I’m a contrarian at heart—but sometimes even contrarians have to go along with the mainstream opinion.

This (as much as it pains me!) is one of those times. You see, like most of the pundits out there, I expect another strong year for stocks in 2026. I see a roughly 12% gain for the S&P 500 this year, to be exact.

That bothers me. A lot.

I know that four strong years in a row is rare, indeed. But that’s what the data is telling me, and I’m not going to argue with it.

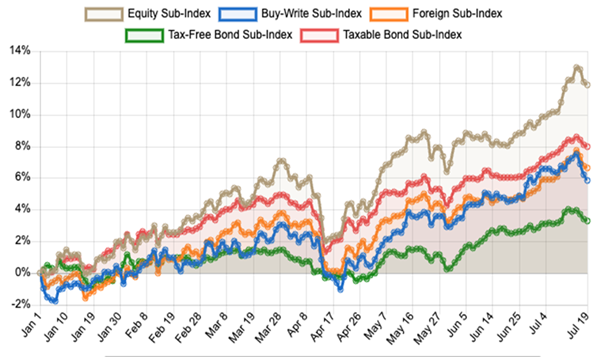

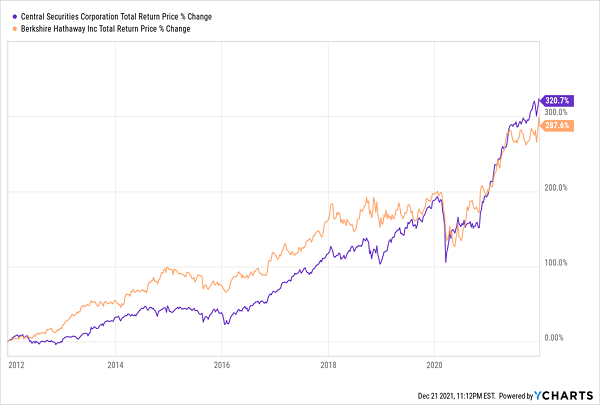

Still Plenty of Cheap CEF Dividends Out There—Even in This “Pricey” Market

Now this doesn’t mean there’s a lack of bargains waiting for us in our favorite income plays: 8%+ closed-end funds (CEFs).… Read more

Recent Comments