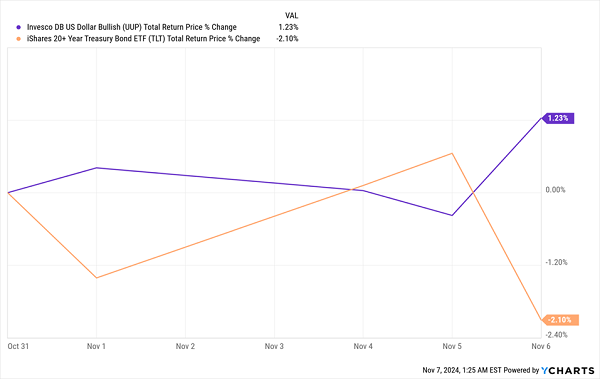

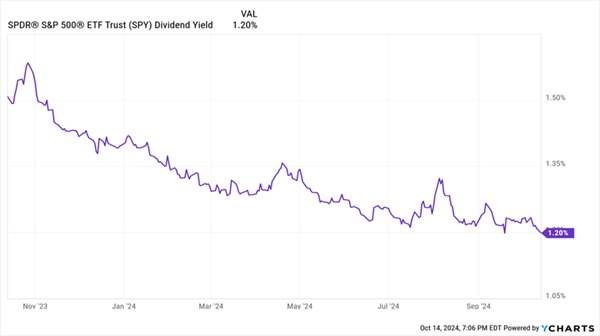

This administration is set on cutting interest rates—and they have the tools to do it.

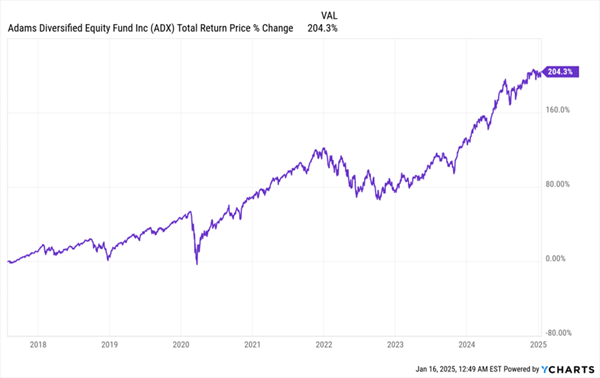

The last thing we contrarian income investors want to do is fight Uncle Sam. Instead, we’re going to front-run his moves with an 11% payer that’s set up nicely for what’s coming.

The reason behind the lower-rate push is pretty obvious: 2026 is an election year, and the administration wants lower borrowing costs heading into the vote.

Bessent, Not Powell (Or Warsh) Is the One to Watch Here

Most people think Jay Powell, or newly nominated Fed chief Kevin Warsh, are the lynchpins here. But when it comes to rates, the real power lies with Treasury Secretary Scott Bessent.… Read more

Recent Comments