Bigger isn’t always better when it comes to dividends. Deutsche Bank recently pointed out “the first half of 2018 has seen the sharpest underperformance of dividend stocks since the financial crisis”, as measured by the Dividend Aristocrats.

Most readers are already familiar with this group of 53 names within the S&P 500 index, many paying out billions of dividends each quarter, with the most common trait being they’ve each boosted payouts a minimum of 25 consecutive years.

However, another item several of the Aristocrats share in common, is that the Law of Large Numbers is catching up to them. They may be paying out more to investors each year, but as my colleague Brett Owens has often pointed out, it’s how much the dividend is growing that is the best predictor for building wealth over time.

This is especially the case when interest rates are rising. An annual payout increase of a penny or two may produce a positive headline and keep you in the Aristocrat club another year, but these three names are barely treading water against other income investments and certainly not keeping up with the 7.2% average year-to-date dividend growth in the S&P 500.

AT&T (T) is the poster child for Aristocrat laggards with a high 6.1% yield, but decelerating dividend growth. This is one of a few potential reasons why the telecom utility is down 13% this year, more than offsetting the income benefit.

Annual Dividend Creep

Ma Bell increased its dividend earlier this year by a penny a share, as it has done each year for the past decade. However, here’s where the Law of Large Numbers kicks in: a 2.5% dividend increase in the midst of the financial crisis is a pleasant surprise, while a 2% boost in a rising rate environment is barely a blip on the radar when growth is at a premium.

The company recently acquired Time Warner and is yielding more than twice as much as the benchmark 10-year U.S. Treasury note. However, investors looking toward the upcoming earnings report on July 24 as a potential catalyst should note that management has exceeded profit expectations just two of the past eight quarters.

Cardinal Health (CAH) is a name we’ve previously panned on this site and has cost investors another 16% in 2018. One tip off to the company’s lagging ways can be seen in the deceleration of its dividend growth the past couple of years.

Slow Money Burn

After a 16% payout boost in 2016, the drug and medical products wholesaler has slowed its annual dividend growth to just 3% in 2017 and 2018. One reason for the paltry increase is that analysts expect Cardinal Health’s earnings to decline 8% this year.

The company’s profit outlook took another hit in June when Amazon.com (AMZN) bought privately-held online pharmacy PillPack. Wholesale margins are already notoriously thin and Amazon has proven a willingness to sacrifice near-term results to squeeze out the competition and win market share.

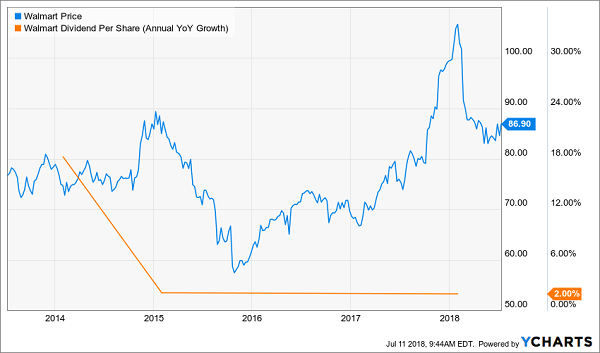

Wal-Mart (WMT) manages to combine the slow annual dividend creep and pressure from Amazon into one package. The retailer yields 2.4%, which has done little to cushion the 10% the stock has lost this year.

Retailer Requires Resuscitation

The company has increased its payout by just a penny a share the past few years, with the last boost representing less than 2% growth.

As far as Amazon is concerned, it is doing to Wal-Mart what Wal-Mart did to smaller retailers for decades. While it can attempt to copy the Prime business model, the retailer has the extra added cost of operating more than 11,000 physical stores across the globe.

I’ve highlighted these cautionary tales because a lot of investors own these names, but there are better ways to fund your retirement today. My colleague Brett Owens has created an easy way for you to retire on 8% dividends (paid monthly!) right now.

Brett has a handpicked portfolio of 8%+ monthly payers that not only will pay you four times more than the market average … but will pay you three times more often!

In retirement, it’s important to line up your dividend income with your regular expenses (which are billed monthly). But most publicly traded companies pay dividends quarterly, leaving us high and dry for an extra 60 days in between payments.

Possible to align quarterly dividend payments to show up roughly in equal amounts every 30 days? Sure – but the effort isn’t necessary.

There are cheap monthly dividend stocks (and funds) available today that pay 8%+ per year and pay the same reliable distribution every 30 days, like clockwork. Our readers regularly collect $3,000-plus in dividends every single month – and do it with a nest egg as modest as $500,000. (And less money is fine, too – a $250,000 portfolio would yield $1,500+ in monthly income. With price upside to boot.)

Our “8% Monthly Payer Portfolio” checks off every box that investors need from retirement:

[X] Monthly dividend income to pay your monthly bills.

[X] Dividends checks large enough to allow you to live off investment income entirely. That means no selling your stocks and shrinking your nest egg, which ultimately shrinks your regular dividend paycheck.

[X] Better returns on any dividends you choose to reinvest. If you don’t need the income from your portfolio right away, you don’t have to wait every three months to put dividends to work – you can sink them back into new investments just about every 30 days!

These monthly dividend payers include a few picks that have remained mostly under the radar despite their high payouts and general quality. For instance, this portfolio includes an 8.7% payer trading at a bizarre 5.3% discount to NAV, and an 8.5% payer that not 1 in 1,000 people even know about.

Because these big dividends compound quicker, they’ll turbocharge your net worth and allow you to enjoy the retirement you’ve worked so dearly to reach. Don’t delay! Click here and Brett will send you his exclusive report, Monthly Dividend Superstars: 8% Yields with 10% Upside, for absolutely FREE.

Recent Comments