Each of my kids collected more than three pounds of candy on Halloween Night. Three-plus pounds! Their efforts were not superhuman by my best late-80s-to-early-90s estimation.

We are going to have these bags until Easter.

The candy hangover was real. Both YMCA basketball games played “the day after” were utter disasters for their dad and coach.

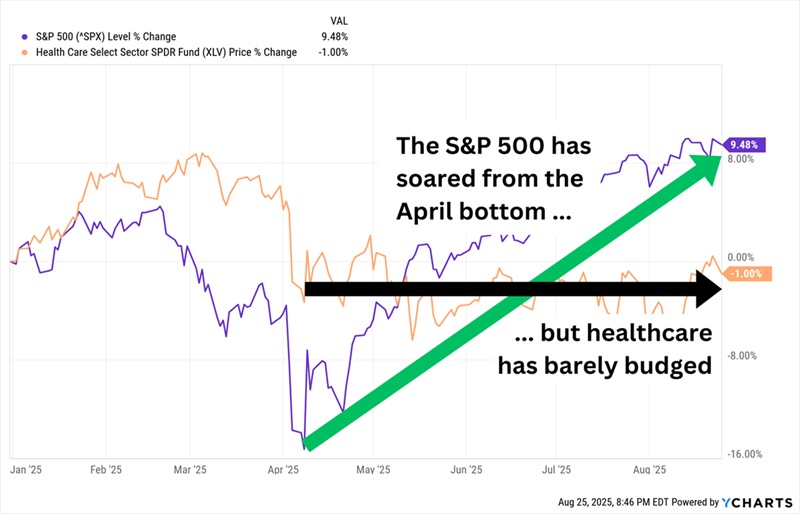

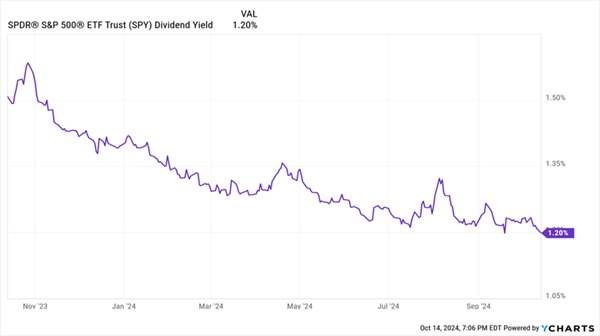

Sugar-high crashes are real. Which is why we are talking “sleep well at night” dividends paying up to 8.6% today.

Don’t be Coach Brett the day after Halloween. If you’re worried about a Wall Street sugar withdrawal, the time to prepare ye ‘ol portfolio is right now.… Read more

Recent Comments