If you don’t like these 10% and 12% dividends, well, you’re not really an income investor.

That’s right. As I write, select closed-end funds (CEFs) yield 12.8%.

Twelve. Point. Eight. Per. Cent!

Vanilla “investors” are panicking. Sentiment has hit washout levels. A short-term bottom is near, or perhaps already in.

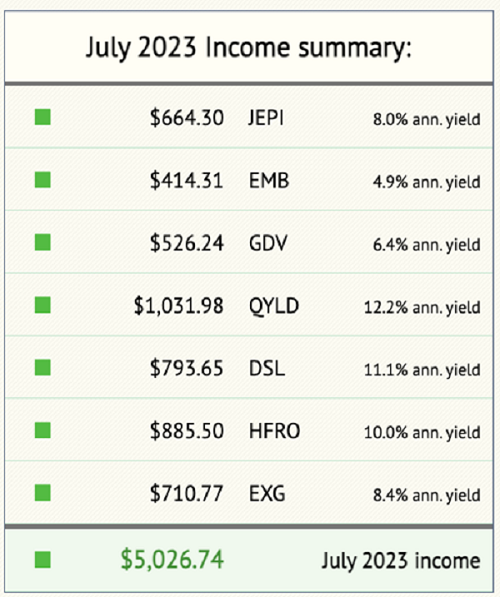

We contrarians are staying calm and locking in the 10% and 12% yields. When the market seas become choppy, we stick to our script. Here it is, broken down in a 11-step playbook for these 10.1% to 12.8% yields.

CEF Rule #1: Buy the Best

Fixed-income behemoth DoubleLine runs some well-known big funds as well as smaller, lesser-known CEFs.… Read more

Recent Comments