One mistake I’ve seen investors make time and time again is leaning too heavily on the latest “investment product” their bank is pitching them.

The problem arises because at the heart of the banking system lies a key conflict of interest: banks make money off fees and interest charged on investments, loans, credit cards and other products, so they’re motivated to get you to use those tools more.

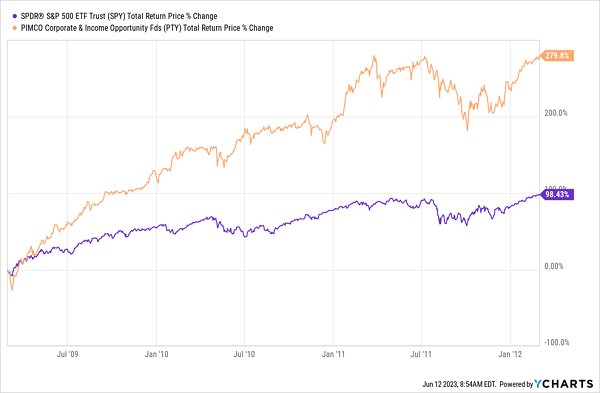

But that usually lies at cross-purposes with our goal as income—and more specifically closed-end fund (CEF)—investors: to retire early on a high income stream (and ideally on our dividends alone), with no need for banks’ expensive loans and debts.… Read more

Recent Comments