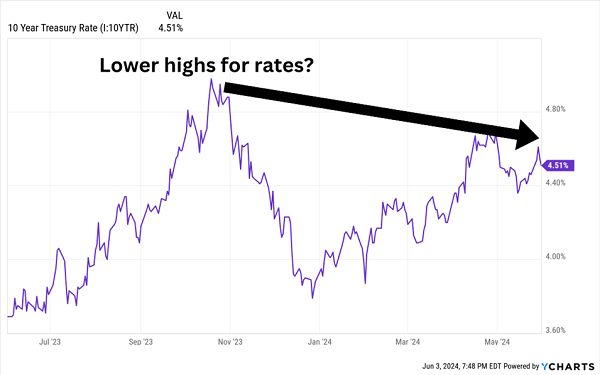

The market pullback we’ve seen in the last couple of weeks really hasn’t come as a surprise to me. The economy is sending what you could—at best—call mixed signals right now. And stocks, as they do in uncertain times, are reacting.

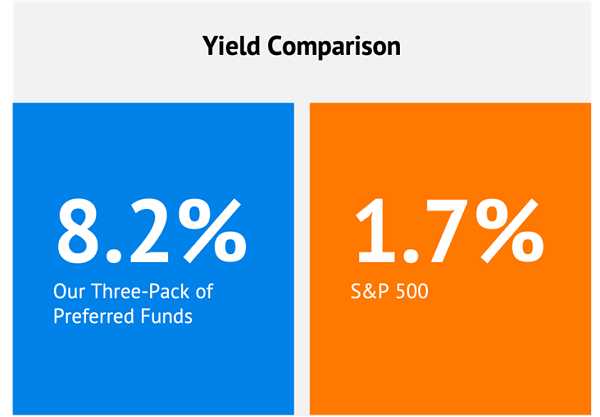

I expect more volatility ahead, so today we’re going to talk about ways to protect ourselves while maintaining the 8%+ dividend streams we’re drawing from our favorite closed-end funds (CEFs). (Read: We’re not going to cash here.)

Instead we’re going to focus on a strategy that’s been around as long as investing itself—diversification—by putting a bit more weight on assets beyond stocks.… Read more

Recent Comments