Bigger isn’t always better when it comes to dividends. Deutsche Bank recently pointed out “the first half of 2018 has seen the sharpest underperformance of dividend stocks since the financial crisis”, as measured by the Dividend Aristocrats.

Most readers are already familiar with this group of 53 names within the S&P 500 index, many paying out billions of dividends each quarter, with the most common trait being they’ve each boosted payouts a minimum of 25 consecutive years.

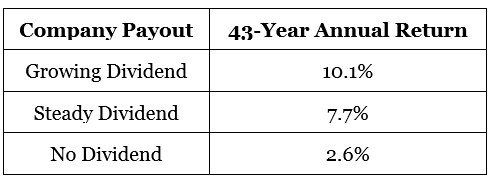

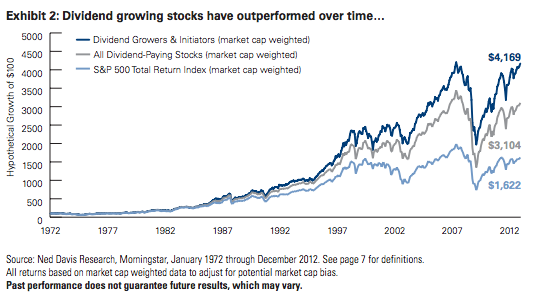

However, another item several of the Aristocrats share in common, is that the Law of Large Numbers is catching up to them. They may be paying out more to investors each year, but as my colleague Brett Owens has often pointed out, it’s how much the dividend is growing that is the best predictor for building wealth over time.…

Read more

Recent Comments