backbone of the US economy, and ADX gets you exposure to all of them while committing to giving you a 6% payout that its returns, as you can see above, far exceed.

A 14.5% discount to net asset value (NAV, or the value of the fund’s portfolio) seals the deal, effectively giving us its portfolio for 85 cents on the dollar.

High-Yield CEF Pick #2: No-Stress Muni Bonds

The Guggenheim Taxable Municipal Managed Duration Trust (GBAB) invests in a special type of bonds called industrial revenue bonds (IRBs), which compensate investors with a higher yield because they hold bonds that, unlike other municipal bonds, are taxed, like normal dividends from stocks or income from a corporate bond.

These bonds are issued by the government to help the development of private-sector infrastructure projects the municipality in question benefits from: telephone lines, power plants and so forth, which also means the income these projects produce fund the income the fund pays out.

And since infrastructure spending is one of the rare things both sides of the aisle often agree on, it’s no surprise GBAB can sustain a 9% yield.

GBAB has actually increased payouts slightly since its IPO over a decade ago, again demonstrating the long-term viability of this fund’s dividends, even at times of higher rates (the mid-2010s and post pandemic to now) and low rates (the early 2010s, when GBAB actually increased payouts aggressively above their current payout level).

That’s because GBAB’s holdings, revenue-backed municipal bonds, are extremely secure because they are tied to a money-making project that communities need: a new toll bridge, a new power plant, things like that.

GBAB’s shareholders profit by getting paid back for lending the money municipalities and the private firms that build these projects need to get the ball rolling. It’s no surprise, then, that GBAB has helped retirees sleep well at night for a long time, and especially during times of extreme turmoil in markets and politics.

The only reason you may want to wait just a bit with this one is that it actually trades at a 4.8% premium to NAV. It does dip into discount territory on the regular, though, most recently in September 2023, so you may not have long to wait.

High-Yield CEF Pick #3: Easy Real Estate Income

If you’ve ever been a landlord, you know how thankless it is. I’ve rented out properties in New York City, perhaps the worst market in which to be a landlord. So I feel your pain.

It’s also why I don’t bother with managing real estate properties these days, and leave it to the pros who manage real estate investment trusts, or REITs—a kind of firm that pools investor money together to buy and manage properties. Those investors then get a passive share of the income from the rents these buildings; tenants pay.

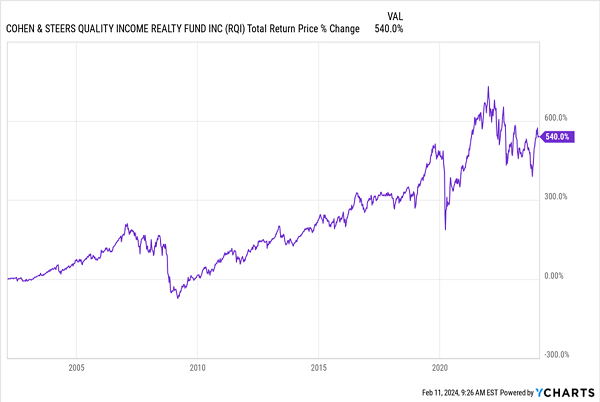

And a CEF like the Cohen & Steers Quality Income Realty Fund (RQI) combines over a hundred of REITs to turbocharge your diversification while giving you an 8.2% dividend yield. Plus, you’re getting in at a 5.7% discount, too.

Big Profits With RQI

With RQI, you have real estate offsetting your bond and stock exposure in a “mini-portfolio getting you an average 7.7% yield. These three funds also boast long track records, meaning you don’t have to bother with regular buying and selling.

These CEFs also demonstrate how an early retirement and a high passive income stream aren’t fantasies only the superrich can afford: they’ve been reality for thousands of retirees for decades.

I Urge You to Buy These 7.8% Dividends Now–Before AI’s Coming “Second Act”

If you’re like most dividend investors, you’ve taken one look at this surging AI trend … and resolved yourself to missing out.

After all, AI’s superstar stocks—the Microsofts and NVIDIAs of the world—pay microscopic yields. A pathetic 0.03% (not a typo!) in NVIDIA’s case.

That’s ridiculous considering the big profits these companies have hauled in since ChatGPT hit the mainstream in late 2022.

But don’t worry, there is a way for us to grab big dividends from AI’s incredible growth.

I’m talking about 4 overlooked AI funds that hold ALL the AI kingpins—Microsoft, NVIDIA and Alphabet among them—plus a collection of smaller AI companies that are just getting started.

The main difference? The dividends! The payouts on these 4 “stealth” AI funds are immense: a 7.8% average yield between them. And all 4 are bargains now.

But that won’t last as AI moves from a new idea to a vital part of everyday life—and more investors scramble to get onboard.

I’m ready to share all the details of this time-sensitive opportunity with you now. Click here to get the full backstory on this rare AI dividend play and download a FREE Special Report naming all 4 of these 7.8%-paying funds now.

Recent Comments